Concept explainers

Journalizing

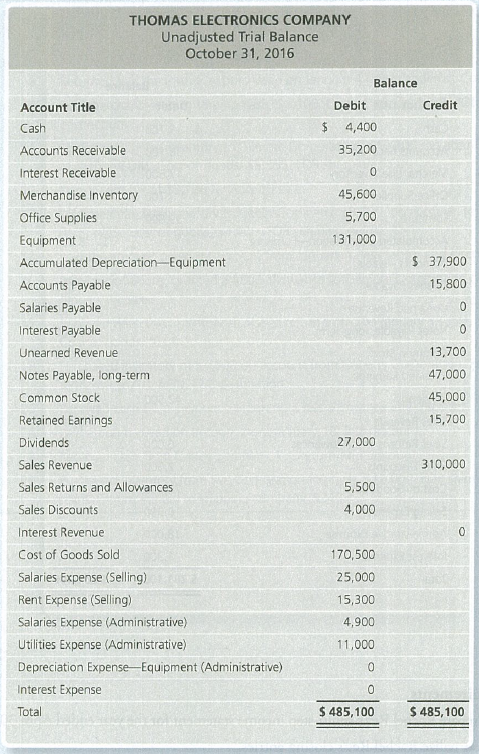

The W1adjusted trial balance for Thomas Electronics Company follows:

Requirements

1. Journalize the adjusting entries using the following data:

a. Interest revenue accrued, $300.

b. Salaries (Selling) accrued, $2,400.

c.

d. Interest expense accrued, $1,300.

e. A physical count of inventory was completed. The ending Merchandise

Inventory should have a balance of $44,900.

2. Prepare Thomas Electronics’s adjusted trial balance as of October 31, 2016.

3. Prepare Thomas Electronics’s multi-step income statement for year ended October 31, 2016.

4. Prepare Thom as Electronics’s statement of

5. Prepare Thomas Electronics’s classified

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

ACC 201/202 MYACCLAB E-TEXT ONLY >I<

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,  Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage