Tanaka Manufacturing Co. uses the

Required:

- 1. Prepare cost of production summaries for the Mixing, Blending, and Bottling (Hint: You must calculate the adjusted unit cost from Blending.) departments.

- 2. Prepare a departmental cost work sheet.

- 3. Draft the

journal entries required to record the month’s operations. - 4. Prepare a statement of cost of goods manufactured for December. (Hint: Goods finished but not transferred to finished goods are considered part of work in process inventory.)

1.

Prepare cost of production summaries for the mixing, blending and bottling.

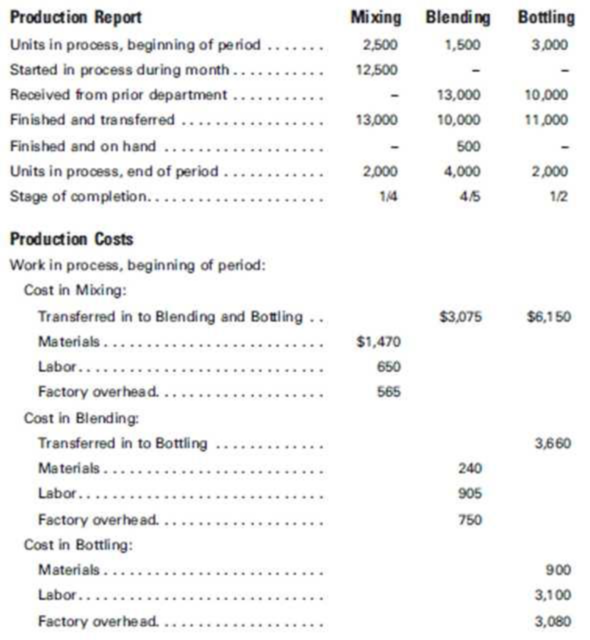

Explanation of Solution

Prepare cost of production summaries for the mixing, blending and bottling.

| Company T | ||

| Cost of Production Summary-Mixing | ||

| For the Month Ended December 31 | ||

| Cost of work in process, beginning of month: | ||

| Materials | $1,470 | |

| Labor | $650 | |

| Factory overhead | $565 | $2,685 |

| Cost of production for month: | ||

| Materials | $15,000 | |

| Labor | $4,750 | |

| Factory overhead | $5,240 | $24,990 |

| Total costs to be accounted for | $27,675 | |

| Unit output for month: | ||

| Finished and transferred to Blending during month | $13,000 | |

| Equivalent units of work in process, end of month | ||

| (2,000 units, one-fourth completed) | $500 | |

| Total equivalent production | $13,500 | |

| Unit cost for month: | ||

| Materials | $1.22 | |

| Labor | $0.4 | |

| Factory overhead | $0.43 | |

| Total | $2.05 | |

| Inventory costs: | ||

| Costs of goods finished and transferred to Blending | $26,650 | |

| during month | ||

| Cost of work in process, end of month: | ||

| Materials | $610 | |

| Labor | $200 | |

| Factory overhead | $215 | $1,025 |

| Total production costs accounted for | $27,675 | |

Table (1)

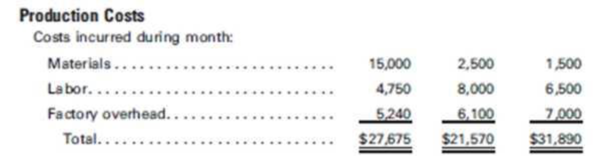

| Company T | |||

| Cost of Production Summary-Blending | |||

| For the Month Ended December 31 | |||

| Cost of work in process, beginning of month: | |||

| Cost in Mixing | $3,075 | ||

| Cost in Blending: | |||

| Materials | $240 | ||

| Labor | $905 | ||

| Factory overhead | $750 | $1,895 | $4,970 |

| Cost of goods received from Mixing during month | $26,650 | ||

| Cost of production for month: | |||

| Materials | $2,500 | ||

| Labor | $8,000 | ||

| Factory overhead | $6,100 | $16,600 | |

| Total costs to be accounted for | $48,220 | ||

| Unit output for month: | |||

| Finished and transferred to Bottling during month | $10,000 | ||

| Finished and on hand | $500 | ||

| Equivalent units of work in process, end of month | |||

| (4,000 units, four-fifths completed) | $3,200 | ||

| Total equivalent production | $13,700 | ||

| Unit cost for month: | |||

| Materials | $.20 | ||

| Labor | $.65 | ||

| Factory overhead | $.50 | ||

| Total | $1.35 | ||

| Inventory costs: | |||

| Costs of goods finished and transferred to Bottling | |||

| during month: | |||

| Cost in Mixing | $20,500 | ||

| Cost in Blending | $13,500 | ||

| | $34,000 | ||

| Cost of goods finished and on hand: | |||

| Cost in Mixing | $1,025 | ||

| Cost in Blending | $675 | ||

| | $1,700 | ||

| Cost of work in process, end of month: | |||

| Cost in Mixing | $8,200 | ||

| Cost in Blending: | |||

| Materials | $640 | ||

| Labor | $2,080 | ||

| Factory overhead | $1,600 | $4,320 | $12,520 |

| Total production costs accounted for | $48,220 | ||

Table (2)

| Company T | |||

| Cost of Production Summary-Bottling | |||

| For the Month Ended December 31 | |||

| Cost of work in process, beginning of month: | |||

| Cost in Mixing | $6,150 | ||

| Cost in Blending | $3,660 | ||

| $9,810 | |||

| Cost in Bottling: | |||

| Materials | $900 | ||

| Labor | $3,100 | ||

| Factory overhead | $3,080 | $7,080 | $16,890 |

| Cost of goods received from Blending | $34,000 | ||

| Cost of production for month: | |||

| Materials | $1,500 | ||

| Labor | $6,500 | ||

| Factory overhead | $7,000 | $15,000 | |

| Total costs to be accounted for | $65,890 | ||

| Unit output for month: | $11,000 | ||

| Finished and transferred to finished goods | |||

| Equivalent units of work in process, end of month | |||

| (2,000 units, one-half completed) | $1,000 | ||

| Total equivalent production | $12,000 | ||

| Unit cost for month: | |||

| Materials | $.20 | ||

| Labor | $.80 | ||

| Factory overhead | $.84 | ||

| Total | $ 1.84 | ||

| Inventory costs: | |||

| Costs of goods finished and transferred: | |||

| Cost in Mixing | $22,500 | ||

Cost in Blending  | $14,520 | ||

| Cost in Bottling | $20,240 | ||

| | $57,310 | ||

| Cost in work in process, end of month: | |||

| Cost in Mixing | $4,100 | ||

| Cost in Blending | $2,640 | ||

| Cost in Bottling: | |||

| Materials | $200 | ||

| Labor | $800 | ||

| Factory overhead | $840 | $1,840 | $8,580 |

| Total production costs accounted for | $65,890 | ||

Table (3)

Working note:

(1)Prepare unit cost of blending:

| Particulars | Units | Blending |

| Units in process, beginning of month | 3,000 | $3,660 |

| Units received during month | 10,000 | 13,500 |

| Total | 13,000 | $17,160 |

| Unit cost | $1.32 |

Table (4)

2.

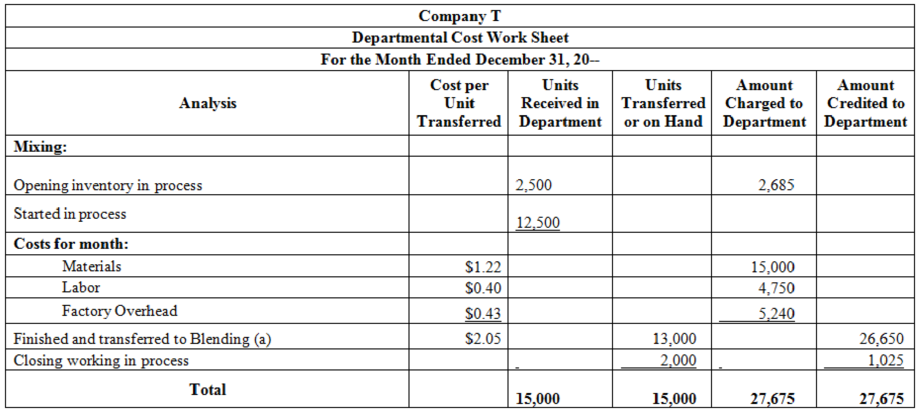

Prepare a departmental cost work sheet.

Explanation of Solution

Prepare a departmental cost work sheet for mixing department.

Figure (1)

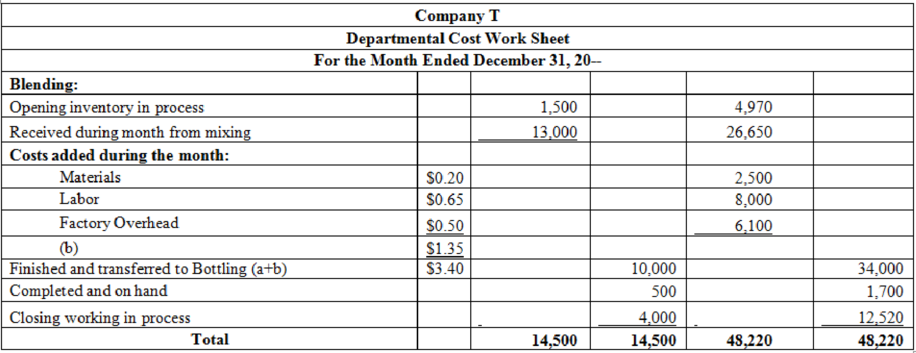

Prepare a departmental cost work sheet for blending department.

Figure (2)

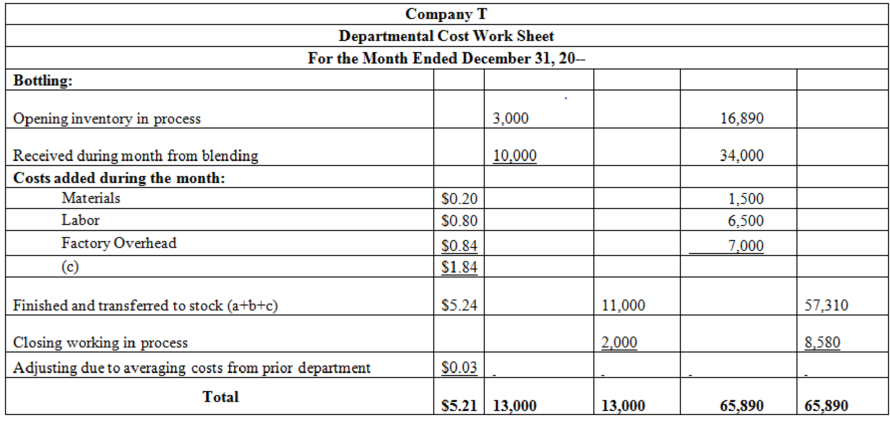

Prepare a departmental cost work sheet for bottling department.

Figure (3)

Prepare summary:

| Summary: | Amount | Amount |

| Materials: | ||

| Mixing | $15,000 | |

| Blending | $2,500 | |

| Bottling | $1,500 | $19,000 |

| Labor: | ||

| Mixing | $4,750 | |

| Blending | $8,000 | |

| Bottling | $6,500 | $19,250 |

| Factory overhead: | ||

| Mixing | $5,240 | |

| Blending | $6,100 | |

| Bottling | $7,000 | $18,340 |

| Total production costs for December | ||

| Add work in process, beginning of month: | ||

| Mixing | $2,685 | |

| Blending | $4,970 | |

| Bottling | $16,890 | $24,545 |

| Total | $81,135 | |

| Deduct work in process, end of month: | ||

| Mixing | $1,025 | |

| Blending (includes $1,700 finished and on hand) | $14,220 | |

| Bottling | $8,580 | $23,825 |

| Cost of production, goods fully manufactured during | ||

| December | $57,310 |

Table (5)

3.

Prepare journal entries to record the month’s operations.

Explanation of Solution

Prepare journal entries to record the month’s operations.

| Date | Account Title and Explanation | Debit ($) | Credit ($) | |

| Work in Process-Mixing | 15,000 | |||

| Work in Process-Blending | 2,500 | |||

| Work in Process-Bottling | 1,500 | |||

| Materials | 19,000 | |||

| Work in Process-Mixing | 4,750 | |||

| Work in Process-Blending | 8,000 | |||

| Work in Process-Bottling | 6,500 | |||

| Payroll | 19,250 | |||

| Work in Process-Mixing | 5,240 | |||

| Work in Process-Blending | 6,100 | |||

| Work in Process-Bottling | 7,000 | |||

| Factory Overhead | 18,340 | |||

| Work in Process-Blending | 26,650 | |||

| Work in Process-Mixing | 26,650 | |||

| Work in Process-Bottling | 34,000 | |||

| Work in Process-Blending | 34,000 | |||

| Finished Goods | 57,310 | |||

| Work in Process-Bottling | 57,310 | |||

Table (6)

4.

Prepare statement of cost of goods manufactured.

Explanation of Solution

Prepare statement of cost of goods manufactured.

| Company T | |

| Statement of Cost of Goods Manufactured | |

| For the Month Ended December 31 | |

| Materials | $19,000 |

| Labor | $19,250 |

| Factory overhead | $18,340 |

| Total | $56,590 |

| Add work in process inventories, December 1 | $24,545 |

| Total | $81,135 |

| Less work in process inventories, December 31 | $23,825 |

| Cost of goods manufactured during the month | $57,310 |

Table (7)

Want to see more full solutions like this?

Chapter 5 Solutions

Principles of Cost Accounting

- The accounting equation must always remain balanced. If an asset increases, what must happen?A. A liability must decreaseB. An equity account must decreaseC. Another asset must decrease, or liability/equity must increaseD. Revenue must decrease i need carrow_forwardI need guidance with this general accounting problem using the right accounting principlesarrow_forwardWhich account would be closed at year-end?A. EquipmentB. Utilities ExpenseC. Retained EarningsD. Accounts Payablearrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning