Intermediate Accounting: Reporting and Analysis

2nd Edition

ISBN: 9781285453828

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 5P

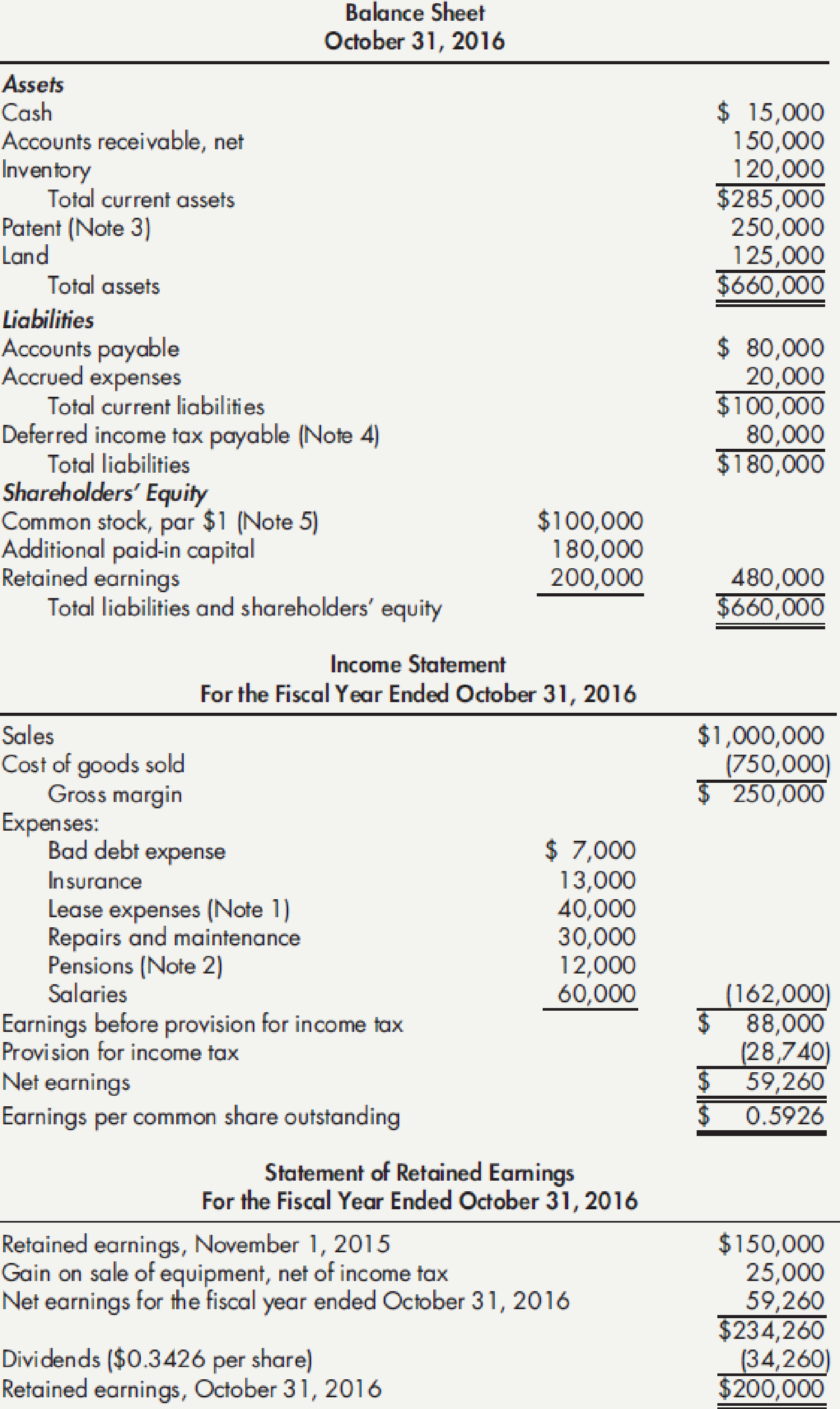

Financial Statement Violations of U.S. GAAP The following are the financial statements issued by Allen Corporation for its fiscal year ended October 31, 2016:

Notes to Financial Statements:

- 1. Long-Term Lease. Under the terms of a 5-year, noncancelable lease for a building, Allen is obligated to make annual rental payments of $40,000 in each of the next 4 fiscal years.

- 2. Pension Plan. Substantially all employees are covered by Allen’s defined benefit pension plan. Pension expense is equal to the total of pension benefits accrued and paid to retired employees during the year. Because it is a defined benefit plan that is paid every year, no pension liability exists.

- 3. Patent. The patent had an estimated remaining life of 10 years at the time of purchase. Allen’s patent was purchased from Apex Corporation on January 1, 2016, for $250,000.

- 4.

Deferred Income Tax Payable. The entire balance in the Deferred Income Tax Payable account arose from tax-exempt municipal bonds that were held during the previous fiscal year, giving rise to a difference between taxable income and reported net earnings for the fiscal year ended October 31, 2016. The deferred liability amount was calculated on the basis of past tax rates. - 5. Warrants. On January 1, 2015, one common stock warrant was issued to shareholders of record for each common share owned. An additional share of common stock is to be issued upon exercise of 10 stock warrants and receipt of an amount equal to par value. For the 6 months ended October 31, 2016, the average market value for Allen’s common stock was $5 per share and no warrants had yet been exercised.

- 6.

Contingent Liability . On October 31, 2016, Allen was contingently liable for product warranties in an amount estimated to aggregate $75,000.

Required:

Next Level Review the preceding financial statements and related notes. Identify any inclusions or exclusions from them that would be in violation of GAAP, and indicate corrective action to be taken. Do not comment as to format or style. Respond in the following order:

- 1.

Balance sheet - 2. Notes

- 3. Income statement

- 4. Statement of

retained earnings - 5. General

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the variable overhead efficiency variance for the month please given correct answer

What is the gross profit rate

Correct answer please

Chapter 5 Solutions

Intermediate Accounting: Reporting and Analysis

Ch. 5 - In general, how does the income statement help...Ch. 5 - Prob. 2GICh. 5 - Define income under the capital maintenance...Ch. 5 - Prob. 4GICh. 5 - What is net income?Ch. 5 - What three things must a company determine to...Ch. 5 - Prob. 7GICh. 5 - Prob. 8GICh. 5 - Prob. 9GICh. 5 - Give an example and explanation for each of the...

Ch. 5 - Define expenses. What do expenses measure?Ch. 5 - Prob. 12GICh. 5 - Define gains and losses. Give examples of three...Ch. 5 - Prob. 14GICh. 5 - What items are included in a companys income from...Ch. 5 - How are unusual or infrequent gains or losses...Ch. 5 - What is interperiod tax allocation?Ch. 5 - Prob. 18GICh. 5 - Prob. 19GICh. 5 - Prob. 20GICh. 5 - Prob. 21GICh. 5 - Prob. 22GICh. 5 - Prob. 23GICh. 5 - Prob. 24GICh. 5 - Prob. 25GICh. 5 - Prob. 26GICh. 5 - Prob. 27GICh. 5 - Prob. 28GICh. 5 - Prob. 29GICh. 5 - Prob. 30GICh. 5 - Prob. 31GICh. 5 - Prob. 32GICh. 5 - What is the rate of return on common equity? What...Ch. 5 - Prob. 34GICh. 5 - Prob. 35GICh. 5 - Which of the following is expensed under the...Ch. 5 - The following information is available for Cooke...Ch. 5 - The following information is available for Wagner...Ch. 5 - Prob. 4MCCh. 5 - A loss from the sale of a component of a business...Ch. 5 - In a statement of cash flows, receipts from sales...Ch. 5 - Brandt Corporation had sales revenue of 500,000...Ch. 5 - Refer to RE5-1. Prepare a single-step income...Ch. 5 - Shaquille Corporation began the current year with...Ch. 5 - Dorno Corporation incurred expenses during the...Ch. 5 - Niler Corporation reported the following after-tax...Ch. 5 - Jordan Corporation reported retained earnings of...Ch. 5 - Prob. 7RECh. 5 - Prob. 8RECh. 5 - Amelias Bookstore reported net income of 62,000...Ch. 5 - Prob. 10RECh. 5 - Prob. 1ECh. 5 - Prob. 2ECh. 5 - Prob. 3ECh. 5 - Cost of Goods Sold and Income Statement Schuch...Ch. 5 - Prob. 5ECh. 5 - Prob. 6ECh. 5 - Prob. 7ECh. 5 - Prob. 8ECh. 5 - Prob. 9ECh. 5 - Prob. 10ECh. 5 - Prob. 11ECh. 5 - Prob. 12ECh. 5 - Prob. 13ECh. 5 - Prob. 14ECh. 5 - Prob. 15ECh. 5 - Prob. 16ECh. 5 - Prob. 17ECh. 5 - Classifications Where would each of the following...Ch. 5 - Prob. 19ECh. 5 - Common-Size Analyses Meagley Company presents the...Ch. 5 - Prob. 21ECh. 5 - Prob. 22ECh. 5 - Prob. 23ECh. 5 - Prob. 24ECh. 5 - Prob. 25ECh. 5 - Prob. 26ECh. 5 - Prob. 1PCh. 5 - Prob. 2PCh. 5 - Prob. 3PCh. 5 - Prob. 4PCh. 5 - Financial Statement Violations of U.S. GAAP The...Ch. 5 - Rox Corporations multiple-step income statement...Ch. 5 - Prob. 7PCh. 5 - Prob. 8PCh. 5 - Prob. 9PCh. 5 - The following is an alphabetical list of accounts...Ch. 5 - Financial Statement Deficiencies The following is...Ch. 5 - Prob. 12PCh. 5 - Prob. 13PCh. 5 - Prob. 14PCh. 5 - Prob. 15PCh. 5 - Prob. 16PCh. 5 - Prob. 17PCh. 5 - Prob. 18PCh. 5 - Prob. 19PCh. 5 - Prob. 20PCh. 5 - Prob. 21PCh. 5 - Prob. 22PCh. 5 - Prob. 23PCh. 5 - Prob. 1CCh. 5 - Prob. 2CCh. 5 - Prob. 3CCh. 5 - Prob. 4CCh. 5 - Nonrecurring Items Lynn Company sells a component...Ch. 5 - Prob. 6CCh. 5 - Accrual Accounting GAAP requires the use of...Ch. 5 - Prob. 8CCh. 5 - Prob. 9CCh. 5 - Prob. 10CCh. 5 - Prob. 12C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Accounting for Finance and Operating Leases | U.S. GAAP CPA Exams; Author: Maxwell CPA Review;https://www.youtube.com/watch?v=iMSaxzIqH9s;License: Standard Youtube License