Accounting

27th Edition

ISBN: 9781337272094

Author: WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 5.19EX

Error in accounts payable subsidiary ledger

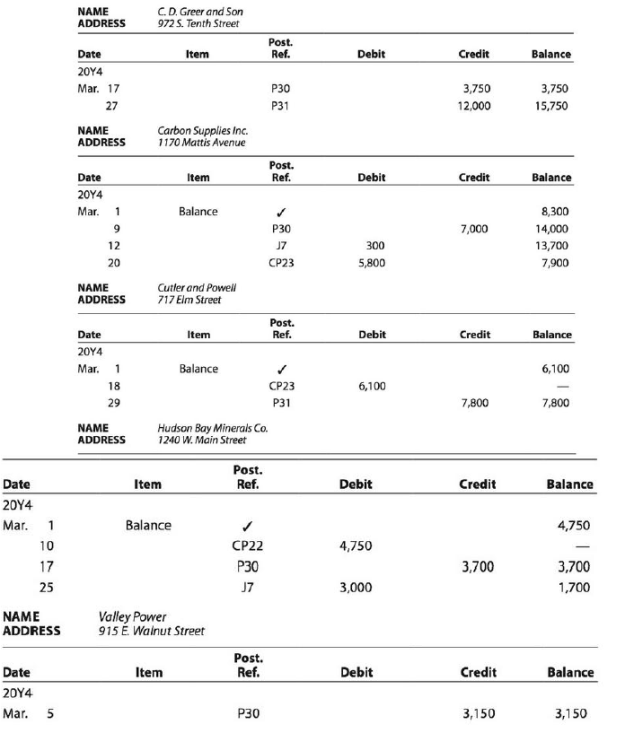

After Bunker Hill Assay Services Inc. had completed all postings for March in the current year (20Y4), the sum of the balances in the following accounts payable ledger did not agree with the $36,600 balance of the controlling account in the general ledger:

Assuming that the controlling account balance of $36,600 has been verified as correct, (a) determine the error(s) in the preceding accounts and (b) prepare a listing of accounts payable creditor balances (from the corrected accounts payable subsidiary ledger).

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Hello tutor please help me this question general accounting

Hy expert give me solution

What is the amount of straight line depreciation for each year of this financial accounting question?

Chapter 5 Solutions

Accounting

Ch. 5 - Why would a company maintain separate accounts...Ch. 5 - What are the major advantages of the use of...Ch. 5 - Prob. 3DQCh. 5 - How many postings to Fees Earned for the month...Ch. 5 - During the current month, the following errors...Ch. 5 - Prob. 6DQCh. 5 - What is an electronic form, and how is it used in...Ch. 5 - When are transactions posted in a computerized...Ch. 5 - What happens to the special journal in a...Ch. 5 - Prob. 10DQ

Ch. 5 - Revenue journal The following revenue transactions...Ch. 5 - Revenue journal The following revenue transactions...Ch. 5 - Accounts receivable subsidiary ledger The debits...Ch. 5 - Accounts receivable subsidiary ledger The debits...Ch. 5 - Purchases journal The following purchase...Ch. 5 - Purchases journal The following purchase...Ch. 5 - Accounts payable subsidiary ledger The debits and...Ch. 5 - Accounts payable subsidiary ledger The debits and...Ch. 5 - Segment analysis McHale Company does business in...Ch. 5 - Segment analysis Back Country Life, Inc., does...Ch. 5 - Identify postings from revenue journal Using the...Ch. 5 - Accounts receivable ledger Based on the data...Ch. 5 - Identify journals Assuming the use of a two-column...Ch. 5 - Identify journals Assuming the use of a two-column...Ch. 5 - Identify transactions in accounts receivable...Ch. 5 - Prepare journal entries in a revenue journal...Ch. 5 - Posting a revenue journal The revenue journal for...Ch. 5 - Accounts receivable subsidiary ledger The revenue...Ch. 5 - Revenue and cash receipts journals Transactions...Ch. 5 - Revenue and cash receipts journals Lasting Summer...Ch. 5 - Prob. 5.11EXCh. 5 - Prob. 5.12EXCh. 5 - Identify transactions in accounts payable...Ch. 5 - Prepare journal entries in a purchases journal...Ch. 5 - Posting a purchases journal The purchases journal...Ch. 5 - Accounts payable subsidiary ledger The cash...Ch. 5 - Purchases and cash payments journals Transactions...Ch. 5 - Purchases and cash payments journals Happy Tails...Ch. 5 - Error in accounts payable subsidiary ledger After...Ch. 5 - Prob. 5.20EXCh. 5 - Cash receipts journal The following cash receipts...Ch. 5 - Computerized accounting systems Most computerized...Ch. 5 - Prob. 5.23EXCh. 5 - Prob. 5.24EXCh. 5 - Segment revenue horizontal analysis Starbucks...Ch. 5 - Prob. 5.26EXCh. 5 - Segment revenue horizontal and vertical analyses...Ch. 5 - Revenue journal; accounts receivable subsidiary...Ch. 5 - Revenue and cash receipts journals; accounts...Ch. 5 - Purchases, accounts payable subsidiary account,...Ch. 5 - Purchases and cash payments journals; accounts...Ch. 5 - All journals and general ledger; trial balance The...Ch. 5 - Revenue journal; accounts receivable subsidiary...Ch. 5 - Revenue and cash receipts journals; accounts...Ch. 5 - Purchases, accounts payable account, and accounts...Ch. 5 - Purchases and cash payments journals; accounts...Ch. 5 - All journals and general ledger; trial balance The...Ch. 5 - Ethics in Action Netbooks Inc. provides accounting...Ch. 5 - Communication Internet-based accounting software...Ch. 5 - Manual vs. computerized accounting systems The...Ch. 5 - Accounts receivable and accounts payable A...Ch. 5 - Design of accounting systems For the past few...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Accounting Changes and Error Analysis: Intermediate Accounting Chapter 22; Author: Finally Learn;https://www.youtube.com/watch?v=c2uQdN53MV4;License: Standard Youtube License