Concept explainers

Interpretation of Regression Results: Simple Regression

Your company is preparing an estimate of its production costs for the coming period. The controller estimates that direct materials costs are $45 per unit and that direct labor costs are $21 per hour. Estimating

The controller’s office estimated overhead costs at $3,600 for fixed costs and $18 per unit for variable costs. Your colleague, Lance, who graduated from a rival school, has already done the analysis and reports the “correct” cost equation as follows:

Overhead = $10,600 + $16.05 per unit

Lance also reports that the correlation coefficient for the regression is .82 and says, “With 82 percent of the variation in overhead explained by the equation, it certainly should be adopted as the best basis for estimating costs.”

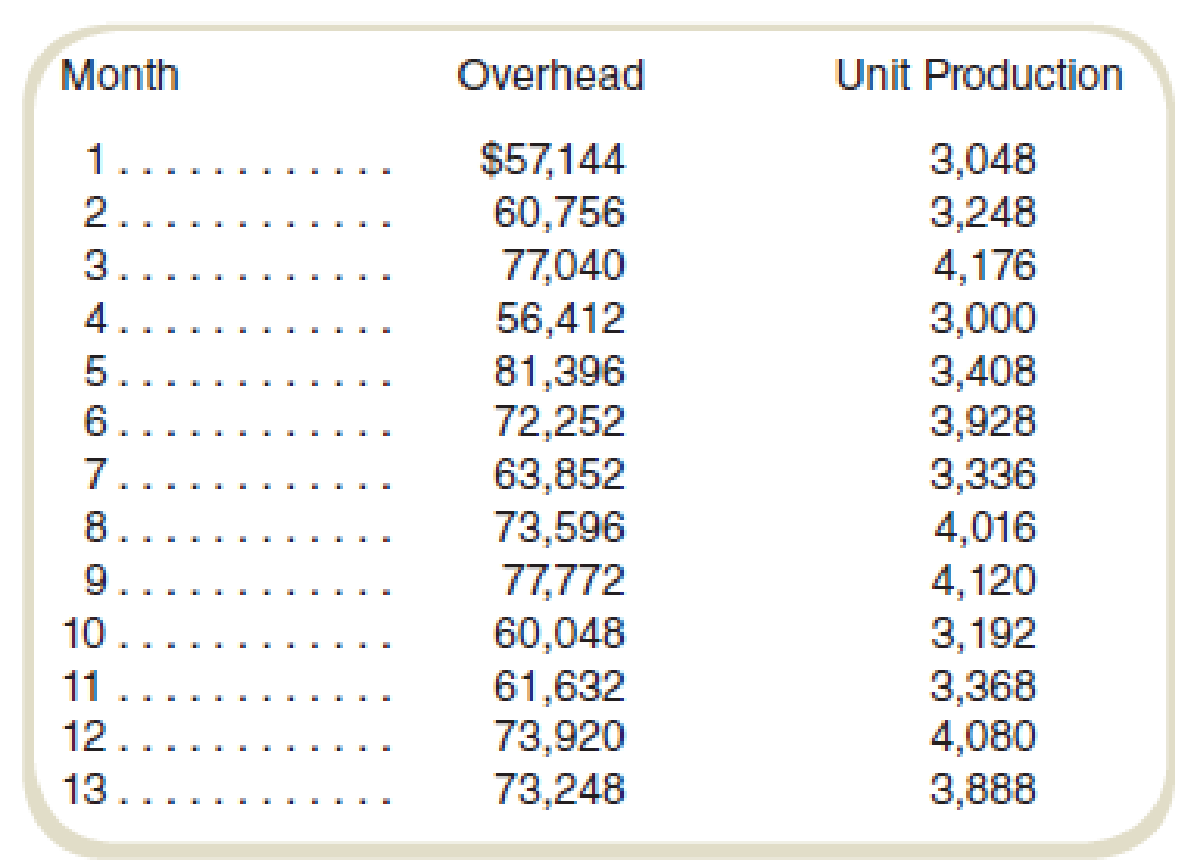

When asked for the data used to generate the regression, Lance produces the following:

Required

The company controller is somewhat surprised that the cost estimates are so different. You have therefore been assigned to check Lance’s equation. You accept the assignment with glee.

Analyze Lance’s results and state your reasons for supporting or rejecting his cost equation.

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Fundamentals of Cost Accounting

- Compare and Contrast Managerial Accounting and Financial Accounting. Be sure to discuss how managerial accounting is useful for providing information for at least one of the following management functions: planning, directing, controlling. or To act ethically in accounting/business is only necessary to follow the law. Do you agree or disagree? Give at least three specific reasons for your answer and provide at least one counter argument and rebut it.arrow_forwardWhat is her partner's return on equity on these financial accounting question?arrow_forwardI want to correct answer accountingarrow_forward

- PLEASE HELP!arrow_forwardQuestion 1. Pearl Leasing Company agrees to lease equipment to Martinez Corporation on January 1, 2025. The following information relates to the lease agreement. 1. The term of the lease is 7 years with no renewal option, and the machinery has an estimated economic life of 9 years. 2 The cost of the machinery is $541,000, and the fair value of the asset on January 1, 2025, is $760,000. 3. At the end of the lease term, the asset reverts to the lessor and has a guaranteed residual value of $45,000, Martinez estimates that the expected residual value at the end of the lease term will be $45,000. Martinez amortizes all of its leased equipment on a straight-line basis. 4. The lease agreement requires equal annual rental payments, beginning on January 1, 2025. 5. The collectibility of the lease payments is probable. 6. Pearl desires a 10% rate of return on its investments. Martinez's incremental borrowing rate is 11%, and the lessor's implicit rate is unknown. Annual rental payment is…arrow_forwardPLEASEEEE HELP!arrow_forward

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning