Accounting

27th Edition

ISBN: 9781337272094

Author: WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 5.16EX

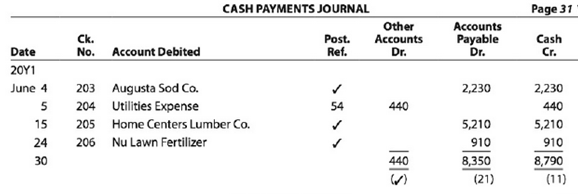

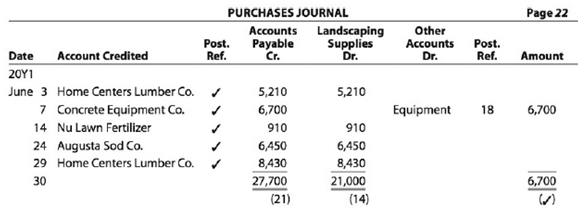

Accounts payable subsidiary ledger

The cash payments and purchases journals for Outdoor Artisan Landscaping follow. The accounts payable control account has a June 1, 20Y1, balance of $2,230, consisting of an amount owed to Augusta Sod Co.

Prepare a schedule of the accounts payable creditor balances and determine that the total agrees with the ending balance of the accounts payable controlling account.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

i want to this correct options

hello tutor please help me account

need this account subject solutions

Chapter 5 Solutions

Accounting

Ch. 5 - Why would a company maintain separate accounts...Ch. 5 - What are the major advantages of the use of...Ch. 5 - Prob. 3DQCh. 5 - How many postings to Fees Earned for the month...Ch. 5 - During the current month, the following errors...Ch. 5 - Prob. 6DQCh. 5 - What is an electronic form, and how is it used in...Ch. 5 - When are transactions posted in a computerized...Ch. 5 - What happens to the special journal in a...Ch. 5 - Prob. 10DQ

Ch. 5 - Revenue journal The following revenue transactions...Ch. 5 - Revenue journal The following revenue transactions...Ch. 5 - Accounts receivable subsidiary ledger The debits...Ch. 5 - Accounts receivable subsidiary ledger The debits...Ch. 5 - Purchases journal The following purchase...Ch. 5 - Purchases journal The following purchase...Ch. 5 - Accounts payable subsidiary ledger The debits and...Ch. 5 - Accounts payable subsidiary ledger The debits and...Ch. 5 - Segment analysis McHale Company does business in...Ch. 5 - Segment analysis Back Country Life, Inc., does...Ch. 5 - Identify postings from revenue journal Using the...Ch. 5 - Accounts receivable ledger Based on the data...Ch. 5 - Identify journals Assuming the use of a two-column...Ch. 5 - Identify journals Assuming the use of a two-column...Ch. 5 - Identify transactions in accounts receivable...Ch. 5 - Prepare journal entries in a revenue journal...Ch. 5 - Posting a revenue journal The revenue journal for...Ch. 5 - Accounts receivable subsidiary ledger The revenue...Ch. 5 - Revenue and cash receipts journals Transactions...Ch. 5 - Revenue and cash receipts journals Lasting Summer...Ch. 5 - Prob. 5.11EXCh. 5 - Prob. 5.12EXCh. 5 - Identify transactions in accounts payable...Ch. 5 - Prepare journal entries in a purchases journal...Ch. 5 - Posting a purchases journal The purchases journal...Ch. 5 - Accounts payable subsidiary ledger The cash...Ch. 5 - Purchases and cash payments journals Transactions...Ch. 5 - Purchases and cash payments journals Happy Tails...Ch. 5 - Error in accounts payable subsidiary ledger After...Ch. 5 - Prob. 5.20EXCh. 5 - Cash receipts journal The following cash receipts...Ch. 5 - Computerized accounting systems Most computerized...Ch. 5 - Prob. 5.23EXCh. 5 - Prob. 5.24EXCh. 5 - Segment revenue horizontal analysis Starbucks...Ch. 5 - Prob. 5.26EXCh. 5 - Segment revenue horizontal and vertical analyses...Ch. 5 - Revenue journal; accounts receivable subsidiary...Ch. 5 - Revenue and cash receipts journals; accounts...Ch. 5 - Purchases, accounts payable subsidiary account,...Ch. 5 - Purchases and cash payments journals; accounts...Ch. 5 - All journals and general ledger; trial balance The...Ch. 5 - Revenue journal; accounts receivable subsidiary...Ch. 5 - Revenue and cash receipts journals; accounts...Ch. 5 - Purchases, accounts payable account, and accounts...Ch. 5 - Purchases and cash payments journals; accounts...Ch. 5 - All journals and general ledger; trial balance The...Ch. 5 - Ethics in Action Netbooks Inc. provides accounting...Ch. 5 - Communication Internet-based accounting software...Ch. 5 - Manual vs. computerized accounting systems The...Ch. 5 - Accounts receivable and accounts payable A...Ch. 5 - Design of accounting systems For the past few...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Maplewood Textiles reported $1,100,000 in net sales and $720,000 in cost of goods sold. If operating expenses totaled $250,000, what is the company's gross profit and operating income?arrow_forwardNonearrow_forwardHarbor Freight Equipment issued $800,000 in bonds with a 7% annual interest rate for a term of 6 years. The company makes semiannual interest payments. What will be the total interest expense over the bond's life?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

7.2 Ch 7: Notes Payable and Interest, Revenue recognition explained; Author: Accounting Prof - making it easy, The finance storyteller;https://www.youtube.com/watch?v=wMC3wCdPnRg;License: Standard YouTube License, CC-BY