John Thomas, vice president of Mallett Company (a producer of a variety of plastic products), has been supervising the implementation of an ABC management system. John wants to improve process efficiency by improving the activities that define the processes. To illustrate the potential of the new system to the president, John has decided to focus on two processes: production and customer service.

Within each process, one activity will be selected for improvement: materials usage for production and sustaining engineering for customer service (sustaining engineers are responsible for redesigning products based on customer needs and feedback). Value-added standards are identified for each activity. For materials usage, the value-added standard calls for six pounds per unit of output (the products differ in shape and function, but their weight is uniform). The value-added standard is based on the elimination of all waste due to defective molds. The standard price of materials is $5 per pound. For sustaining engineering, the standard is 58% of current practical activity capacity. This standard is based on the fact that about 42% of the complaints have to do with design features that could have been avoided or anticipated by the company.

Current practical capacity (at the end of 20X1) is defined by the following requirements: 6,000 engineering hours for each product group that has been on the market or in development for 5 years or less and 2,400 hours per product group of more than 5 years. Four product groups have less than 5 years’ experience, and 10 product groups have more. Each of the 24 engineers is paid a salary of $60,000. Each engineer can provide 2,000 hours of service per year. No other significant costs are incurred for the engineering activity.

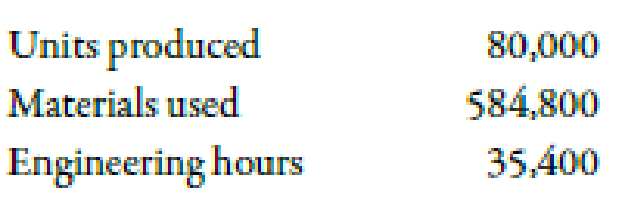

Actual materials usage for 20X1 was 25% above the level called for by the value-added standard; engineering usage was 46,000 hours. A total of 80,000 units of output were produced. John and the operational managers have selected some improvement measures that promise to reduce nonvalue-added activity usage by 40% in 20X2. Selected actual results achieved for 20X2 are as follows:

The actual prices paid for materials and engineering hours are identical to the standard or budgeted prices.

Required:

- 1. For 20X1, calculate the nonvalue-added usage and costs for materials usage and sustaining engineering.

- 2. CONCEPTUAL CONNECTION Using the budgeted improvements, calculate the expected activity usage levels for 20X2. Now, compute the 20X2 usage variances (the difference between the expected and actual values), expressed in both physical and financial measures, for materials and engineering. Comment on the company’s ability to achieve its targeted reductions. In particular, discuss what measures the company must take to capture any realized reductions in resource usage.

1.

Calculate the value of accounting costs which is apportion to a backpack before the duffle-bag line was added with the help of plant wide rate approach. Also, identify whether this approach is accurate or not.

Explanation of Solution

Non-Value Added Cost:

Non-value added cost refers to the cash and cash equivalents which are incurred due to the non-value activities or by the ineffective presentation of value-added activities.

Calculation of non-value added usage and costs for 20X1:

| Particulars |

Actual Quantity (A) |

Value added Quantity (B) |

Non-value usage (C) |

Standard Price (D) |

Non-value cost ($) |

| Materials | 600,0001 | 480,0003 | 120,000 | 5 | 600,000 |

| Engineering | 48,0002 | 27,8404 | 20,160 | 305 | 604,800 |

Table (1)

Working Note:

1.

Calculation of actual quantity of material:

2.

Calculation of actual quantity of engineering:

3.

Calculation of value added quantity of material:

4.

Calculation of value added quantity of engineering:

5.

Calculation of standard price of engineering:

2.

Compute the value of expected activity usage levels for 20X2 with the help of budgeted improvements. Also, calculate the value of usage variances for 20X2. Explain the measures that company should take to capture any reductions in resource usage.

Explanation of Solution

Use the following formula to calculate expected activity usage levels for materials:

Substitute $480,000 for value added quantity, 60% for value added activity usage and 120,000 for non-value usage in the above formula.

Therefore, an expected activity usage level for materials is 552,000 pounds.

Use the following formula to calculate expected activity usage levels for engineering:

Substitute $27,840 for value added quantity, 60% for value added activity usage and 20,160 for non-value usage in the above formula.

Therefore, an expected activity usage level for engineering is 39,936 hours.

Calculation of non-value added usage and costs for 20X2:

| Particulars |

Actual Quantity (A) |

Expected Quantity (B) |

Excess Non-value usage (C) |

Standard Price (D) |

Excess Non-value cost ($) |

| Materials | 584,800 | 552,000 | 32,800 | 5 | 164,000(U) |

| Engineering | 35,400 | 39,936 | 4,536 | 30 | 136,080(F) |

Table (2)

According to the above calculations, company is not able to attain the material standard but successfully achieve the engineering standard. The actual consumption of engineering is 35,400 hours and the activity usage is 48,000. Therefore, company is able to create an unused capacity of engineering of 12,600 hours

- Company lay off the six engineers to increase the total profits of the organization by saving the salaries amount of $360,000.

- Company should reassign the activities that have insufficient resources it will also helps to the organization in saving the engineering cost.

Want to see more full solutions like this?

Chapter 5 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- On average, FurniStyle Ltd. is able to sell its inventory in 30 days. The firm takes 90 days on average to pay for its purchases. On the other hand, its average customer pays with a credit card, which allows the firm to collect its receivables in 6 days. What is the length of the operating cycle?arrow_forwardwhat is the cost of goods sold.arrow_forwardHelp mearrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub