Principles of Economics 2e

2nd Edition

ISBN: 9781947172364

Author: Steven A. Greenlaw; David Shapiro

Publisher: OpenStax

expand_more

expand_more

format_list_bulleted

Textbook Question

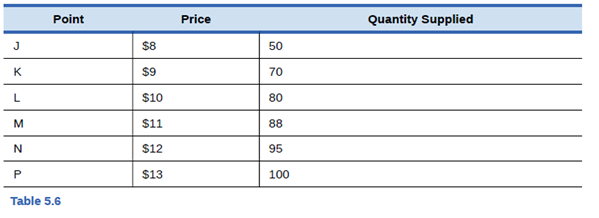

Chapter 5, Problem 2SCQ

From the data in Table 5.6 about supply of alarm clocks, calculate the

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

According to Lee et al. (2009), the incremental cost-effectiveness ratio comparing the current dialysis treatment to the next least cost dialysis treatment is $61,294 per life year and $129,090 per QALY. Can you account for the different estimates?

You are employed as an economic consultant to the regional planning office of a large metropolitan area, and your task is to estimate the demand for hospital services in the area. Your estimates indicate that the own-price elasticity of demand equals 0.25, the income elasticity of demand equals 0.45, the cross-price elasticity of demand for hospital services with respect to the price of nursing home services equals 0.1, and the elasticity of travel time equals −0.37. Use this information to project the impact of the following changes on the demand for hospital services.

Average travel time to the hospital diminishes by 5 percent due to overall improvements in the public transportation system.

The price of nursing home care decreases by 10 percent.

Average real income decreases by 10 percent.

The hospital is forced to increase its price for services by 2 percent.

The commissioner of health is concerned about the increasing number of reported cases of preventable childhood diseases, such as polio and rubella. It appears that a growing number of young children are not being vaccinated against childhood diseases as they should be. Two proposals to address the problem are sitting on the commissioner’s desk. The programs have equal costs, but the commissioner has funding for only one. The first proposal involves providing free vaccinations at clinics around the country. The benefits from a free vaccination program are likely to be experienced immediately in terms of a drop in the number of reported cases of illness. The second program calls for educating young married couples about the benefits of vaccination. The benefits in this instance will not be felt for some years. The commissioner wants to use cost-benefit analysis to determine which proposal should be implemented. Explain to the commissioner the critical role the discount rate plays in…

Chapter 5 Solutions

Principles of Economics 2e

Ch. 5 - From the data in Table 5.5 about demand for smart...Ch. 5 - From the data in Table 5.6 about supply of alarm...Ch. 5 - Why is the demand curve with constant unitary...Ch. 5 - Why is the supply curve with constant unitary...Ch. 5 - The federal 3mm decides to require that automobile...Ch. 5 - Suppose you are in change of sales at a...Ch. 5 - What would the gasoline price elasticity of supply...Ch. 5 - The avenge annual income rises from 25,000 to...Ch. 5 - Suppose the cross-price elasticity of apples with...Ch. 5 - What is the formula for calculating elasticity?

Ch. 5 - What is the price elasticity of demand? Can you...Ch. 5 - What is the price elasticity of supply? Can you...Ch. 5 - Describe the general appearance of a demand or a...Ch. 5 - Describe the general appearance of a demand or a...Ch. 5 - If demand is elastic, will shifts in supply have a...Ch. 5 - If demand is inelastic, will shifts in supply have...Ch. 5 - If supply is elastic, will shifts in demand have a...Ch. 5 - If supply is inelastic, will shifts in demand have...Ch. 5 - Would you usually expect elasticity of demand or...Ch. 5 - Under which circumstances does line tax burden...Ch. 5 - What is the formula for the income elasticity of...Ch. 5 - What is the formula for line cross-price...Ch. 5 - What is the formula for the wage elasticity of...Ch. 5 - What is the formula for elasticity of savings with...Ch. 5 - Transatlantic air travel in business class has an...Ch. 5 - What is the relationship between price elasticity...Ch. 5 - Can you think of an industry (or product) with...Ch. 5 - Would you expect supply to play a more significant...Ch. 5 - A city has build a bridge over a river and it...Ch. 5 - In a market where the supply curve is perfectly...Ch. 5 - Economists define normal goods as having a...Ch. 5 - Suppose you could buy shoes one at a time, miter...Ch. 5 - The equation for a demand curve is P=483Q. What is...Ch. 5 - The equation for a demand curve is P=2/Q. What is...Ch. 5 - The equation for a supply curve is 4P=Q. What is...Ch. 5 - The equation for a supply curve is P=3Q8. What is...Ch. 5 - The supply of paintings by Leonardo Da Vinci, who...Ch. 5 - Say that a certain stadium for professional...Ch. 5 - When someones kidneys fail, the person needs to...Ch. 5 - Assume that the supply of law-skilled worker is...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Define cost object and give three examples.

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Preference for current ratio and quick ratio. Introduction: Current ratio explains the liquidity position of a ...

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Tennessee Tool Works (TTW) is considering investment in five independent projects, Any profitable combination o...

Engineering Economy (17th Edition)

4. JC Manufacturing purchase d inventory for $ 5,300 and al so paid a $260 freight bill. JC Manufacturing retur...

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

(Capital structure theory) Match each of the following definitions to the appropriate terms:

Foundations Of Finance

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Which of the following Nobel Prize Winners’ primary work in investments was consistent with market efficiency? Mark each “Yes” or “No.” You can search the internet for more information about their Nobel Prizes. Eugene Fama Harry Markowitz William Sharpe Robert Shillerarrow_forwardnot use ai pleasearrow_forwardNot use ai pleasearrow_forward

- Exercise 6 Imagine that you head production of a multinational food processing company. The ongoing uncer- tainty about costs means that you are unsure of the future cost of one of your inputs, x2. Your firm's production function is y = f(x1, x2) = x²x²² The output price p is 1000, x1 = 27, and wx₁ = 60. 1. Suppose the current input price is Wx2 = 50. Solve for the optimal choice of x2. 2. Now suppose that the probability the input price remains 50 is 0.65 and the probability that Wx2 60 is 0.35. Solve for the optimal choice of x2. Round down to the nearest integer. = 3. Finally, suppose the costs do actually rise, i.e., Wx2 = 60. Calculate the difference in profit from the uncertainty in (2) vs. the certainty in (1).arrow_forwardNot use ai please letarrow_forwardQuestions from textbook: Santerre, Rexford, E., and Neun, Stephan P. Health Economics: Theories, Insights, and Industry Studies, 6th Edition, ISBN 13: 978-1-111-822729. Mason, OH: South-Western, Cengage Learning, 2013. 1. Suppose a health expenditure function is specified in the following manner: E = 500 + 0.2Y where E represents annual health care expenditures per capita and Y stands for income per capita. a. Using the slope of the health expenditure function, predict the change in per capita health care expenditures that would result from a $1,000 increase in per capita income. b. Compute the level of per capita health care spending when per capita income takes on the following dollar values: 0; 1,000; 2,000; 4,000; and 6,000. c. Using the resulting values for per capita health care spending in part B, graph the associated health care expenditure function. d. Assume that the fixed amount of health care spending decreases to $250. Graph the new and original health care functions on…arrow_forward

- Graph shows the daily market price of jeans when the tax on sellers is set to zero per pair supposed the government institutes attacks of $20.30 per pair to be paid by the seller what is the quantity after taxarrow_forwardHow do you figure out tax incidents in elasticityarrow_forwardnot use ai pleasearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...

Economics

ISBN:9781305506893

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...

Economics

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Price Elasticity of Supply; Author: Economics Online;https://www.youtube.com/watch?v=4bDIm3j-7is;License: Standard youtube license