FUNDAMENTALS OF FINANCIAL ACCOUNTING

6th Edition

ISBN: 9781260664386

Author: PHILLIPS, LIBB

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 9E

Determining

Refer to E4-8.

Required:

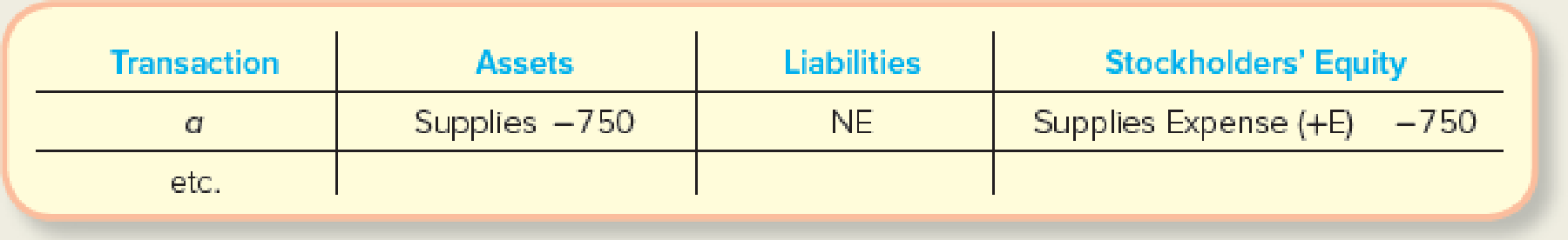

For each of the transactions in E4-8, indicate the amount and direction of effects of the

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Nexus Manufacturing uses a single raw material in its production process. The standard price for a unit of material is $1.95. During the month, the company purchased and used 680 units of this material at a price of $2.15 per unit. The standard quantity required per finished product is 2 units, and during the month, the company produced 320 finished units. How much was the material quantity variance? A. $45 favorable B. $50 unfavorable C. $63 favorable D. $78 unfavorable. Help

Please explain the correct approach for solving this general accounting question.

Bianca Industries has an accounts receivable turnover of 12 and annual credit sales of $3,600,000. What is the average collection period? A) 32.75 days B) 30.42 days C) 28.33 days D) 35.17 days

Chapter 4 Solutions

FUNDAMENTALS OF FINANCIAL ACCOUNTING

Ch. 4 - Prob. 1QCh. 4 - Explain the relationships between adjustments and...Ch. 4 - Prob. 3QCh. 4 - Prob. 4QCh. 4 - What is a contra-asset? Give an example of one.Ch. 4 - Explain the differences between depreciation...Ch. 4 - What is an adjusted trial balance? What is its...Ch. 4 - On December 31, a company makes a 59,000 payment...Ch. 4 - Using the information in question 8, determine the...Ch. 4 - Using the information in question 8, prepare the...

Ch. 4 - What is the equation for each of the following...Ch. 4 - Prob. 12QCh. 4 - What is the purpose of closing journal entries?Ch. 4 - Prob. 14QCh. 4 - Prob. 15QCh. 4 - What is a post-closing trial balance? Is it a...Ch. 4 - The owner of a local business complains that the...Ch. 4 - Which of the following accounts would not appear...Ch. 4 - Which account is least likely to appear in an...Ch. 4 - When a concert promotions company collects cash...Ch. 4 - On December 31, an adjustments made to reduce...Ch. 4 - An adjusting journal entry to recognize accrued...Ch. 4 - Prob. 6MCCh. 4 - Company A has owned a building for several years....Ch. 4 - Which of the following trial balances is used as a...Ch. 4 - Assume the balance in Prepaid Insurance is 2,500...Ch. 4 - Assume a company receives a bill for 10,000 for...Ch. 4 - Prob. 1MECh. 4 - Understanding Concepts Related to Adjustments...Ch. 4 - Matching Transactions with Type of Adjustment...Ch. 4 - Recording Adjusting Journal Entries Using the...Ch. 4 - Determine Accounting Equation Effects of Deferral...Ch. 4 - Prob. 6MECh. 4 - Determining Accounting Equation Effects of Accrual...Ch. 4 - Recording Adjusting Journal Entries Using be...Ch. 4 - Preparing Journal Entries for Deferral...Ch. 4 - Preparing Journal Entries for Deferral...Ch. 4 - Preparing Journal Entries for Deferral and Accrual...Ch. 4 - Reporting Adjusted Account Balances Indicate...Ch. 4 - Preparing an Adjusted Trial Balance Macro Company...Ch. 4 - Reporting an Income Statement The Sky Blue...Ch. 4 - Reporting a Statement of Retained Earnings Refer...Ch. 4 - Prob. 16MECh. 4 - Recording Closing Journal Entries Refer to the...Ch. 4 - Preparing and Posting Adjusting Journal Entries At...Ch. 4 - Preparing and Posting Adjusting Journal Entries At...Ch. 4 - Prob. 20MECh. 4 - Prob. 21MECh. 4 - Prob. 22MECh. 4 - Prob. 23MECh. 4 - Prob. 24MECh. 4 - Prob. 25MECh. 4 - Prob. 26MECh. 4 - Prob. 1ECh. 4 - Identifying Adjustments and Preparing Financial...Ch. 4 - Prob. 3ECh. 4 - Determining Adjustments and Accounting Equation...Ch. 4 - Determining Adjustments and Accounting Equation...Ch. 4 - Determining Adjustments and Accounting Equation...Ch. 4 - Recording Adjusting Journal Entries Refer to E4-6....Ch. 4 - Recording Typical Adjusting Journal Entries...Ch. 4 - Determining Accounting Equation Effects of Typical...Ch. 4 - Determining Adjusted Income Statement Account...Ch. 4 - Reporting Depreciation The adjusted trial balance...Ch. 4 - Recording Transactions Including Adjusting and...Ch. 4 - Analyzing the Effects of Adjusting Journal Entries...Ch. 4 - Reporting an Adjusted Income Statement Dyer, Inc.,...Ch. 4 - Recording Adjusting Entries and Preparing an...Ch. 4 - Recording Four Adjusting Journal Entries and...Ch. 4 - Recording Four Adjusting Journal Entries and...Ch. 4 - Prob. 18ECh. 4 - Analyzing, Recording, and Summarizing Business...Ch. 4 - Preparing Adjusting Entries, an Adjusted Trial...Ch. 4 - Preparing an Adjusted Trial Balance, Closing...Ch. 4 - Analyzing and Recording Adjusting Journal Entries...Ch. 4 - Prob. 3CPCh. 4 - Identifying and Preparing Adjusting Journal...Ch. 4 - Preparing a Trial Balance, Closing Journal Entry,...Ch. 4 - Analyzing and Recording Adjusting Journal Entries...Ch. 4 - Prob. 3PACh. 4 - Identifying and Preparing Adjusting Journal...Ch. 4 - Preparing a Trial Balance, Closing Journal Entry,...Ch. 4 - Recording Adjusting Journal Entries Cactus...Ch. 4 - Determining Accounting Equation Effects of...Ch. 4 - Identifying and Preparing Adjusting Journal...Ch. 4 - From Recording Transactions to Preparing Accrual...Ch. 4 - Prob. 2COPCh. 4 - Recording Transactions (Including Adjusting...Ch. 4 - From Recording Transactions (Including Adjusting...Ch. 4 - From Recording Transactions to Preparing Accrual...Ch. 4 - Prob. 6COPCh. 4 - Finding Financial Information Refer to the...Ch. 4 - Prob. 2SDCCh. 4 - Ethical Decision Making: A Mini-Case Assume you...Ch. 4 - Adjusting the Accounting Records Assume it is now...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardCan you solve this financial accounting question with the appropriate financial analysis techniques?arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

The ACCOUNTING EQUATION For BEGINNERS; Author: Accounting Stuff;https://www.youtube.com/watch?v=56xscQ4viWE;License: Standard Youtube License