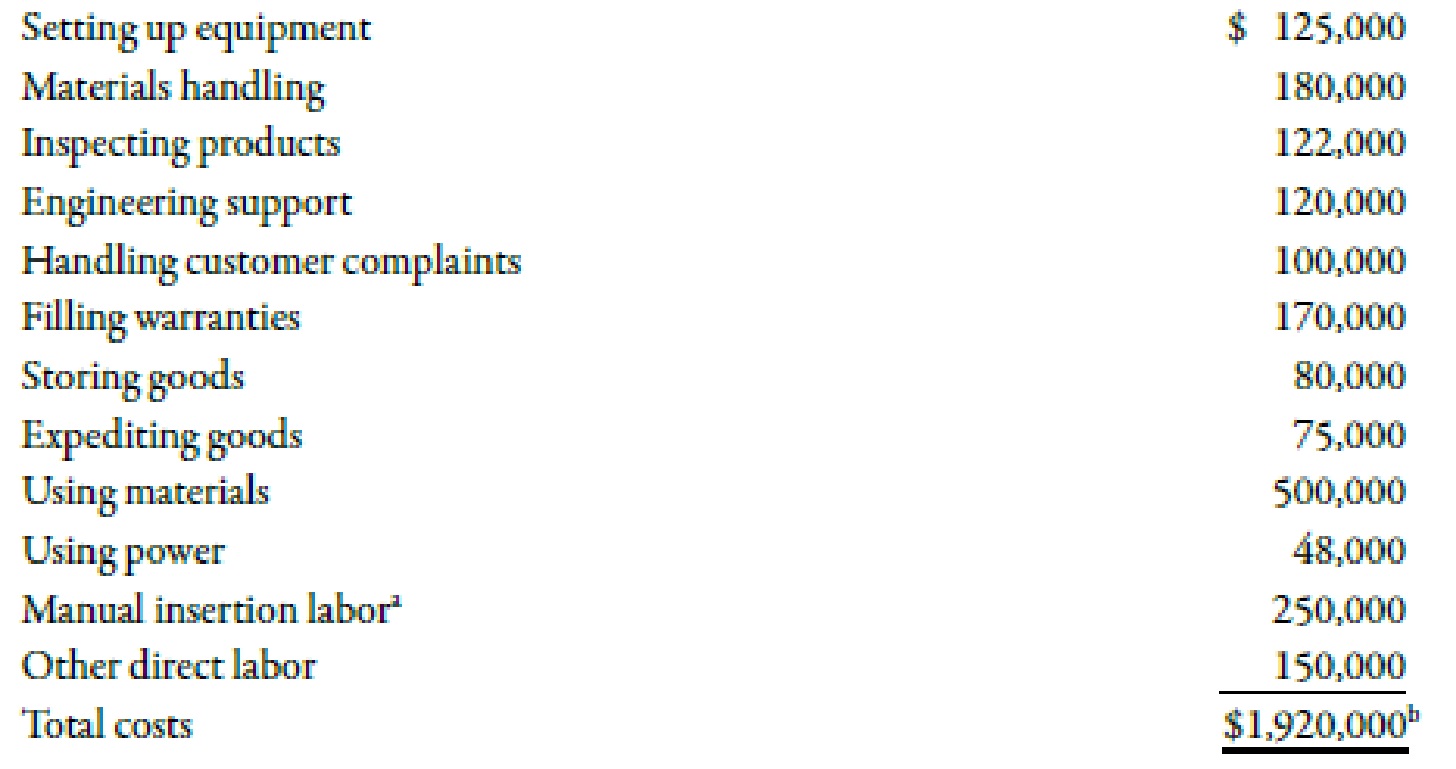

Danna Martin, president of Mays Electronics, was concerned about the end-of-the year marketing report that she had just received. According to Larry Savage, marketing manager, a price decrease for the coming year was again needed to maintain the company’s annual sales volume of integrated circuit boards (CBs). This would make a bad situation worse. The current selling price of $18 per unit was producing a $2-per-unit profit—half the customary $4-per-unit profit. Foreign competitors kept reducing their prices. To match the latest reduction would reduce the price from $18 to $14. This would put the price below the cost to produce and sell it. How could these firms sell for such a low price? Determined to find out if there were problems with the company’s operations, Danna decided to hire a consultant to evaluate the way in which the CBs were produced and sold. After two weeks, the consultant had identified the following activities and costs:

The consultant indicated that some preliminary activity analysis shows that per-unit costs can be reduced by at least $7. Since the marketing manager had indicated that the market share (sales volume) for the boards could be increased by 50% if the price could be reduced to $12, Danna became quite excited.

Required:

- 1. CONCEPTUAL CONNECTION What is activity-based management? What phases of activity analysis did the consultant provide? What else remains to be done?

- 2. CONCEPTUAL CONNECTION Identify as many nonvalue-added costs as possible. Compute the cost savings per unit that would be realized if these costs were eliminated. Was the consultant correct in the preliminary cost reduction assessment? Discuss actions that the company can take to reduce or eliminate the nonvalue-added activities.

- 3. Compute the unit cost required to maintain current market share, while earning a profit of $4 per unit. Now compute the unit cost required to expand sales by 50%, assuming a per-unit profit of $4. How much cost reduction would be required to achieve each unit cost?

- 4. Assume that further activity analysis revealed the following: switching to automated insertion would save $60,000 of engineering support and $90,000 of direct labor. Now, what is the total potential cost reduction per unit available from activity analysis? With these additional reductions, can Mays achieve the unit cost to maintain current sales? To increase it by 50%? What form of activity analysis is this: reduction, sharing, elimination, or selection?

- 5. CONCEPTUAL CONNECTION Calculate income based on current sales, prices, and costs. Then calculate the income by using a $14 price and a $12 price, assuming that the maximum cost reduction possible is achieved (including Requirement 4’s reduction). What price should be selected?

1.

Explain activity based management. Discuss the phases that are provided by the consultant. Also, explain the other phases that need to be done in an organization.

Explanation of Solution

Activity Based Costing (ABC):

Activity based costing is a apportionment of costs that first considers the activity drivers that helps in the allocation of costs to various activities and then allocates costs to different cost objects by using the drivers.

Activity based management is a technique that focuses on the attention of management towards the various activities. It includes two dimensions that is a cost dimension and a process dimension. Activity based management are identifying the activities, evaluating their values and continuing only value-adding activities. The consultant only identifying the activities but does not categorize the activities as value-added activity or non-value added activity. Also, consultant does not give any suggestions for increasing efficiency of use of activities. The consultant only eliminates non-value added activities for increasing the potential savings. Therefore, activity based management suggest how to reduce, remove, share and choose various activities in order to get the cost reductions.

2.

Calculate the cost savings per unit that would be realized if these costs were eliminated. Identify whether the consultant correct in the preliminary cost reduction assessment. Also, explain the actions that company can take to reduce or eliminate the non-value added activities.

Explanation of Solution

| Particulars |

Amount ($) |

| Setting up equipment | 125,000 |

| Materials handling | 180,000 |

| Inspecting products | 122,000 |

| Handling customer complaints | 100,000 |

| Filling warranties | 170,000 |

| Storing goods | 80,000 |

| Expediting goods | 75,000 |

| Total (A) | 852,000 |

| Units produced and sold (B) | 120,0001 |

| Potential unit cost reduction | 7.10 |

Table (1)

Consultant is able to achieve its target. On the basis of above calculation, per unit costs is reduced by $7.10 and consultant is also able to reduce further costs by improving the value-added activities.

Currently, an organization earns $2 per unit profit. If an organization decreases the cost per unit to $4 per unit, then their current sales and profit is $14 at a price. Also, if an organization savings the cost, then the company is able to earn additional profit.

Working Note:

1.

Calculation of units produced and sold:

3.

Calculate the unit cost required to maintain the current market share while earning a profit of $4 per unit. Calculate the unit cost required to expand sale by 50%. Also, discuss how much cost reduction is needed to attain the each unit cost.

Explanation of Solution

Use the following formula to calculate the unit cost to maintain sales:

Substitute $14 for latest reduction and $4 for profit per unit in the above formula.

Therefore, unit cost to maintain sales is $10.

Use the following formula to calculate the unit cost to expand sales:

Substitute $12 for latest reduction and $4 for profit per unit in the above formula.

Therefore, unit cost to expand sales is $8.

Use the following formula to calculate the cost reduction to maintain sales:

Substitute $16 for current sales and $10 for unit cost to maintain sales in the above formula.

Therefore, cost reduction to maintain sales is $6.

Use the following formula to calculate the cost reduction to expand sales:

Substitute $16 for current sales and $8 for unit cost to expand sales in the above formula.

Therefore, cost reduction to expand sales is $8.

4.

Calculate the total potential cost reduction per unit. Also, identify the form of activity as a reduction, sharing, elimination or selection.

Explanation of Solution

| Particulars |

Amount ($) |

| Total potential reduction | 852,000 |

| Automated Cost | 150,000 |

| Total (A) | 1,002,000 |

| Units (B) | 120,000 |

| Units savings | 8.35 |

Table (2)

Therefore, company needs to decrease the cost by $8.35 to maintain the current market share. If company removes the non-value added costs, then the cost reduction increases the market share. In the given problem, activity selection is uses in the activity management.

5.

Compute the income based on current sales, prices and costs. Also, compute the income with the help of $14 price and a $12 price.

Explanation of Solution

Calculation of the income on the basis of current sales:

| Particulars |

Amount ($) |

| Sales | 2,160,000 |

| Less: Costs | 1,920,000 |

| Income | 240,000 |

Table (3)

Calculation of the income when the price is $14:

| Particulars |

Amount ($) |

| Sales | 1,680,000 |

| Less: Costs | 918,000 |

| Income | 762,000 |

Table (4)

Calculation of the income when the price is $12:

| Particulars |

Amount ($) |

| Sales | 2,160,000 |

| Less: Costs | 1,377,000 |

| Income | 783,000 |

Table (5)

Therefore, if company is adopting the price of $12, then company is able to earn maximum profit.

Working Note:

1.

Calculation of cost rate:

Want to see more full solutions like this?

Chapter 5 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning