Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 5.2.4MBA

Ratio of cash to monthly cash expenses

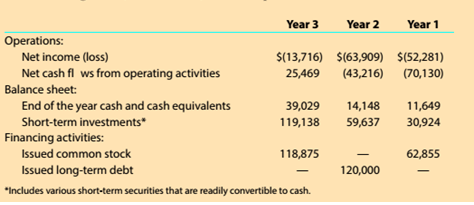

Pacira Pharmaceuticals

Inc. (PCRX)

Develops, produces, and sells products used in hospitals and surgery centers.

The following data (in thousands) were adapted from recent financial statements.

Comment on the results from parts (2) and (3).

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Craft Made Company expects to produce 20,000 total units during the current period.

The costs and cost drivers associated with four activity cost pools are given below:

ACTIVITIES UNIT

PRODUCT FACILITY

Cost

LEVEL

$27,000

BATCH

LEVEL

LEVEL

LEVEL

$39,000

$12,000

$141,000

20,000 units

Cost Driver 2,500 labor hrs 192 set ups % of use

Production of 1,350 units of an auto towing tool required 600 labor hours, 11 setups,

and consumed 35% of the product sustaining activities. How much total overhead

cost will be allocated to this product if the company allocates overhead on the basis

of a single overhead allocation rate based on direct labor hours?

Problem related financial Accounting

General accounting

Chapter 5 Solutions

Survey of Accounting (Accounting I)

Ch. 5 - Prob. 1SEQCh. 5 - Prob. 2SEQCh. 5 - Prob. 3SEQCh. 5 - Adjustments to the company’s records based on the...Ch. 5 - Prob. 5SEQCh. 5 - Prob. 1CDQCh. 5 - Prob. 2CDQCh. 5 - Prob. 3CDQCh. 5 - Prob. 4CDQCh. 5 - Prob. 5CDQ

Ch. 5 - Prob. 6CDQCh. 5 - Prob. 7CDQCh. 5 - Prob. 8CDQCh. 5 - Prob. 9CDQCh. 5 - Assume that Leslie Hunter, accounts payable clerk...Ch. 5 - Prob. 11CDQCh. 5 - The accounting clerk pays all obligations by...Ch. 5 - Prob. 13CDQCh. 5 - Prob. 14CDQCh. 5 - Do items reported as a credit memorandum on the...Ch. 5 - Prob. 16CDQCh. 5 - Prob. 17CDQCh. 5 - Prob. 5.1ECh. 5 - Prob. 5.2ECh. 5 - Prob. 5.3ECh. 5 - Prob. 5.4ECh. 5 - Prob. 5.5ECh. 5 - Prob. 5.6ECh. 5 - Prob. 5.7ECh. 5 - Prob. 5.8ECh. 5 - Prob. 5.9ECh. 5 - Prob. 5.10ECh. 5 - Prob. 5.11ECh. 5 - Prob. 5.12ECh. 5 - Prob. 5.13ECh. 5 - Prob. 5.14ECh. 5 - Prob. 5.15ECh. 5 - Prob. 5.16ECh. 5 - Prob. 5.17ECh. 5 - Prob. 5.18ECh. 5 - Prob. 5.19ECh. 5 - Entries for note collected by bank Accompanying a...Ch. 5 - Prob. 5.21ECh. 5 - Prob. 5.22ECh. 5 - Prob. 5.23ECh. 5 - Prob. 5.24ECh. 5 - Prob. 5.25ECh. 5 - Prob. 5.1PCh. 5 - Prob. 5.2.1PCh. 5 - Prob. 5.2.2PCh. 5 - Prob. 5.3.1PCh. 5 - Prob. 5.3.2PCh. 5 - Prob. 5.4.1PCh. 5 - Prob. 5.4.2PCh. 5 - Prob. 5.4.3PCh. 5 - Prob. 5.4.4PCh. 5 - Prob. 5.1.1MBACh. 5 - Prob. 5.1.2MBACh. 5 - Prob. 5.1.3MBACh. 5 - Prob. 5.1.4MBACh. 5 - Ratio of cash to monthly cash expenses AcelRx...Ch. 5 - Prob. 5.2.1MBACh. 5 - Prob. 5.2.2MBACh. 5 - Ratio of cash to monthly cash expenses Pacira...Ch. 5 - Ratio of cash to monthly cash expenses Pacira...Ch. 5 - Prob. 5.2.5MBACh. 5 - Prob. 5.3.1MBACh. 5 - Prob. 5.3.2MBACh. 5 - Prob. 5.3.3MBACh. 5 - Prob. 5.3.4MBACh. 5 - Prob. 5.3.5MBACh. 5 - Prob. 5.4.1MBACh. 5 - Prob. 5.4.2MBACh. 5 - Prob. 5.1CCh. 5 - Prob. 5.2CCh. 5 - Prob. 5.3CCh. 5 - Prob. 5.4CCh. 5 - Prob. 5.5.1CCh. 5 - Prob. 5.5.2CCh. 5 - Prob. 5.5.3CCh. 5 - Prob. 5.6C

Additional Business Textbook Solutions

Find more solutions based on key concepts

Which of the following is a primary activity in the value chain?

purchasing

accounting

post-sales service

human...

Accounting Information Systems (14th Edition)

10-10 What challenges do managers face in managing global teams? How should those challenges be handled?

Fundamentals of Management (10th Edition)

CHAPTER CASE

S&S Air’s Mortgage

Mark Sexton and Todd Story, the owners of S&S Air, Inc., were impressed by the ...

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Whether callable bonds have a higher or lower yield than otherwise identical bonds without a call feature. Intr...

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

(Interest rate determination) You’re looking at some corporate bonds issued by Ford, and you are trying to det...

Foundations Of Finance

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting (2nd Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

GE McKinsey Matrix for SBU Strategies; Author: Wolters World;https://www.youtube.com/watch?v=FffD1Ze76JQ;License: Standard Youtube License