Prepare

July l Purchased merchandise from Boden Company for $6,000 under credit terms of 1/15, n/30, FOB shipping point, invoice dated July 1.

2 Sold merchandise to Creek Co. for $900 under credit terms of 2/10, n/60, FOB shipping point, invoice dated July 2. The merchandise had cost $500.

3 Paid $ 125 cash for freight charges on the purchase of July 1.

8 Sold merchandise that had cost $ 1,300 for $1,700 cash.

9 Purchased merchandise from Leight Co. for $2,200 under credit terms of 2/15, n/60, FOB destination, invoice dated July 9.

11 Received a $200 credit memorandum from Leight Co. for the return of part of the merchandise purchased on July 9.

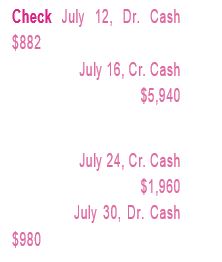

12 Received the balance due from Creek Co. for the invoice dated July 2, net of the discount.

16 Paid the balance due to Boden Company within the discount period.

19 Sold merchandise that cost $800 to Art Co. for $ 1.200 under credit terms of 2/15, n/60, FOB shipping point, invoice dated July 19.

21 Issued a $200 credit memorandum to Art Co. for an allowance on goods sold on July 19.

24 Paid Leight Co. the balance due after deducting the discount.

30 Received the balance due from Art Co. for the invoice dated July 19, net of discount.

31 Sold merchandise that cost $4,800 to Creek Co. for $7,000 under credit terms of 2/10, n/60. FOB shipping point, invoice dated July 31.

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Loose Leaf for Fundamentals of Accounting Principles and Connect Access Card

- What is the firm's net profit margin?arrow_forwardOn January 1 of the current year (Year 1), CVX acquired a delivery van for $68,000. The estimated useful life of the van is 6 years or 120,000 miles. The residual value at the end of 6 years is estimated to be $8,000. The actual mileage for the van was 19,000 miles in Year 1 and 25,000 miles in Year 2. What is the depreciation expense for the second year of use (Year 2) if CVX uses the units of production method? Provide answerarrow_forwardDon't use ai given answer accounting questionsarrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,