Concept explainers

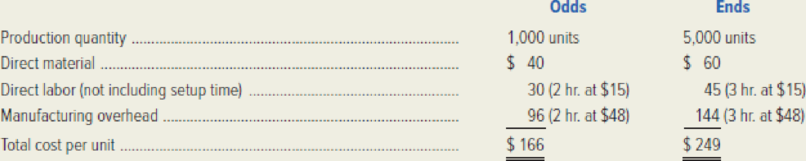

Knickknack, Inc. manufactures two products: Odds and Ends. The firm uses a single, plantwide overhead rate based on direct-labor hours. Production and product-costing data are as follows:

Calculation of predetermined overhead rate:

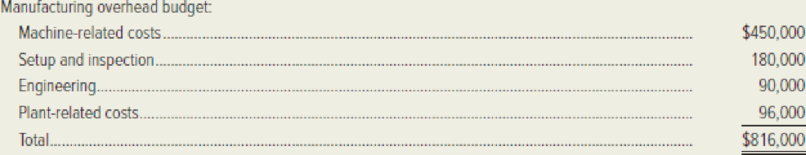

Manufacturing overhead budget:

Predetermined overhead rate:

Knickknack, Inc. prices its products at 120 percent of cost, which yields target prices of $199.20 for Odds and $298.80 for Ends. Recently, however, Knickknack has been challenged in the market for Ends by a European competitor, Bricabrac Corporation. A new entrant in this market, Bricabrac has been selling Ends for $220 each. Knickknack’s president is puzzled by Bricabrac’s ability to sell Ends at such a low cost. She has asked you (the controller) to look into the matter. You have decided that Knickknack’s traditional, volume-based product-costing system may be causing cost distortion between the firm’s two products. Ends are a high-volume, relatively simple product. Odds, on the other hand, are quite complex and exhibit a much lower volume. As a result, you have begun work on an activity-based costing system.

Required:

- 1. Let each of the overhead categories in the budget represent an activity cost pool. Categorize each in terms of the type of activity (e.g., unit-level activity).

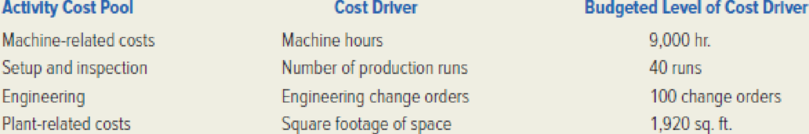

- 2. The following cost drivers have been identified for the four activity cost pools.

You have gathered the following additional information:

- Each Odd requires 4 machine hours, whereas each End requires 1 machine hour.

- Odds are manufactured in production runs of 50 units each. Ends are manufactured in 250-unit batches.

- Three-quarters of the engineering activity, as measured in terms of change orders, is related to Odds.

- The plant has 1,920 square feet of space, 80 percent of which is used in the production of Odds.

For each activity cost pool, compute a pool rate. (Hint: Regarding the pool rate refer to Exhibit 5–6.)

- 3. Determine the unit cost, for each activity cost pool, for Odds and Ends.

- 4. Compute the new product cost per unit for Odds and Ends, using the ABC system.

- 5. Using the same pricing policy as in the past, compute prices for Odds and Ends. Use the product costs determined by the ABC system.

- 6. Show that the ABC system fully assigns the total budgeted

manufacturing overhead costs of $816,000. - 7. Show how Knickknack’s traditional, volume-based costing system distorted its product costs. (Refer to Exhibit 5–10 for guidance.)

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Managerial Accounting

- The rate return on assets for 2012 was ? General accountingarrow_forwardWhat is the unit product cost under absorption costing?arrow_forwardYom Electronics has an accounts receivable turnover for the year of 8.2. Net sales for the period are $120,000. What is the number of days' sales in receivables? accurate answerarrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning  Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning