Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 15EA

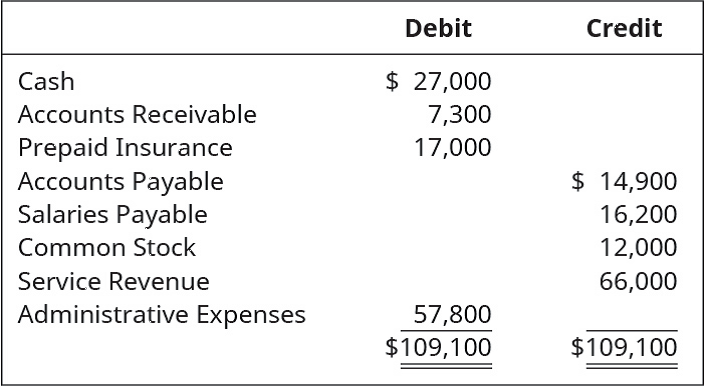

Using the following account balances, calculate:

A.

B.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

I am searching for the correct answer to this general accounting problem with proper accounting rules.

Please explain the correct approach for solving this general accounting question.

I am looking for the correct answer to this financial accounting problem using valid accounting standards.

Chapter 5 Solutions

Principles of Accounting Volume 1

Ch. 5 - Which of the following accounts is considered a...Ch. 5 - Which of the following accounts is considered a...Ch. 5 - If a journal entry includes a debit or credit to...Ch. 5 - If a journal entry includes a debit or credit to...Ch. 5 - Which of these accounts would be present in the...Ch. 5 - Which of these accounts would not be present in...Ch. 5 - Which of these accounts is never closed? A....Ch. 5 - Which of these accounts is never closed? A....Ch. 5 - Which account would be credited when closing the...Ch. 5 - Which account would be credited when closing the...

Ch. 5 - Which of these accounts is included in the...Ch. 5 - Which of these accounts is not included in the...Ch. 5 - On which of the following would the year-end...Ch. 5 - Which of these accounts is included in the...Ch. 5 - If current assets are $112,000 and current...Ch. 5 - If current assets are $100,000 and current...Ch. 5 - Explain what is meant by the term real accounts...Ch. 5 - Explain what is meant by the term nominal accounts...Ch. 5 - What is the purpose of the closing entries?Ch. 5 - What would happen if the company failed to make...Ch. 5 - Which of these account types (Assets, Liabilities,...Ch. 5 - Which of these account types (Assets, Liabilities,...Ch. 5 - The account called Income Summary is often used in...Ch. 5 - What are the four entries required for closing,...Ch. 5 - After the first two closing entries are made,...Ch. 5 - After the first two closing entries are made,...Ch. 5 - What account types are included in a post-closing...Ch. 5 - Which of the basic financial statements can be...Ch. 5 - Describe the calculation required to compute...Ch. 5 - Describe the calculation required to compute the...Ch. 5 - Describe the progression of the three trial...Ch. 5 - Identify whether each of the following accounts is...Ch. 5 - For each of the following accounts, identify...Ch. 5 - For each of the following accounts, identify...Ch. 5 - The following accounts and normal balances existed...Ch. 5 - The following accounts and normal balances existed...Ch. 5 - Use the following excerpts from the year-end...Ch. 5 - Use the following T-accounts to prepare the four...Ch. 5 - Use the following T-accounts to prepare the four...Ch. 5 - Identify whether each of the following accounts...Ch. 5 - Identify which of the following accounts would not...Ch. 5 - For each of the following accounts, identify in...Ch. 5 - Using the following Balance Sheet summary...Ch. 5 - Using the following account balances, calculate...Ch. 5 - Using the following Balance Sheet summary...Ch. 5 - Using the following account balances, calculate:...Ch. 5 - Identify whether each of the following accounts...Ch. 5 - For each of the following accounts, identify...Ch. 5 - For each of the following accounts, identify...Ch. 5 - The following accounts and normal balances existed...Ch. 5 - The following accounts and normal balances existed...Ch. 5 - Use the following excerpts from the year-end...Ch. 5 - Use the following T-accounts to prepare the four...Ch. 5 - Use the following T-accounts to prepare the four...Ch. 5 - Identify which of the following accounts would be...Ch. 5 - Identify which of the following accounts would not...Ch. 5 - For each of the following accounts, identify in...Ch. 5 - Using the following Balance Sheet summary...Ch. 5 - Using the following account balances, calculate...Ch. 5 - Using the following Balance Sheet summary...Ch. 5 - From the following Company B adjusted trial...Ch. 5 - Identify whether each of the following accounts...Ch. 5 - The following selected accounts and normal...Ch. 5 - The following selected accounts and normal...Ch. 5 - Use the following Adjusted Trial Balance to...Ch. 5 - Use the following Adjusted Trial Balance to...Ch. 5 - Use the following T-accounts to prepare the four...Ch. 5 - Assume that the first two closing entries have...Ch. 5 - Correct any obvious errors in the following...Ch. 5 - Assuming the following Adjusted Trial Balance,...Ch. 5 - The following Post-Closing Trial Balance contains...Ch. 5 - Assuming the following Adjusted Trial Balance,...Ch. 5 - Use the following Adjusted Trial Balance to...Ch. 5 - Using the following Balance Sheet summary...Ch. 5 - Using the following Balance Sheet summary...Ch. 5 - Using the following account balances, calculate...Ch. 5 - From the following Company R adjusted trial...Ch. 5 - From the following Company T adjusted trial...Ch. 5 - Identify whether each of the following accounts...Ch. 5 - The following selected accounts and normal...Ch. 5 - The following selected accounts and normal...Ch. 5 - Use the following Adjusted Trial Balance to...Ch. 5 - Use the following Adjusted Trial Balance to...Ch. 5 - Use the following T-accounts to prepare the four...Ch. 5 - Assume that the first two closing entries have...Ch. 5 - Correct any obvious errors in the following...Ch. 5 - Assuming the following Adjusted Trial Balance,...Ch. 5 - The following Post-Closing Trial Balance contains...Ch. 5 - Assuming the following Adjusted Trial Balance,...Ch. 5 - Use the following Adjusted Trial Balance to...Ch. 5 - Using the following Balance Sheet summary...Ch. 5 - Using the following Balance Sheet summary...Ch. 5 - Using the following account balances, calculate...Ch. 5 - From the following Company S adjusted trial...Ch. 5 - Assume you are the controller of a large...Ch. 5 - Assume you are a senior accountant and have been...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Depreciation Methods, Disposal. Kurtis Koal Company, Inc. purchased a new mining machine at a total cost of 900...

Intermediate Accounting (2nd Edition)

Define investors’ expected rate of return.

Foundations Of Finance

Why a convertible security not be converted when the market price of stock raises above the conversion price an...

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

11-13. Discuss how your team is going to identify the existing competitors in your chosen market. Based on the ...

Business Essentials (12th Edition) (What's New in Intro to Business)

Define cost pool, cost tracing, cost allocation, and cost-allocation base.

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Knowledge Booster

Similar questions

- Please explain the solution to this financial accounting problem with accurate explanations.arrow_forwardPlease provide the solution to this financial accounting question with accurate financial calculations.arrow_forwardI need assistance with this general accounting question using appropriate principles.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub - Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning