Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 13PB

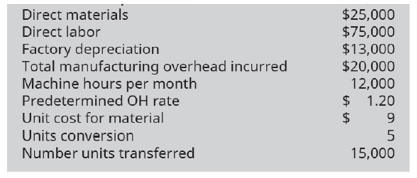

Selected information from Hernandez Corporation shows the following:

Prepare journal entries to record the following:

- raw material purchased

- direct labor incurred

depreciation expense (hint: this is part of manufacturingoverhead )- raw materials used

- overhead applied on the basis of $0.50 per machine hour

- the transfer from department 1 to department 2

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please provide the correct solution to this financial accounting question using valid principles.

I need help with this financial accounting problem using accurate calculation methods.

Please give me true answer this financial accounting question

Chapter 5 Solutions

Principles of Accounting Volume 2

Ch. 5 - Which of the following production characteristics...Ch. 5 - A process costing system Is most likely used by...Ch. 5 - Which of the following is a prime cost? A. direct...Ch. 5 - Which of the following is a conversion cost? A....Ch. 5 - During production, how are the costs in process...Ch. 5 - Which is nor needed to compute equivalent units of...Ch. 5 - What is the cost of direct labor f the conversion...Ch. 5 - What is the conversion cost to manufacture...Ch. 5 - Which of the following lists contains only...Ch. 5 - Direct material costs $3 per unit, direct labor...

Ch. 5 - Beginning inventory and direct material cost added...Ch. 5 - The initial processing department had a beginning...Ch. 5 - There were 1,000 units in ending inventory after...Ch. 5 - The costs to be accounted for consist of which of...Ch. 5 - Which of the following is the step in which...Ch. 5 - The journal entry to record the $500 of work in...Ch. 5 - Assigning indirect costs to departments is...Ch. 5 - In a process costing system, which account shows...Ch. 5 - In a process cost system, factory depreciation...Ch. 5 - Explain how process costing differs from job order...Ch. 5 - Would a pharmaceutical manufacturer use process or...Ch. 5 - Which costs are assigned using the...Ch. 5 - What is the primary purpose of process costing?Ch. 5 - What is the difference between prime costs and...Ch. 5 - Explain conversion costs using an example.Ch. 5 - Why are there conversion costs in both job order...Ch. 5 - What are equivalent units of production, and how...Ch. 5 - How can there be a different number of equivalent...Ch. 5 - Why is the number of equivalent units for...Ch. 5 - What are the four steps involved in determining...Ch. 5 - What is the weighted-average method for computing...Ch. 5 - How does process costing treat the costs...Ch. 5 - Why does each department have its own work in...Ch. 5 - March each term with its description.Ch. 5 - How is manufacturing overhead handled in a process...Ch. 5 - How are predetermined overhead rates used in...Ch. 5 - How many units were started into production in a...Ch. 5 - A company started a new product, and in the first...Ch. 5 - Given the following information, determine the...Ch. 5 - There were 1,700 units in beginning inventory that...Ch. 5 - A company has 1,500 units in ending work in...Ch. 5 - There were 2,400 units in ending work in process...Ch. 5 - How many units must be in ending inventory if...Ch. 5 - How many units must have been completed and...Ch. 5 - Using the weighted-average method, compute the...Ch. 5 - Using the weighted-average method, compute the...Ch. 5 - Mazomanie Farm completed 20,000 units during the...Ch. 5 - What are the total costs to account for if a...Ch. 5 - A company started the month with 8,329 units in...Ch. 5 - A production department within a company received...Ch. 5 - Production data show 35,920 units were transferred...Ch. 5 - Overhead is assigned to the manufacturing...Ch. 5 - Prepare the journal entry to record the factory...Ch. 5 - Prepare the journal entry to record the transfer...Ch. 5 - Prepare the journal entry to record the sale of...Ch. 5 - Given the following information, determine the...Ch. 5 - There were 2.000 units in beginning inventory that...Ch. 5 - A company has 100 units in ending work in process...Ch. 5 - There were 1,500 units in ending work in process...Ch. 5 - Using the weighted-average method, compute the...Ch. 5 - What are the total costs to account for if a...Ch. 5 - A company started the month with 4,519 units in...Ch. 5 - A production department within a company received...Ch. 5 - Production data show 15,200 units were transferred...Ch. 5 - Overhead is assigned to the manufacturing...Ch. 5 - Prepare the journal entry to record the factory...Ch. 5 - Prepare the journal entry to record the transfer...Ch. 5 - Prepare the journal entry to record the sale of...Ch. 5 - The following product Costs are available for...Ch. 5 - The following product costs are available for...Ch. 5 - Pant Risers manufactures bands for self-dressing...Ch. 5 - During March, the following costs were charged to...Ch. 5 - Materials are added at the beginning of a...Ch. 5 - Narwhal Swimwear has a beginning work in process...Ch. 5 - The following data show the units in beginning...Ch. 5 - The finishing department started the month with...Ch. 5 - The packaging department began the month with 500...Ch. 5 - Production information shows these costs and units...Ch. 5 - Given the following information, prepare a...Ch. 5 - Complete this production cost report:Ch. 5 - Selected information from Skylar Studios shows the...Ch. 5 - Loanstar had 100 units in beginning inventory...Ch. 5 - The following product costs are available for...Ch. 5 - The following product costs are available for...Ch. 5 - Vexar manufactures nails. Manufacturing is a...Ch. 5 - During March, the following costs were charged to...Ch. 5 - Ardt-Barger has a beginning work in process...Ch. 5 - The following data show the units in beginning...Ch. 5 - The following data show the units in beginning...Ch. 5 - The following data show the units in beginning...Ch. 5 - The finishing department started the month with...Ch. 5 - The packaging department began the month with 750...Ch. 5 - Production information shows these costs and units...Ch. 5 - Given the following information, prepare a...Ch. 5 - Selected information from Hernandez Corporation...Ch. 5 - Rexar had 1,000 units in beginning inventory...Ch. 5 - How would process costing exist in a service...Ch. 5 - Why are labor and manufacturing overhead grouped...Ch. 5 - How is process costing for a single manufacturing...Ch. 5 - What is different between the journal entries for...

Additional Business Textbook Solutions

Find more solutions based on key concepts

E5-18 Using accounting vocabulary

Learning Objectives 1, 2,3

Match the accounting terms with the corresponding ...

Horngren's Accounting (12th Edition)

Explain how to derive a total expenditures (TE) curve.

Macroeconomics

Quick ratio and current ratio (Learning Objective 7) 1520 min. Consider the following data COMPANY A B C D Cash...

Financial Accounting, Student Value Edition (5th Edition)

Using the numbers in the preceding question, what is the size of Ectenias labor force? a. 50 b. 60 c. 70 d. 80

Principles of Economics (MindTap Course List)

Consider the sales data for Computer Success given in Problem 7. Use a 3-month weighted moving average to forec...

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardI need help finding the correct solution to this financial accounting problem with valid methods.arrow_forwardCan you solve this financial accounting question with the appropriate financial analysis techniques?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub  College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

What is Cost Allocation? Definition & Process; Author: FloQast;https://www.youtube.com/watch?v=hLhvvHvZ3JM;License: Standard Youtube License