Estimating Cost Behavior Using Least-Squares Regression and High-Low Method

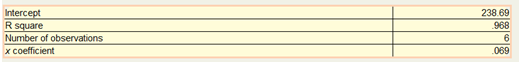

Tempt Office Services and Supplies (TOSS) provides various products and services in the Tempt Research Park, home to numerous high-tech and bio-tech companies. Making color copies is one of its most popular and profitable services. The controller performed a regression analysis of data from the Color Copy Department with the following results:

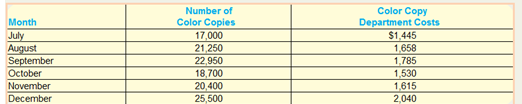

The regression output was based on the following data:

1. What is the variable cost per color copy for TOSS?

2. What is the used cost for the Color Copy Department?

3. Based on the regression output obtained by the controller, what cost formula should be used to estimate future total costs for the Color Copy Department?

4. How accurate will the cost formula developed in requirement 3 be at predicting the total cost for the Color Copy Department?

5. Use the high-low method to estimate the variable and fixed costs for the Color Copy Department. What cost formula should be used based on your analysis?

6. If 22,100 copies are made during January, what is the total cost predicted by each method?

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Managerial Accounting

- General Accounting Reasoning Problem : Desert Sun Solar panels have a base output of 300 watts, but their efficiency is affected by temperature and dust. The temperature causes a loss of 0.5% per degree Celsius above 25°C, and dust reduces efficiency by 3% per week since the last cleaning. Calculate the output of the solar panel after 3 weeks at 35°C, considering both the temperature and dust reduction effects. a) 269.35 b) 249.35 c) 259.35 d) 239.35arrow_forward4 POINTSarrow_forwardHow much overhead cost?arrow_forward

- what is a true answer of this General accounting questionarrow_forwardAt the beginning of the year, Morrison Manufacturing estimated its manufacturing overhead to be $815,500. At the end of the year, actual labor hours worked totaled 38,500 hours, the actual manufacturing overhead incurred was $798,000, and the manufacturing overhead was overapplied by $36,250. If the predetermined overhead rate is based on direct labor hours, then the estimated labor hours at the beginning of the year used in the predetermined overhead rate must have been: a. 36,787.45 direct labor hours b. 37,856.33 direct labor hours c. 38,501.85 direct labor hours d. 37,632.67 direct labor hours. Need your help with questionarrow_forwardGeneral accounting questionarrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub