Concept explainers

Comprehensive Problem for Chapters 1-5

Completing a Merchandiser’s Accounting Cycle

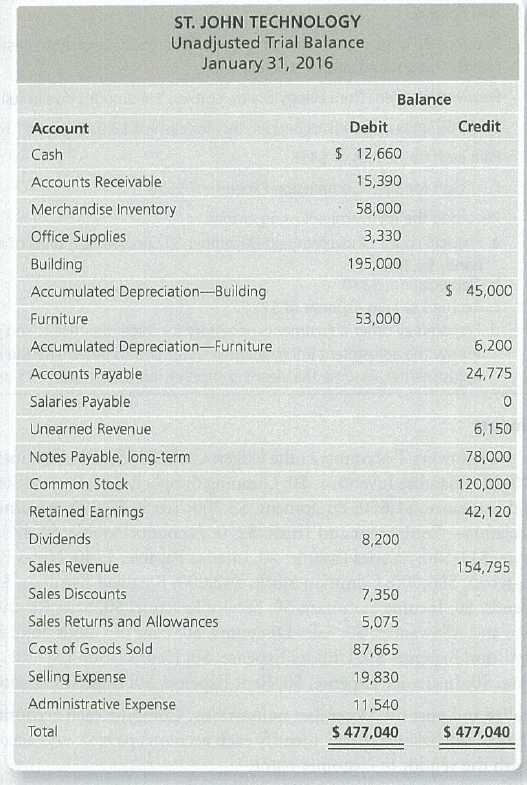

St. John Technology uses a perpetual inventory system. The end-of-month unadjusted

Additional data at January 31, 2 016:

a. Office Supplies consumed during the month, $1,780. Half is selling expense, and the other half is administrative expense.

b.

c. Unearned revenue that has been earned during January, $3,825.

d. Accrued salaries, an administrative expense, $975.

e. Merchandise Inventory on hand, $55,375. St. John uses the perpetual inventory system.

Requirements

1. Using T-accounts, open the accounts listed on the trial balance, inserting their unadjusted balances. Label the balances as Bal. Al so open the Income Summary account.

2. Journalize and post the

3. Enter the unadjusted trial balance on a worksheet, and complete the worksheet for the month ended January 31, 2016. St. John Technology groups all operating expenses under two accounts, Selling Expense and Administrative Expense. Leave two blank lines under Selling Expense and three blank lines under Administrative Expense.

4. Prepare the company’s multi-step in com e statement and statement of

5. Journalize and

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

ACC 201/202 MYACCLAB E-TEXT ONLY >I<

- Subject general accountingarrow_forwardTimberline worked on four jobs during its first year of operation: Nos. 501, 502, 503, and 504. Nos. 501 and 502 were completed by year-end, and No. 501 was sold at a profit of 35% of cost. A review of Job No. 503’s cost record revealed direct material charges of $18,000 and total manufacturing costs of $23,400. If Timberline allocated overhead at 140% of direct labor cost, the overhead allocated to Job No. 503 must have been __. Need answerarrow_forwardHow much was the firm's taxable income or earnings before taxes on this financial accounting question?arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,