Concept explainers

Journalizing

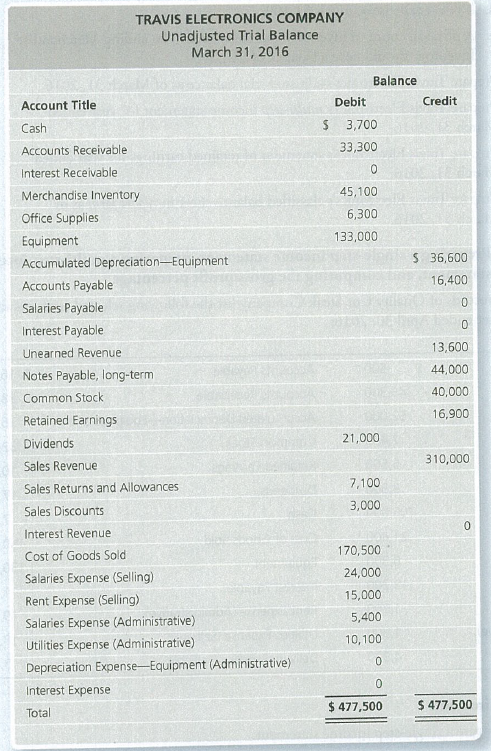

The unadjusted trial balance for Travis Electronics Company at March 31, 2016, follows:

Requirements

1. Journalize the adjusting entries using the following data:

a. Interest revenue accrued, $450.

b. Salaries (Selling) accrued, $2,500.

c.

d. Interest expense accrued, $1,100.

e. A physical count of inventory was completed. The ending Merchandise Inventory should have a balance of $44,600.

2. Prepare Travis Electronics’s adjusted trial balance as of March 31, 2016.

3. Prepare Travis Electronics’s multi-step income statement for year ended March 31, 2016.

4. Prepare Travis Electronics’s statement of

5. Prepare Travis Electronics’s classified

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

ACC 201/202 MYACCLAB E-TEXT ONLY >I<

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning  Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub