Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 7PA

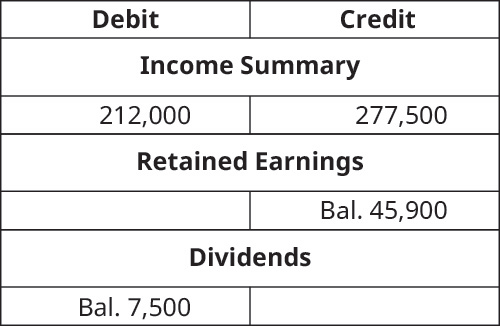

Assume that the first two closing entries have been made and posted. Use the T-accounts provided as follows to:

A. complete the closing entries

B. determine the ending balance in the

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

For each of the transactions above, indicate the amount of the adjusting entry on the elements of the balance sheet and income statement.Note: Enter negative amounts with a minus sign.

Need help with this question solution general accounting

Don't use ai given answer accounting questions

Chapter 5 Solutions

Principles of Accounting Volume 1

Ch. 5 - Which of the following accounts is considered a...Ch. 5 - Which of the following accounts is considered a...Ch. 5 - If a journal entry includes a debit or credit to...Ch. 5 - If a journal entry includes a debit or credit to...Ch. 5 - Which of these accounts would be present in the...Ch. 5 - Which of these accounts would not be present in...Ch. 5 - Which of these accounts is never closed? A....Ch. 5 - Which of these accounts is never closed? A....Ch. 5 - Which account would be credited when closing the...Ch. 5 - Which account would be credited when closing the...

Ch. 5 - Which of these accounts is included in the...Ch. 5 - Which of these accounts is not included in the...Ch. 5 - On which of the following would the year-end...Ch. 5 - Which of these accounts is included in the...Ch. 5 - If current assets are $112,000 and current...Ch. 5 - If current assets are $100,000 and current...Ch. 5 - Explain what is meant by the term real accounts...Ch. 5 - Explain what is meant by the term nominal accounts...Ch. 5 - What is the purpose of the closing entries?Ch. 5 - What would happen if the company failed to make...Ch. 5 - Which of these account types (Assets, Liabilities,...Ch. 5 - Which of these account types (Assets, Liabilities,...Ch. 5 - The account called Income Summary is often used in...Ch. 5 - What are the four entries required for closing,...Ch. 5 - After the first two closing entries are made,...Ch. 5 - After the first two closing entries are made,...Ch. 5 - What account types are included in a post-closing...Ch. 5 - Which of the basic financial statements can be...Ch. 5 - Describe the calculation required to compute...Ch. 5 - Describe the calculation required to compute the...Ch. 5 - Describe the progression of the three trial...Ch. 5 - Identify whether each of the following accounts is...Ch. 5 - For each of the following accounts, identify...Ch. 5 - For each of the following accounts, identify...Ch. 5 - The following accounts and normal balances existed...Ch. 5 - The following accounts and normal balances existed...Ch. 5 - Use the following excerpts from the year-end...Ch. 5 - Use the following T-accounts to prepare the four...Ch. 5 - Use the following T-accounts to prepare the four...Ch. 5 - Identify whether each of the following accounts...Ch. 5 - Identify which of the following accounts would not...Ch. 5 - For each of the following accounts, identify in...Ch. 5 - Using the following Balance Sheet summary...Ch. 5 - Using the following account balances, calculate...Ch. 5 - Using the following Balance Sheet summary...Ch. 5 - Using the following account balances, calculate:...Ch. 5 - Identify whether each of the following accounts...Ch. 5 - For each of the following accounts, identify...Ch. 5 - For each of the following accounts, identify...Ch. 5 - The following accounts and normal balances existed...Ch. 5 - The following accounts and normal balances existed...Ch. 5 - Use the following excerpts from the year-end...Ch. 5 - Use the following T-accounts to prepare the four...Ch. 5 - Use the following T-accounts to prepare the four...Ch. 5 - Identify which of the following accounts would be...Ch. 5 - Identify which of the following accounts would not...Ch. 5 - For each of the following accounts, identify in...Ch. 5 - Using the following Balance Sheet summary...Ch. 5 - Using the following account balances, calculate...Ch. 5 - Using the following Balance Sheet summary...Ch. 5 - From the following Company B adjusted trial...Ch. 5 - Identify whether each of the following accounts...Ch. 5 - The following selected accounts and normal...Ch. 5 - The following selected accounts and normal...Ch. 5 - Use the following Adjusted Trial Balance to...Ch. 5 - Use the following Adjusted Trial Balance to...Ch. 5 - Use the following T-accounts to prepare the four...Ch. 5 - Assume that the first two closing entries have...Ch. 5 - Correct any obvious errors in the following...Ch. 5 - Assuming the following Adjusted Trial Balance,...Ch. 5 - The following Post-Closing Trial Balance contains...Ch. 5 - Assuming the following Adjusted Trial Balance,...Ch. 5 - Use the following Adjusted Trial Balance to...Ch. 5 - Using the following Balance Sheet summary...Ch. 5 - Using the following Balance Sheet summary...Ch. 5 - Using the following account balances, calculate...Ch. 5 - From the following Company R adjusted trial...Ch. 5 - From the following Company T adjusted trial...Ch. 5 - Identify whether each of the following accounts...Ch. 5 - The following selected accounts and normal...Ch. 5 - The following selected accounts and normal...Ch. 5 - Use the following Adjusted Trial Balance to...Ch. 5 - Use the following Adjusted Trial Balance to...Ch. 5 - Use the following T-accounts to prepare the four...Ch. 5 - Assume that the first two closing entries have...Ch. 5 - Correct any obvious errors in the following...Ch. 5 - Assuming the following Adjusted Trial Balance,...Ch. 5 - The following Post-Closing Trial Balance contains...Ch. 5 - Assuming the following Adjusted Trial Balance,...Ch. 5 - Use the following Adjusted Trial Balance to...Ch. 5 - Using the following Balance Sheet summary...Ch. 5 - Using the following Balance Sheet summary...Ch. 5 - Using the following account balances, calculate...Ch. 5 - From the following Company S adjusted trial...Ch. 5 - Assume you are the controller of a large...Ch. 5 - Assume you are a senior accountant and have been...

Additional Business Textbook Solutions

Find more solutions based on key concepts

To what does the lifetime value of the customer refer, and how is it calculated?

MARKETING:REAL PEOPLE,REAL CHOICES

Tennessee Tool Works (TTW) is considering investment in five independent projects, Any profitable combination o...

Engineering Economy (17th Edition)

The exchange rate, potential risk, transfer pricing, tax law differences and strategies are the items affects t...

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

4. JC Manufacturing purchase d inventory for $ 5,300 and al so paid a $260 freight bill. JC Manufacturing retur...

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

Consider the sales data for Computer Success given in Problem 7. Use a 3-month weighted moving average to forec...

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I want to correct answer general accounting questionarrow_forwardKindly help me with accounting questionsarrow_forwardDuo Corporation is evaluating a project with the following cash flows: Year 0 1 2 3 Cash Flow -$ 30,000 12,200 14,900 16,800 4 5 13,900 -10,400 The company uses an interest rate of 8 percent on all of its projects. a. Calculate the MIRR of the project using the discounting approach. Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. b. Calculate the MIRR of the project using the reinvestment approach. Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. c. Calculate the MIRR of the project using the combination approach. Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. a. Discounting approach MIRR b. Reinvestment approach MIRR c. Combination approach MIRR % % %arrow_forward

- Provide correct answer general accounting questionarrow_forwardNeed help with this question solution general accountingarrow_forwardConsider a four-year project with the following information: Initial fixed asset investment = $555,000; straight-line depreciation to zero over the four-year life; zero salvage value; price = $37; variable costs = $25; fixed costs = $230,000; quantity sold = 79,000 units; tax rate = 24 percent. How sensitive is OCF to changes in quantity sold?arrow_forward

- Light emitting diodes (LED) light bulbs have become required in recent years, but do they make financial sense? Suppose a typical 60-watt incandescent light bulb costs $.39 and lasts 1,000 hours. A 15-watt LED, which provides the same light, costs $3.10 and lasts for 12,000 hours. A kilowatt-hour of electricity costs $.115. A kilowatt-hour is 1,000 watts for 1 hour. If you require a return of 11 percent and use a light fixture 500 hours per year, what is the equivalent annual cost of each light bulb? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.arrow_forwardRecently, Abercrombie & Fitch has been implementing a turnaround strategy since its sales had been falling for the past few years (11% decrease in 2014, 8% in 2015, and just 3% in 2016.) One part of Abercrombie's new strategy has been to abandon its logo-adorned merchandise, replacing it with a subtler look. Abercrombie wrote down $20.6 million of inventory, including logo-adorned merchandise, during the year ending January 30, 2016. Some of this inventory dated back to late 2013. The write-down was net of the amount it would be able to recover selling the inventory at a discount. The write-down is significant; Abercrombie's reported net income after this write-down was $35.6 million. Interestingly, Abercrombie excluded the inventory write-down from its non-GAAP income measures presented to investors; GAAP earnings were also included in the same report. Question: From an investor standpoint, do you think that the effect of the inventory write-down should be considered when…arrow_forwardFinancial accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY