Redwood Company sells craft kits and supplies to retail outlets and through its catalog. Some of the items are manufactured by Redwood, while others are purchased for resale. For the products it manufactures, the company currently bases its selling prices on a product-costing system that accounts for direct material, direct labor, and the associated overhead costs. In addition to these product costs, Red wood incurs substantial selling costs, and Roger Jackson, controller, has suggested that these selling costs should be included in the product pricing structure.

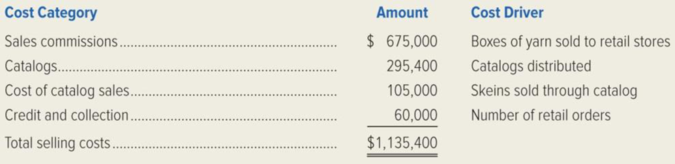

After studying the costs incurred over the past two years for one of its products, skeins of knitting yarn, Jackson has selected four categories of selling costs and chosen cost drivers for each of these costs. The selling costs actually incurred during the past year and the cost drivers are as follows:

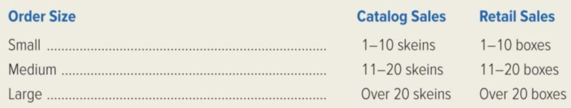

The knitting yarn is sold to retail outlets in boxes, each containing 12 skeins of yarn. The sale of partial boxes is not permitted. Commissions are paid on sales to retail outlets but not on catalog sales. The cost of catalog sales includes telephone costs and the wages of personnel who take the catalog orders. Jackson believes that the selling costs vary significantly with the size of the order. Order sizes are divided into three categories as follows:

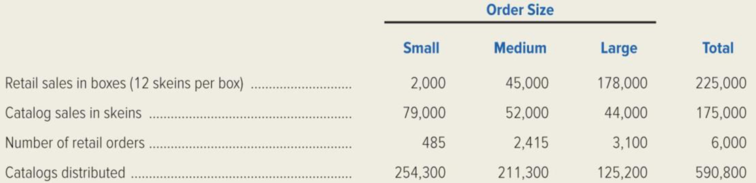

An analysis of the previous year’s records produced the following statistics.

Required:

- 1. Prepare a schedule showing Redwood Company’s total selling cost for each order size and the per skein selling cost within each order size.

- 2. Explain how the analysis of the selling costs for skeins of knitting yarn is likely to impact future pricing and product decisions at Redwood Company.

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Managerial Accounting

- Hurwitz, LLC sells a parcel of waterfront land and a residential condo building with an adjusted tax basis of $100,000 and 50,000, respectively for $500,000. The original purchase price Hurwitz, LLC allocated to the building was $600,000. Hurwitz LLC has deducted $550,000 in depreciation expense. Hurwitz, LLC's realized gain on this transaction is $350,000. If Hurwitz LLC takes back a note as part of the proceeds, what is Hurwitz LLC's gross profit percentage? A. 83.33% B. 71.43% C. 70% D. 50% E. 30%arrow_forwardprovide answer of this Financial accounting questionarrow_forwardhi expert given answer General accounting questionarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning