Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

thumb_up100%

Chapter 5, Problem 16MC

The

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Faced with rising pressure for a $17 per hour minimum

wage rate, the farming industry is currently exploring the

possible use of robotics to replace some farm workers. The

Produce Bot is one such robot; its job is to thin out a field

of lettuce, removing the least promising buds of lettuce. By

removing these weaker plants, the stronger lettuce plants have

more room to grow. Assume the following facts:

i (Click the icon to view the information.)

While the Produce Bot itself may be in workable

condition for up to five years, assume that the farm

would view its implementation as a one-year

experiment.

Requirement

Perform a cost-benefit analysis for the first year of

implementation to determine whether the Produce Bot

would be a financially viable investment if the minimum

wage is raised to $17 per hour. (Round your answers to

the

„bola dallon\

Cost-Benefit Analysis

Expected Benefits (Cost Savings):

Total expected benefits

Expected Costs:

Total expected costs

Net expected benefit (cost)…

Please help me with the last entry. The dropdown options are the revenue accounts i can use

Please help me with this problem!

Chapter 5 Solutions

Principles of Accounting Volume 2

Ch. 5 - Which of the following production characteristics...Ch. 5 - A process costing system Is most likely used by...Ch. 5 - Which of the following is a prime cost? A. direct...Ch. 5 - Which of the following is a conversion cost? A....Ch. 5 - During production, how are the costs in process...Ch. 5 - Which is nor needed to compute equivalent units of...Ch. 5 - What is the cost of direct labor f the conversion...Ch. 5 - What is the conversion cost to manufacture...Ch. 5 - Which of the following lists contains only...Ch. 5 - Direct material costs $3 per unit, direct labor...

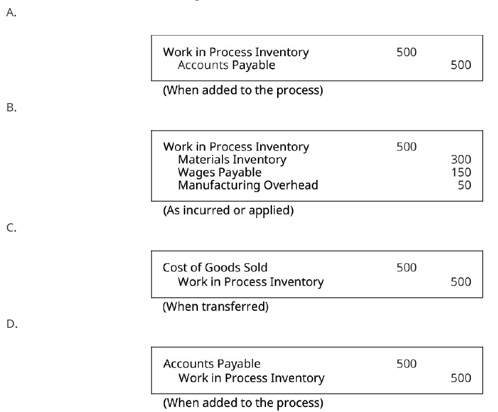

Ch. 5 - Beginning inventory and direct material cost added...Ch. 5 - The initial processing department had a beginning...Ch. 5 - There were 1,000 units in ending inventory after...Ch. 5 - The costs to be accounted for consist of which of...Ch. 5 - Which of the following is the step in which...Ch. 5 - The journal entry to record the $500 of work in...Ch. 5 - Assigning indirect costs to departments is...Ch. 5 - In a process costing system, which account shows...Ch. 5 - In a process cost system, factory depreciation...Ch. 5 - Explain how process costing differs from job order...Ch. 5 - Would a pharmaceutical manufacturer use process or...Ch. 5 - Which costs are assigned using the...Ch. 5 - What is the primary purpose of process costing?Ch. 5 - What is the difference between prime costs and...Ch. 5 - Explain conversion costs using an example.Ch. 5 - Why are there conversion costs in both job order...Ch. 5 - What are equivalent units of production, and how...Ch. 5 - How can there be a different number of equivalent...Ch. 5 - Why is the number of equivalent units for...Ch. 5 - What are the four steps involved in determining...Ch. 5 - What is the weighted-average method for computing...Ch. 5 - How does process costing treat the costs...Ch. 5 - Why does each department have its own work in...Ch. 5 - March each term with its description.Ch. 5 - How is manufacturing overhead handled in a process...Ch. 5 - How are predetermined overhead rates used in...Ch. 5 - How many units were started into production in a...Ch. 5 - A company started a new product, and in the first...Ch. 5 - Given the following information, determine the...Ch. 5 - There were 1,700 units in beginning inventory that...Ch. 5 - A company has 1,500 units in ending work in...Ch. 5 - There were 2,400 units in ending work in process...Ch. 5 - How many units must be in ending inventory if...Ch. 5 - How many units must have been completed and...Ch. 5 - Using the weighted-average method, compute the...Ch. 5 - Using the weighted-average method, compute the...Ch. 5 - Mazomanie Farm completed 20,000 units during the...Ch. 5 - What are the total costs to account for if a...Ch. 5 - A company started the month with 8,329 units in...Ch. 5 - A production department within a company received...Ch. 5 - Production data show 35,920 units were transferred...Ch. 5 - Overhead is assigned to the manufacturing...Ch. 5 - Prepare the journal entry to record the factory...Ch. 5 - Prepare the journal entry to record the transfer...Ch. 5 - Prepare the journal entry to record the sale of...Ch. 5 - Given the following information, determine the...Ch. 5 - There were 2.000 units in beginning inventory that...Ch. 5 - A company has 100 units in ending work in process...Ch. 5 - There were 1,500 units in ending work in process...Ch. 5 - Using the weighted-average method, compute the...Ch. 5 - What are the total costs to account for if a...Ch. 5 - A company started the month with 4,519 units in...Ch. 5 - A production department within a company received...Ch. 5 - Production data show 15,200 units were transferred...Ch. 5 - Overhead is assigned to the manufacturing...Ch. 5 - Prepare the journal entry to record the factory...Ch. 5 - Prepare the journal entry to record the transfer...Ch. 5 - Prepare the journal entry to record the sale of...Ch. 5 - The following product Costs are available for...Ch. 5 - The following product costs are available for...Ch. 5 - Pant Risers manufactures bands for self-dressing...Ch. 5 - During March, the following costs were charged to...Ch. 5 - Materials are added at the beginning of a...Ch. 5 - Narwhal Swimwear has a beginning work in process...Ch. 5 - The following data show the units in beginning...Ch. 5 - The finishing department started the month with...Ch. 5 - The packaging department began the month with 500...Ch. 5 - Production information shows these costs and units...Ch. 5 - Given the following information, prepare a...Ch. 5 - Complete this production cost report:Ch. 5 - Selected information from Skylar Studios shows the...Ch. 5 - Loanstar had 100 units in beginning inventory...Ch. 5 - The following product costs are available for...Ch. 5 - The following product costs are available for...Ch. 5 - Vexar manufactures nails. Manufacturing is a...Ch. 5 - During March, the following costs were charged to...Ch. 5 - Ardt-Barger has a beginning work in process...Ch. 5 - The following data show the units in beginning...Ch. 5 - The following data show the units in beginning...Ch. 5 - The following data show the units in beginning...Ch. 5 - The finishing department started the month with...Ch. 5 - The packaging department began the month with 750...Ch. 5 - Production information shows these costs and units...Ch. 5 - Given the following information, prepare a...Ch. 5 - Selected information from Hernandez Corporation...Ch. 5 - Rexar had 1,000 units in beginning inventory...Ch. 5 - How would process costing exist in a service...Ch. 5 - Why are labor and manufacturing overhead grouped...Ch. 5 - How is process costing for a single manufacturing...Ch. 5 - What is different between the journal entries for...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Tennessee Tool Works (TTW) is considering investment in five independent projects, Any profitable combination o...

Engineering Economy (17th Edition)

Typical maturity, denominations and interest rate of a bound and protective mechanism for bound holders. Introd...

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

19. Why is it inappropriate for a company to include freight-out expense in the Cost of Goods Sold account?

Financial Accounting: Tools for Business Decision Making, 8th Edition

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

15-18 Societal moral issue: Although enforcement of worker safety in Bangladesh is clearly lax, government offi...

Fundamentals of Management (10th Edition)

E3-18 Comparing cash and accrual basis accounting and applying the revenue recognition principle

Learning Ob...

Horngren's Accounting (12th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help me with this problemarrow_forwardPROBLEM 2 On July 1, 2022, LTU Contracting, Inc. purchased a new Peiner SK575 Tower Crane for a total cost of $875,000. The crane has an estimated useful life of five (5) years. For financial reporting (book) purposes, the company utilizes straight line depreciation. For tax purposes, the equipment is depreciated over five years utilizing the 200% declining balance method. A. Prepare a table that computes the book and tax depreciation for each year of the useful life and determine the difference in book value between each method at the end of each year. B. On July 1st, 2025, the company is considering selling the crane for $500,000. Compute what the gain or loss would have been at that time for both book and tax purposes.arrow_forwardPLEASE HELP AND FILL ALL CELLSarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY