Concept explainers

Interpretation of Regression Results: Multiple Choice

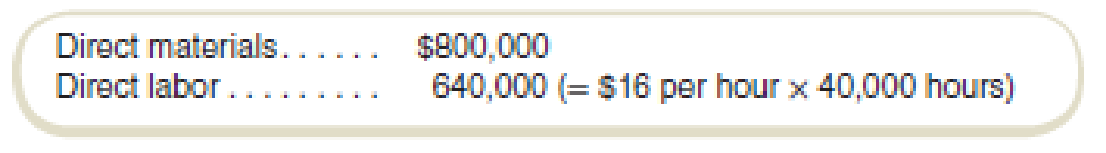

Cortez Company is planning to introduce a new product that will sell for $96 per unit. The following

Manufacturing

Required

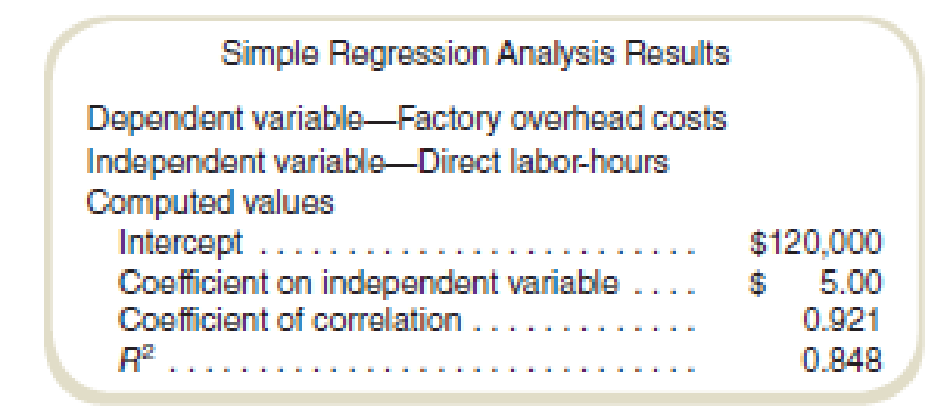

- a. What percentage of the variation in overhead costs is explained by the independent variable?

- (1) 84.8%.

- (2) 45.0%.

- (3) 92.1%.

- (4) 8.48%.

- (5) Some other amount.

- b. What is the total overhead cost for an estimated activity level of 50,000 direct labor-hours?

- (1) $120,000.

- (2) $370,000.

- (3) $250,000.

- (4) $320,000.

- (5) Some other amount.

- c. How much is the variable manufacturing cost per unit, using the variable overhead estimated by the regression (assuming that direct materials and direct labor are variable costs)?

- (1) $88.00.

- (2) $82.00.

- (3) $86.80.

- (4) $72.00.

- (5) Some other amount.

- d. What is the expected contribution margin per unit to be earned during the first year on 20,000 units of the new product? (Assume that all marketing and administrative costs are fixed.)

- (1) $96.00

- (2) $24.00

- (3) $56.00

- (4) $14.00

- (5) Some other amount.

- e. What is the manufacturing cost equation implied by these results?

- (1) Total cost = $640,000 + ($5.00 × Number of units).

- (2) Total cost = $120,000 + ($86.80 × Number of units).

- (3) Total cost = $120,000 + ($72.00 × Number of units).

- (4) Some other equation.

a.

Identify the appropriate answer for the given statement from the given choices.

Answer to Problem 42E

Option (1) The percentage of the variation in overhead costs is 84.8%.

Explanation of Solution

Regression analysis:

Regression analysis is used to show the relationship between the cost and the activity. It is used to estimate the cost at various level of activity.

The most important step in the calculation of regression analysis is to establish a logical relationship between the cost and the activity. The activity (independent variable) is placed on the right-hand side and the cost (dependent variable) is placed on the left-hand side of the graph.

