Concept explainers

Dublin Brewing Co. uses the

Production Costs

Work in process, beginning of period:

Costs incurred during month:

Production Data:

13,000 units finished and transferred to stockroom

Work in process, end of period, 2,000 units one-half completed

Required:

Prepare a cost of production summary for October.

Prepare a cost of production summary for October.

Explanation of Solution

Unit Cost of Production: The cost production derived in terms of corresponding units of production is called unit cost of production.

Prepare a cost of production summary for October.

| Cost Elements | Amount ($) | Total cost ($) |

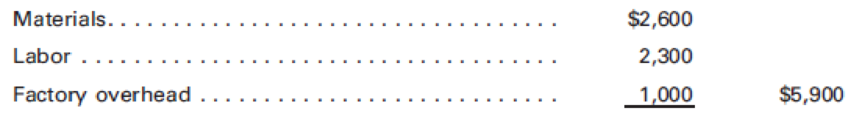

| Cost of work in process, beginning of month: | ||

| Materials | 2,600 | |

| Labor | 2,300 | |

| Factory overhead | 1,000 | 5,900 |

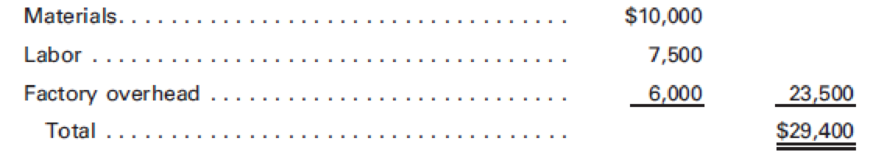

| Cost of production for month: | ||

| Materials | 10,000 | |

| Labor | 7,500 | |

| Factory overhead | 6,000 | 23,500 |

| Total costs to be accounted for | 29,400 |

Table (1)

Compute the total equivalent production.

| Cost Elements | Unit output |

| Finished and transferred to finished goods during month | 13,000 |

| Equivalent units of work in process, end of month | 10,000 |

| Total equivalent production | 14,000 |

Table (2)

Compute the unit cost.

| Cost Elements | Unit cost ($) |

| Cost of work in process, beginning of month: | |

| Materials (1) | 0.90 |

| Labor (2) | 0.70 |

| Factory overhead (3) | 0.50 |

| Total | 2.10 |

Table (3)

Working Note:

(1) Calculate the unit cost (materials).

(2) Calculate the unit cost (labor).

(3) Calculate the unit cost (factory overhead).

Compute production costs.

| Cost Elements | Amount ($) | Amount ($) |

|

Costs of goods finished and transferred to finished goods during month (4) | 27,300 | |

| Materials (5) | 900 | |

| Labor (6) | 700 | |

| Factory overhead (7) | 500 | 2,100 |

| Total production costs accounted for | 29,400 |

Table (4)

Working Note:

(4) Calculate the costs of goods finished and transferred to finished goods during month.

(5) Calculate the inventory costs (material).

(6) Calculate the inventory costs (labor).

(7) Calculate the inventory costs (factory overhead).

Want to see more full solutions like this?

Chapter 5 Solutions

Principles of Cost Accounting

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning