Loose Leaf for Fundamentals of Accounting Principles and Connect Access Card

22nd Edition

ISBN: 9781259542169

Author: John J Wild

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

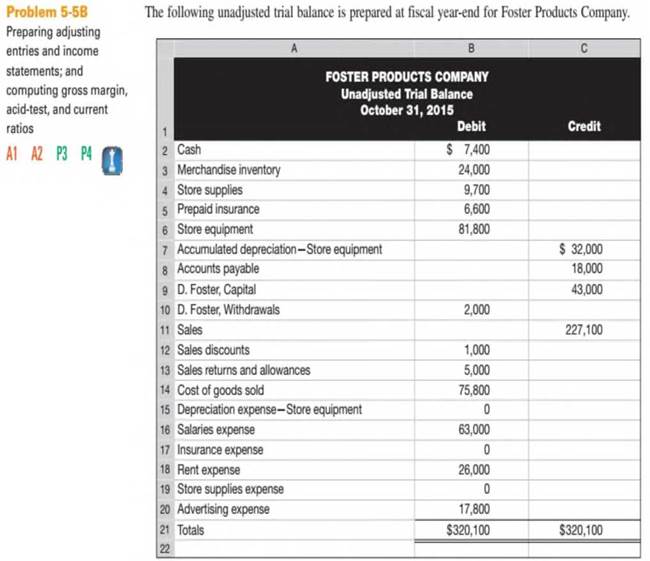

Chapter 5, Problem 6BPSB

Problem 5-6BE

Refer to the data and information in Problem 5-5B.

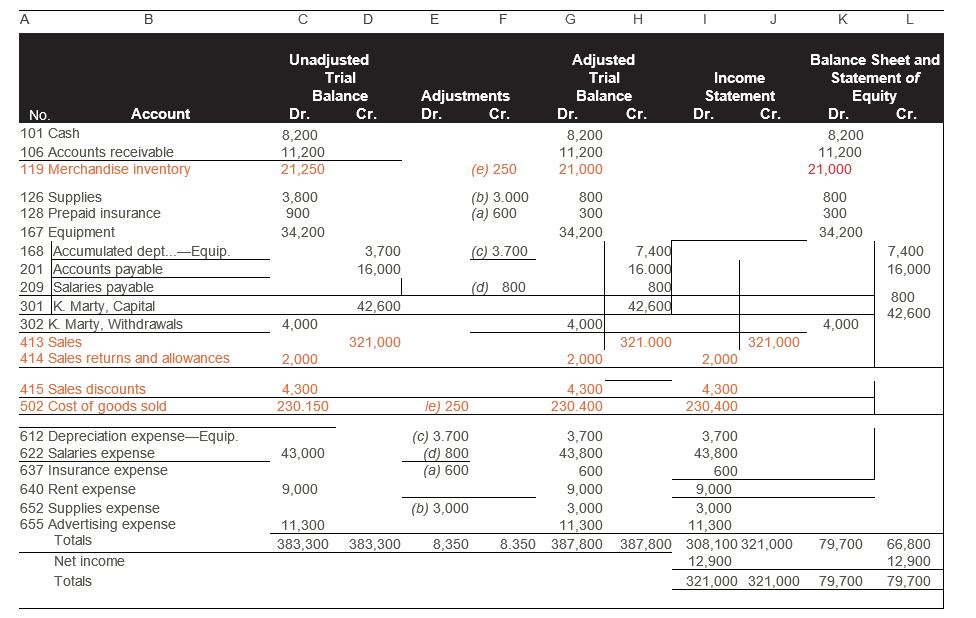

Preparing a work sheet for a merchandiser

Required

Prepare and complete the entire 10-column work sheet for Foster Products Company. Follow the structure of Exhibit 5B.1 in Appendix 5B.

Rent expense and salaries expense are equally divided between selling activities and the general and administrative activities. Foster Products Company uses a perpetual inventory system.

Required

- Prepare

adjusting journal entries to reflect each of the following. - Store supplies still available at fiscal year-end amount to $3,700.

- Expired insurance, an administrative expense, for the fiscal year is $2,800.

Depreciation expense on store equipment, a selling expense, is $3,000 for the fiscal year.- To estimate shrinkage, a physical count of ending merchandise inventory is taken. It shows $21,300 of inventory is still available at fiscal year-end.

EXHIBIT 5B.1

Work Sheet for Merchandiser (using a perpetual system)

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

need help this answer

For each of the transactions above, indicate the amount of the adjusting entry on the elements of the balance sheet and income statement.Note: Enter negative amounts with a minus sign.

Need help with this question solution general accounting

Chapter 5 Solutions

Loose Leaf for Fundamentals of Accounting Principles and Connect Access Card

Ch. 5 - Prob. 1DQCh. 5 - 2. In comparing the accounts of a merchandising...Ch. 5 - Prob. 3DQCh. 5 - Prob. 4DQCh. 5 - Prob. 5DQCh. 5 - Prob. 6DQCh. 5 - Prob. 7DQCh. 5 - Prob. 8DQCh. 5 - Prob. 9DQCh. 5 - Prob. 10DQ

Ch. 5 - Prob. 11DQCh. 5 - Prob. 12DQCh. 5 - Prob. 13DQCh. 5 - Prob. 14DQCh. 5 - Prob. 15DQCh. 5 - Prob. 1QSCh. 5 - Prob. 2QSCh. 5 - Prob. 3QSCh. 5 - Prob. 4QSCh. 5 - Prob. 5QSCh. 5 - Prob. 6QSCh. 5 - Prob. 7QSCh. 5 - Prob. 8QSCh. 5 - Prob. 9QSCh. 5 - Prob. 10QSCh. 5 - Prob. 11QSCh. 5 - Prob. 12QSCh. 5 - Prob. 13QSCh. 5 - Prob. 14QSCh. 5 - Prob. 15QSCh. 5 - Prob. 16QSCh. 5 - Prob. 17QSCh. 5 - Prob. 18QSCh. 5 - Prob. 1ECh. 5 - Prob. 2ECh. 5 - Prob. 3ECh. 5 - Prob. 4ECh. 5 - Prob. 5ECh. 5 - Exercise 5-6 Recording purchase returns and...Ch. 5 - Prob. 7ECh. 5 - Prob. 8ECh. 5 - Prob. 9ECh. 5 - Prob. 10ECh. 5 - Prob. 11ECh. 5 - Prob. 12ECh. 5 - Prob. 13ECh. 5 - Prob. 14ECh. 5 - Prob. 15ECh. 5 - Prob. 16ECh. 5 - Exercise 5-17A Recording purchases and...Ch. 5 - Prob. 18ECh. 5 - Prob. 19ECh. 5 - Prob. 20ECh. 5 - Prepare journal entries to record the following...Ch. 5 - (

Problem 5-2A

Preparing journal entries for...Ch. 5 - Prob. 3APSACh. 5 - Prob. 4APSACh. 5 - Prob. 5APSACh. 5 - Prob. 6APSACh. 5 - Prob. 1BPSBCh. 5 - Prepare journal entries to record the following...Ch. 5 - Prob. 3BPSBCh. 5 - Prob. 4BPSBCh. 5 - Prob. 5BPSBCh. 5 - Problem 5-6BE Refer to the data and information in...Ch. 5 - Prob. 5SPCh. 5 - Prob. 1GLPCh. 5 - Prepare journal entries to record the following...Ch. 5 - Based on Problem 5-5A Problem 5-5A Preparing...Ch. 5 - Prob. 1BTNCh. 5 - Prob. 2BTNCh. 5 - Prob. 3BTNCh. 5 - Prob. 4BTNCh. 5 - Prob. 5BTNCh. 5 - Prob. 6BTNCh. 5 - Prob. 7BTNCh. 5 - Prob. 8BTNCh. 5 - Prob. 9BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Duo Corporation is evaluating a project with the following cash flows: Year 0 1 2 3 Cash Flow -$ 30,000 12,200 14,900 16,800 4 5 13,900 -10,400 The company uses an interest rate of 8 percent on all of its projects. a. Calculate the MIRR of the project using the discounting approach. Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. b. Calculate the MIRR of the project using the reinvestment approach. Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. c. Calculate the MIRR of the project using the combination approach. Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. a. Discounting approach MIRR b. Reinvestment approach MIRR c. Combination approach MIRR % % %arrow_forwardHello tutor please provide this question solution general accountingarrow_forwardGet correct answer accounting questionsarrow_forward

- Consider a four-year project with the following information: Initial fixed asset investment = $555,000; straight-line depreciation to zero over the four-year life; zero salvage value; price = $37; variable costs = $25; fixed costs = $230,000; quantity sold = 79,000 units; tax rate = 24 percent. How sensitive is OCF to changes in quantity sold?arrow_forwardLight emitting diodes (LED) light bulbs have become required in recent years, but do they make financial sense? Suppose a typical 60-watt incandescent light bulb costs $.39 and lasts 1,000 hours. A 15-watt LED, which provides the same light, costs $3.10 and lasts for 12,000 hours. A kilowatt-hour of electricity costs $.115. A kilowatt-hour is 1,000 watts for 1 hour. If you require a return of 11 percent and use a light fixture 500 hours per year, what is the equivalent annual cost of each light bulb? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.arrow_forwardRecently, Abercrombie & Fitch has been implementing a turnaround strategy since its sales had been falling for the past few years (11% decrease in 2014, 8% in 2015, and just 3% in 2016.) One part of Abercrombie's new strategy has been to abandon its logo-adorned merchandise, replacing it with a subtler look. Abercrombie wrote down $20.6 million of inventory, including logo-adorned merchandise, during the year ending January 30, 2016. Some of this inventory dated back to late 2013. The write-down was net of the amount it would be able to recover selling the inventory at a discount. The write-down is significant; Abercrombie's reported net income after this write-down was $35.6 million. Interestingly, Abercrombie excluded the inventory write-down from its non-GAAP income measures presented to investors; GAAP earnings were also included in the same report. Question: From an investor standpoint, do you think that the effect of the inventory write-down should be considered when…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Chapter 6 Merchandise Inventory; Author: Vicki Stewart;https://www.youtube.com/watch?v=DnrcQLD2yKU;License: Standard YouTube License, CC-BY

Accounting for Merchandising Operations Recording Purchases of Merchandise; Author: Socrat Ghadban;https://www.youtube.com/watch?v=iQp5UoYpG20;License: Standard Youtube License