Concept explainers

Ratio of cash to monthly cash expenses

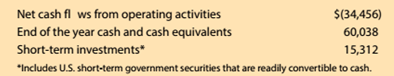

AcelRx Pharmaceuticals, Inc. (ACRX),

Develops therapies for pain relief for a variety of patients. including cancer and trauma patients. The following data (in thousands) were adapted from financial statements of a recent year.

AceIRx had negative

Trending nowThis is a popular solution!

Chapter 5 Solutions

Survey of Accounting (Accounting I)

Additional Business Textbook Solutions

FUNDAMENTALS OF CORPORATE FINANCE

Marketing: An Introduction (13th Edition)

Intermediate Accounting (2nd Edition)

Horngren's Accounting (12th Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning