Managerial Accounting

3rd Edition

ISBN: 9780077826482

Author: Stacey M Whitecotton Associate Professor, Robert Libby, Fred Phillips Associate Professor

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 5E

Estimating Cost Behavior Using High-Low Method

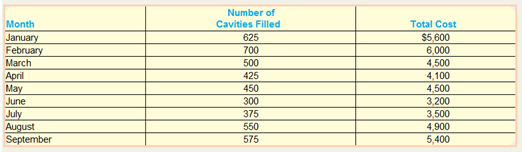

Mountain Dental Services is a specialized dental practice whose only service is filling cavities. Mountain has recorded the following for the past nine months:

1. Use the high-low method to estimate total fixed cost and variable cost per cavity filled.

2. Using these estimates, calculate Mountain’s total cost for filling 500 cavities.

3. How closely does your estimate match the actual cost for March? If they are different, explain why.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please solve this questions

what will be the new ROE'?

Objective: The purpose of this exercise is to ensure that students can locate the audit requirements for a Single Audit.

Scenario: A nonprofit organization, ABC Youth Services, receives $1.2 million in federal grant funding to provide after-school programs. The organization must comply with the Single Audit Act but is unfamiliar with the audit requirements. To guide the organization, please provide the information below. Use the federal regulations for Single Audits (2 CFR Part 200, Subpart F) as a reference for your responses.

Why Is the non-profit subject to the Single Audit Requirements? Cite the federal regulation that applies.

Chapter 5 Solutions

Managerial Accounting

Ch. 5 - Define each of the following terms variable cost,...Ch. 5 - Prob. 2QCh. 5 - Prob. 3QCh. 5 - Prob. 4QCh. 5 - Prob. 5QCh. 5 - Describe the three methods used to estimate cost...Ch. 5 - Prob. 7QCh. 5 - Prob. 8QCh. 5 - Prob. 9QCh. 5 - Prob. 10Q

Ch. 5 - Prob. 11QCh. 5 - Prob. 12QCh. 5 - Prob. 13QCh. 5 - Prob. 14QCh. 5 - Which of the following increases when activity...Ch. 5 - Prob. 2MCCh. 5 - Prob. 3MCCh. 5 - Consider the following information for a local...Ch. 5 - Prob. 5MCCh. 5 - Prob. 6MCCh. 5 - Prob. 7MCCh. 5 - Prob. 8MCCh. 5 - Prob. 9MCCh. 5 - Hathaway Corp, manufactures garden hoses. Last...Ch. 5 - Identifying Cost Behavior Heather Oak is trying to...Ch. 5 - Prob. 2MECh. 5 - Defining Cost Behavior Match each of the following...Ch. 5 - Prob. 4MECh. 5 - Defining Terms for the High-Low Method Indicate...Ch. 5 - Prob. 6MECh. 5 - Prob. 7MECh. 5 - Prob. 8MECh. 5 - Prob. 9MECh. 5 - Prob. 10MECh. 5 - Prob. 11MECh. 5 - Prob. 12MECh. 5 - Prob. 13MECh. 5 - Prob. 14MECh. 5 - Prob. 15MECh. 5 - Prob. 16MECh. 5 - Compare full absorption costing to variable...Ch. 5 - Identifying Cost Behavior Patterns Steve...Ch. 5 - Prob. 2ECh. 5 - Prob. 3ECh. 5 - Prob. 4ECh. 5 - Estimating Cost Behavior Using High-Low Method...Ch. 5 - Prob. 6ECh. 5 - Prob. 7ECh. 5 - Prob. 8ECh. 5 - Prob. 9ECh. 5 - Estimating Cost Behavior Using Scattergraph and...Ch. 5 - Estimating Cost Behavior Using Least-Squares...Ch. 5 - Comparing High-Low Method and Least-Squares...Ch. 5 - Preparing Contribution Margin Income Statement...Ch. 5 - Determining Cost Behavior, Preparing Contribution...Ch. 5 - Prob. 15ECh. 5 - Prob. 16ECh. 5 - Prob. 17ECh. 5 - Prob. 18ECh. 5 - Comparing Full Absorption Costing and Variable...Ch. 5 - Estimating Cost Behavior Using Least-Squares...Ch. 5 - Prob. 1.1GAPCh. 5 - Prob. 1.2GAPCh. 5 - Prob. 1.3GAPCh. 5 - Prob. 1.4GAPCh. 5 - Prob. 1.5GAPCh. 5 - Prob. 1.6GAPCh. 5 - Prob. 2.1GAPCh. 5 - Prob. 2.2GAPCh. 5 - Prob. 2.3GAPCh. 5 - Prob. 2.4GAPCh. 5 - Prob. 2.5GAPCh. 5 - Prob. 2.6GAPCh. 5 - Prob. 2.7GAPCh. 5 - Prob. 3.1GAPCh. 5 - Prob. 3.2GAPCh. 5 - Prob. 3.3GAPCh. 5 - Prob. 3.4GAPCh. 5 - Prob. 3.5GAPCh. 5 - Prob. 4.1GAPCh. 5 - Prob. 4.2GAPCh. 5 - Prob. 4.3GAPCh. 5 - Comparing Full Absorption and Variable Costing...Ch. 5 - Comparing Full Absorption and Variable Costing...Ch. 5 - Prob. 5.3GAPCh. 5 - Prob. 6.1GAPCh. 5 - Prob. 6.2GAPCh. 5 - Prob. 6.3GAPCh. 5 - Prob. 6.4GAPCh. 5 - Prob. 6.5GAPCh. 5 - Prob. 6.6GAPCh. 5 - Prob. 1.1GBPCh. 5 - Prob. 1.2GBPCh. 5 - Prob. 1.3GBPCh. 5 - Prob. 1.4GBPCh. 5 - Estimating Cost Behavior Using Scattergraph,...Ch. 5 - Prob. 1.6GBPCh. 5 - Prob. 2.1GBPCh. 5 - Estimating Cost Behavior Using Scattergraph,...Ch. 5 - Prob. 2.3GBPCh. 5 - Prob. 2.4GBPCh. 5 - Prob. 2.5GBPCh. 5 - Prob. 2.6GBPCh. 5 - Prob. 2.7GBPCh. 5 - Prob. 3.1GBPCh. 5 - Prob. 3.2GBPCh. 5 - Prob. 3.3GBPCh. 5 - Prob. 3.4GBPCh. 5 - Prob. 3.5GBPCh. 5 - Prob. 4.1GBPCh. 5 - Prob. 4.2GBPCh. 5 - Prob. 4.3GBPCh. 5 - Prob. 5.1GBPCh. 5 - Prob. 5.2GBPCh. 5 - Prob. 5.3GBPCh. 5 - Prob. 6.1GBPCh. 5 - Prob. 6.2GBPCh. 5 - Prob. 6.3GBPCh. 5 - Prob. 6.4GBPCh. 5 - Prob. 6.5GBPCh. 5 - Prob. 6.6GBP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Question 1Toodles Inc. had sales of $1,840,000. Cost of goods sold,administrative and selling expenses, and depreciation expenses were$1,180,000, $185,000 and $365,000 respectively. In addition, thecompany had an interest expense of $280,000 and a tax rate of 35percent. (Ignore any tax loss carry-back or carry-forward provisions.)Arrange the financial information for Toodles Inc. in an incomestatement and compute its OCF?arrow_forwardIts days' sales uncollected equalsarrow_forwardI want to correct answer general accounting questionarrow_forward

- the estimated total fixed cost is:arrow_forwardStone Company is facing several decisions regarding investing and financing activities. Address each decision independently. On June 30, 2024, the Stone Company purchased equipment from Paper Corporation. Stone agreed to pay $28,000 on the purchase date and the balance in five annual installments of $5,000 on each June 30 beginning June 30, 2025. Assuming that an interest rate of 10% properly reflects the time value of money in this situation, at what amount should Stone value the equipment? Stone needs to accumulate sufficient funds to pay a $580,000 debt that comes due on December 31, 2029. The company will accumulate the funds by making five equal annual deposits to an account paying 5% interest compounded annually. Determine the required annual deposit if the first deposit is made on December 31, 2024. On January 1, 2024, Stone leased an office building. Terms of the lease require Stone to make 10 annual lease payments of $138,000 beginning on January 1, 2024. A 10% interest rate…arrow_forwardCorrect answer pleasearrow_forward

- Get correct answer general accounting questionsarrow_forwardWhat is tikki's ROE for 2008 ?arrow_forward1. I want to know how to solve these 2 questions and what the answers are 1. Solar industries has a debt-to-equity ratio of 1.25. Its WACC is 7.8%, and its cost of debt is 4.7%. The corporate tax rate is 21%. a. What is the company’s cost of equity capital?b. What is the company’s unlevered cost of equity capital?c. What would be the cost of equity if the D/E ratio were 2? What if it were 1? 2. Therap software company is trying to determine its optimal capital structure. The company’s current capital structure consists of 35% debt and 65% common equity; however, the treasurer believes that the firm should use more debt. Currently, the company’s cost of equity capital is 9%, which is determined by CAPM. What would be Therap’s estimated cost of equity capital if they change their capital structure to 50% debt? Risk-free rate is 3%, market index returns 11%, and the Therap’s tax rate is 25%.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

How to Estimate Project Costs: A Method for Cost Estimation; Author: Online PM Courses - Mike Clayton;https://www.youtube.com/watch?v=YQ2Wi3Jh3X0;License: Standard Youtube License