Engineering Economy, Student Value Edition (17th Edition)

17th Edition

ISBN: 9780134838137

Author: William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 5P

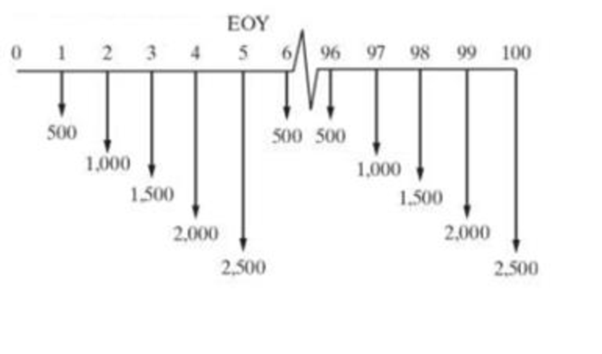

What is the capitalized worth of a project that has an indefinitely long study period and dollar cash flows that repeat as shown in the following figure. The interest rate is 15% per year. (5.3)

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

5. We learnt the following equation in the class: Ak = sy - (n + 8)k where y = ko. Now, I

transform this equation into: Ak/k = sy/k - (n + 8). I want you to use a diagram to show the

steady state solution of this equation (In the diagram, there will be two curves - one

represents sy/k and one represents (n + 8). In the steady state, of course, Ak/k = 0). In this

diagram, the x-axis is k. What will happen to this diagram if the value of n increases?

Not use ai please

3. A country has the following production function: Y = K0.2L0.6p0.2 where Y is total

output, K is capital stock, L is population size and P is land size. The depreciation rate (8)

is 0.05. The population growth rate (n) is 0. We define: y = ½, k = 1 and p = . Land size

is fixed.

L

a) Find out the steady state values of k and y in terms of p, the per capita land size.

Chapter 5 Solutions

Engineering Economy, Student Value Edition (17th Edition)

Ch. 5.A - Use the ERR method with = 8% per year to solve for...Ch. 5.A - Apply the ERR method with = 12% per year to the...Ch. 5.A - Are there multiple IRRs for the following...Ch. 5.A - Are there multiple IRRs for the following cash...Ch. 5 - Tennessee Tool Works (TTW) is considering...Ch. 5 - Prob. 2PCh. 5 - Prob. 3PCh. 5 - Prob. 4PCh. 5 - What is the capitalized worth of a project that...Ch. 5 - A large induced-draft fan is needed for an...

Ch. 5 - Prob. 7PCh. 5 - Prob. 8PCh. 5 - Prob. 9PCh. 5 - A corporate bond pays 5% of its face value once...Ch. 5 - Prob. 11PCh. 5 - Prob. 12PCh. 5 - Prob. 13PCh. 5 - The cash-flow diagram below has an internal rate...Ch. 5 - Prob. 15PCh. 5 - Prob. 16PCh. 5 - Prob. 17PCh. 5 - Prob. 18PCh. 5 - Prob. 19PCh. 5 - Your firm is thinking about investing 200,000in...Ch. 5 - Determine the FW of the following engineering...Ch. 5 - Prob. 22PCh. 5 - Fill in Table P5-23 below when P = 10,000, S = 2,...Ch. 5 - An asset has an initial capital investment of4...Ch. 5 - A simple, direct space heating system is currently...Ch. 5 - Prob. 26PCh. 5 - Prob. 27PCh. 5 - Prob. 28PCh. 5 - Prob. 29PCh. 5 - Its easier to make money when interest rates in...Ch. 5 - Prob. 31PCh. 5 - Prob. 32PCh. 5 - Stan Moneymaker has been informed of a major...Ch. 5 - The required investment cost of a new, large...Ch. 5 - Prob. 35PCh. 5 - A parking garage has a capital investment cost of...Ch. 5 - The city of Oak Ridge is considering the...Ch. 5 - Prob. 38PCh. 5 - Prob. 39PCh. 5 - Prob. 40PCh. 5 - Prob. 41PCh. 5 - Prob. 42PCh. 5 - Prob. 43PCh. 5 - To purchase a used automobile, you borrow 10,000...Ch. 5 - Your boss has just presented you with the summary...Ch. 5 - Experts agree that the IRR of a college education...Ch. 5 - A company has the opportunity to take over a...Ch. 5 - The prospective exploration for oil in the outer...Ch. 5 - Prob. 49PCh. 5 - An integrated, combined cycle power plant produces...Ch. 5 - A computer call center is going to replace all of...Ch. 5 - Prob. 52PCh. 5 - Prob. 53PCh. 5 - Prob. 54PCh. 5 - The upturned wingtips on jet aircraft reduce drag...Ch. 5 - Prob. 56PCh. 5 - Prob. 57PCh. 5 - Prob. 58PCh. 5 - In southern California a photovoltaic (PV) system...Ch. 5 - a. Calculate the IRR for each of the three...Ch. 5 - Prob. 61PCh. 5 - A hospital germ-fighting and floor cleaning robot,...Ch. 5 - Prob. 63PCh. 5 - Prob. 64SECh. 5 - Prob. 65SECh. 5 - Prob. 66SECh. 5 - A certain medical device will result in an...Ch. 5 - Refer to Problem 5-61. Develop a spreadsheet to...Ch. 5 - Prob. 69CSCh. 5 - Prob. 70CSCh. 5 - Suppose that the average utilization of the CVD...Ch. 5 - Prob. 72FECh. 5 - Prob. 73FECh. 5 - Prob. 74FECh. 5 - Prob. 75FECh. 5 - Prob. 76FECh. 5 - Prob. 77FECh. 5 - Prob. 78FECh. 5 - Prob. 79FECh. 5 - A new machine was bought for 9,000 with life of...Ch. 5 - Prob. 81FECh. 5 - Prob. 82FECh. 5 - Prob. 83FECh. 5 - Prob. 84FECh. 5 - Prob. 85FE

Additional Business Textbook Solutions

Find more solutions based on key concepts

Which of the following is a primary activity in the value chain?

purchasing

accounting

post-sales service

human...

Accounting Information Systems (14th Edition)

How is activity-based costing useful for pricing decisions?

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Mary Williams, owner of Williams Products, is evaluating whether to introduce a new product line. After thinkin...

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

A typical discounted price of a AAA battery is 0.75. It is designed to provide 1.5 volts and 1.0 amps for about...

Engineering Economy (17th Edition)

Assume you are a CFO of a company that is attempting to race additional capital to finance an expansion of its ...

Financial Accounting, Student Value Edition (5th Edition)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Not use ai please letarrow_forwardConsider the market for sweaters in a Hamilton neighbourhood shown in the figure to the right. The consumer surplus generated by consuming the 29th sweater is OA. $67.90. OB. $58.20. ○ C. $77.60. OD. $38.80. ○ E. $19.50. Price ($) 97 68.0 48.5 29.0 29.0 Sweater Market 48.5 Quantity (Sweaters per week)arrow_forwardNot use ai pleasearrow_forward

- In the following table, complete the third column by determining the quantity sold in each country at a price of $18 per toy train. Next, complete the fourth column by calculating the total profit and the profit from each country under a single price. Price Single Price Quantity Sold Price Discrimination Country (Dollars per toy train) (Millions of toy trains) Profit (Millions of dollars) Price (Dollars per toy train) Quantity Sold (Millions of toy trains) Profit (Millions of dollars) France 18 Russia 18 Total N/A N/A N/A N/A Suppose that as a profit-maximizing firm, Le Jouet decides to price discriminate by charging a different price in each market, while its marginal cost of production remains $8 per toy. Complete the last three columns in the previous table by determining the profit-maximizing price, the quantity sold at that price, the profit in each country, and total profit if Le Jouet price discriminates. Le Jouet charges a lower price in the market with a relatively elastic…arrow_forwardNot use ai pleasearrow_forwardNot dhdjdjdjduudnxnxjfjfi feverarrow_forward

- Discuss the different types of resources (natural, human, capital) and how they are allocated in an economy. Identify which resources are scarce and which are abundant, and explain the implications of this scarcity or abundance.arrow_forwardNot use ai pleasearrow_forwardNot use ai please letarrow_forward

- Location should be in GWAGWALADA Abuja Nigeria Use the Internet to do itarrow_forwardUsing data from 1988 for houses sold in Andover, Massachusetts, from Kiel and McClain (1995), the following equation relates housing price (price) to the distance from a recently built garbage incinerator (dist): = log(price) 9.40 + 0.312 log(dist) n = 135, R2 = 0.162. Interpretation of the slope coefficient? ► How would our interpretation of the slope coefficient change if distance were measured in metres instead of kilometres?arrow_forwardIf GDP goes up by 1% and the investment component of GDPgoes up by more than 1%, how is the investment share ofGDP changing in absolute terms?▶ In economics, what else is expressed as relative percentagechanges?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...

Economics

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:Cengage Learning

Exploring Economics

Economics

ISBN:9781544336329

Author:Robert L. Sexton

Publisher:SAGE Publications, Inc

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...

Economics

ISBN:9781305506893

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...

Economics

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

DATA GEMS: How to Access Income Data Tables and Reports From the CPS ASEC; Author: U.S. Census Bureau;https://www.youtube.com/watch?v=BWpVC-Clczw;License: Standard Youtube License