Percentage of the variation in overhead costs is explained by the independent variable:

The percentage of the variation in overhead costs is 84.8% as per the value of R2.

Justification for the correct and incorrect answer:

(1)

84.8%: This is the correct figure as the value is equal to the value of R2.

(2)

45.0%: This is an incorrect figure as the value is not matching with the value of R2.

(3)

92.1%: This is an incorrect figure as the value is not matching with the correct value of 84.8%.

(4)

$14.00: This is an incorrect figure as the value is not matching with the value of R2.

(5)

Some other amount: This is an incorrect option as the value is 84.8% is given above in the option.

b.

Identify the appropriate answer for the given statement from the given choices.

Answer to Problem 42E

Option (2) The total overhead cost is $370,000.

Explanation of Solution

Total overhead cost:

Total overhead cost is the total cost of the given overhead. It consists of fixed cost and variable cost.

Calculate the total overhead cost:

Thus, the total overhead cost is $370,000.

Justification for the correct and incorrect answer:

(1)

$120,000: This is an incorrect figure as it is not matching with the total overhead cost of $370,000.

(2)

$370,000: This is the correct figure as the total overhead cost is $370,000.

(3)

$250,000: This is an incorrect figure as the value is not matching with the correct value of $370,000.

(4)

$320,000: This is an incorrect figure as the value of total overhead cost is $370,000

(5)

Some other amount: This is an incorrect option as the value is $370,000 is given in the above options.

c.

Identify the appropriate answer for the given statement from the given choices.

Answer to Problem 42E

Option (2) The variable manufacturing cost per unit is $82.

Explanation of Solution

Variable manufacturing cost:

Variable manufacturing cost is the cost of production that varies with the change in the volume of the production.

Calculate the variable manufacturing cost per unit:

Thus, the variable manufacturing cost is $82.

Working note 1:

Calculate the labor cost per unit:

Working note 2:

Calculate the total labor hours:

Justification for the correct and incorrect answer:

(1)

$88.00: This is incorrect figure is not as per the above calculation of 40,000 direct hours.

(2)

$82.00: This is the correct figure as the figure is matching with the calculated figure of $82

(3)

$86.60: This is an incorrect figure as the value is not matching with the correct value of $82.

(4)

$72.00: This is an incorrect figure as the value is $82.00.

(5)

Some other amount: This is an incorrect option as the value is $82.00 is given above option.

d.

Identify the appropriate answer for the given statement from the given choices.

Answer to Problem 42E

Option (4). The expected contribution margin is $14.00.

Explanation of Solution

Contribution margin:

The surplus of sales price over the variable expenses is known as the contribution margin. It is computed by deducting the variable expenses from the sales revenue. The contribution margin income statement is made to record the contribution margin.

Calculate the estimated contribution margin:

Thus, the estimated contribution margin is $14.

Justification for the correct and incorrect answer:

(1)

$96.00: This is an incorrect figure as it is not as per the above-calculated value of $14.

(2)

$24.00: This is an incorrect figure as per the figure is not matching the calculated figure of $14.

(3)

$56.00: This is an incorrect figure as the value is not matching with the correct value of above-calculated figure $56.

(4)

$14.00: This is the correct figure as per the above calculation.

(5)

Some other amount: This is an incorrect option as the value is $14 is given in the above options.

e.

Identify the appropriate answer for the given statement from the given choices.

Answer to Problem 42E

Option (4) The manufacturing cost equation is:

Explanation of Solution

Cost equation:

Cost equation is a mathematical representation of the cost estimation at various level of activity. It is used by defining the fixed cost, and variable cost per unit. The variable cost per unit is multiplied by the given variable to calculate the relative cost.

Calculate the manufacturing cost equation:

Thus, the manufacturing cost equation is:

Justification for the correct and incorrect answer:

(1)

(2)

(3)

(4)

Some other equation: This is the correct figure as the correct answer is not given in any of the above options.

Want to see more full solutions like this?

Chapter 5 Solutions

Fundamentals of Cost Accounting

- I need the correct answer to this financial accounting problem using the standard accounting approach.arrow_forwardPlease provide the solution to this financial accounting question using proper accounting principles.arrow_forwardOn May 31, 2026, Oriole Company paid $3,290,000 to acquire all of the common stock of Pharoah Corporation, which became a division of Oriole. Pharoah reported the following balance sheet at the time of the acquisition: Current assets $846,000 Current liabilities $564,000 Noncurrent assets 2,538,000 Long-term liabilities 470,000 Stockholder's equity 2,350,000 Total assets $3,384,000 Total liabilities and stockholder's equity $3,384,000 It was determined at the date of the purchase that the fair value of the identifiable net assets of Pharoah was $2,914,000. At December 31, 2026, Pharoah reports the following balance sheet information: Current assets $752,000 Noncurrent assets (including goodwill recognized in purchase) 2,256,000 Current liabilities (658,000) Long-term liabilities (470,000) Net assets $1,880,000 It is determined that the fair value of the Pharoah division is $2,068,000.arrow_forward

- On May 31, 2026, Oriole Company paid $3,290,000 to acquire all of the common stock of Pharoah Corporation, which became a division of Oriole. Pharoah reported the following balance sheet at the time of the acquisition: Current assets $846,000 Current liabilities $564,000 Noncurrent assets 2,538,000 Long-term liabilities 470,000 Stockholder's equity 2,350,000 Total assets $3,384,000 Total liabilities and stockholder's equity $3,384,000 It was determined at the date of the purchase that the fair value of the identifiable net assets of Pharoah was $2,914,000. At December 31, 2026, Pharoah reports the following balance sheet information: Current assets $752,000 Noncurrent assets (including goodwill recognized in purchase) 2,256,000 Current liabilities (658,000) Long-term liabilities (470,000) Net assets $1,880,000 It is determined that the fair value of the Pharoah division is $2,068,000.arrow_forwardThe following transactions involving intangible assets of Oriole Corporation occurred on or near December 31, 2025. 1.) Oriole paid Grand Company $520,000 for the exclusive right to market a particular product, using the Grand name and logo in promotional material. The franchise runs for as long as Oriole is in business. 2.) Oriole spent $654,000 developing a new manufacturing process. It has applied for a patent, and it believes that its application will be successful. 3.) In January 2026, Oriole's application for a patent (#2 above) was granted. Legal and registration costs incurred were $247,800. The patent runs for 20 years. The manufacturing process will be useful to Oriole for 10 years. 4.) Oriole incurred $168,000 in successfully defending one of its patents in an infringement suit. The patent expires during December 2029. 5.) Oriole incurred $446,400 in an unsuccessful patent defense. As a result of the adverse verdict, the patent, with a remaining unamortized cost of…arrow_forwardReffering to fair value of an asset, division, or organization, What exactly is fair value and how is it assessed?arrow_forward

- The following transactions involving intangible assets of Oriole Corporation occurred on or near December 31, 2025. 1.) Oriole paid Grand Company $520,000 for the exclusive right to market a particular product, using the Grand name and logo in promotional material. The franchise runs for as long as Oriole is in business. 2.) Oriole spent $654,000 developing a new manufacturing process. It has applied for a patent, and it believes that its application will be successful. 3.) In January 2026, Oriole's application for a patent (#2 above) was granted. Legal and registration costs incurred were $247,800. The patent runs for 20 years. The manufacturing process will be useful to Oriole for 10 years. 4.) Oriole incurred $168,000 in successfully defending one of its patents in an infringement suit. The patent expires during December 2029. Oriole incurred 5.) $446,400 in an unsuccessful patent defense. As a result of the adverse verdict, the patent, with a remaining unamortized cost of…arrow_forwardNonearrow_forwardPlease provide the solution to this general accounting question with accurate financial calculations.arrow_forward

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning