FUNDAMENTALS OF FINANCIAL ACCOUNTING

6th Edition

ISBN: 9781260664386

Author: PHILLIPS, LIBB

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 4, Problem 13E

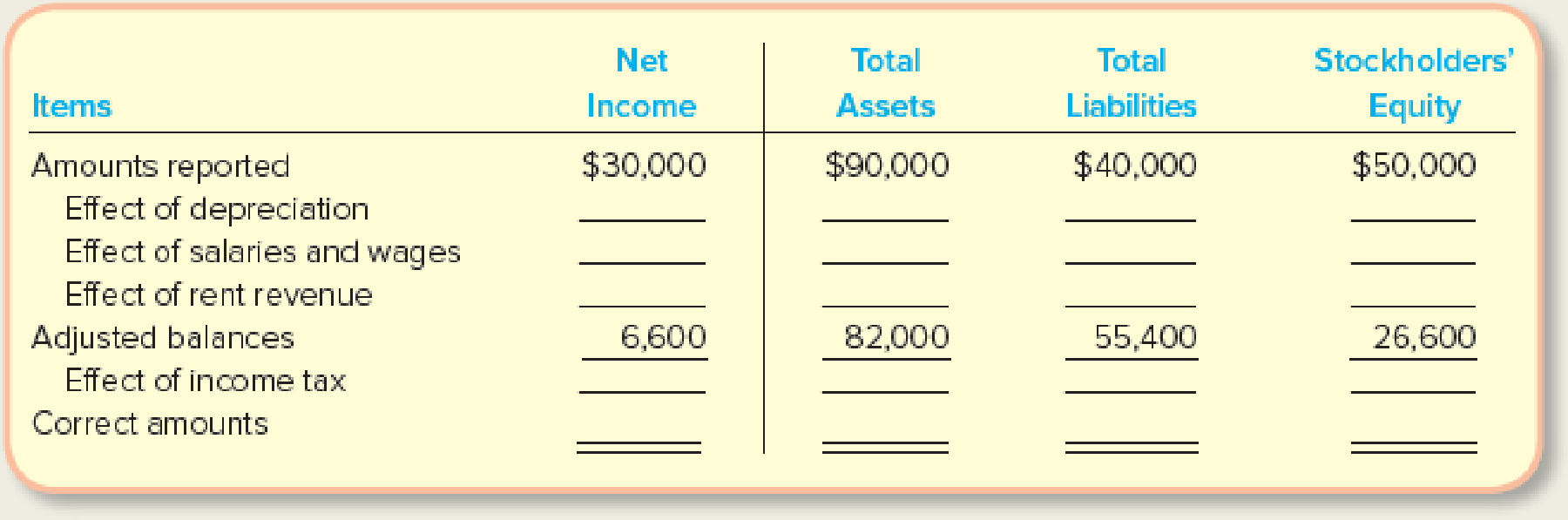

Analyzing the Effects of

On December 31, 2018, Alan and Company prepared an income statement and balance sheet but failed to take into account four adjusting journal entries. The income statement, prepared on this incorrect basis, reported income before income tax of $30,000. The balance sheet (before the effect of income taxes) reflected total assets, $90,000; total liabilities, $40,000; and stockholders’ equity, $50,000. The data for the four adjusting journal entries follow:

- a. Amortization of $8,000 for the year on software was not recorded.

- b. Salaries and wages amounting to $17,000 for the last three days of December 2018 were not paid and not recorded (the next payroll will be on January 10, 2019).

- c. Rent revenue of $4,800 was collected on December 1, 2018, for office space for the three-month period December 1, 2018, to February 28, 2019. The $4,800 was credited in full to Deferred Revenue when collected.

- d. Income taxes were not recorded and not paid. The income tax rate for the company is 30%.

Required:

Complete the following table to show the effects of the four adjusting journal entries (indicate deductions with parentheses):

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please add on to it and expand please.

Please provide the accurate answer to this general accounting problem using appropriate methods.

None

Chapter 4 Solutions

FUNDAMENTALS OF FINANCIAL ACCOUNTING

Ch. 4 - Prob. 1QCh. 4 - Explain the relationships between adjustments and...Ch. 4 - Prob. 3QCh. 4 - Prob. 4QCh. 4 - What is a contra-asset? Give an example of one.Ch. 4 - Explain the differences between depreciation...Ch. 4 - What is an adjusted trial balance? What is its...Ch. 4 - On December 31, a company makes a 59,000 payment...Ch. 4 - Using the information in question 8, determine the...Ch. 4 - Using the information in question 8, prepare the...

Ch. 4 - What is the equation for each of the following...Ch. 4 - Prob. 12QCh. 4 - What is the purpose of closing journal entries?Ch. 4 - Prob. 14QCh. 4 - Prob. 15QCh. 4 - What is a post-closing trial balance? Is it a...Ch. 4 - The owner of a local business complains that the...Ch. 4 - Which of the following accounts would not appear...Ch. 4 - Which account is least likely to appear in an...Ch. 4 - When a concert promotions company collects cash...Ch. 4 - On December 31, an adjustments made to reduce...Ch. 4 - An adjusting journal entry to recognize accrued...Ch. 4 - Prob. 6MCCh. 4 - Company A has owned a building for several years....Ch. 4 - Which of the following trial balances is used as a...Ch. 4 - Assume the balance in Prepaid Insurance is 2,500...Ch. 4 - Assume a company receives a bill for 10,000 for...Ch. 4 - Prob. 1MECh. 4 - Understanding Concepts Related to Adjustments...Ch. 4 - Matching Transactions with Type of Adjustment...Ch. 4 - Recording Adjusting Journal Entries Using the...Ch. 4 - Determine Accounting Equation Effects of Deferral...Ch. 4 - Prob. 6MECh. 4 - Determining Accounting Equation Effects of Accrual...Ch. 4 - Recording Adjusting Journal Entries Using be...Ch. 4 - Preparing Journal Entries for Deferral...Ch. 4 - Preparing Journal Entries for Deferral...Ch. 4 - Preparing Journal Entries for Deferral and Accrual...Ch. 4 - Reporting Adjusted Account Balances Indicate...Ch. 4 - Preparing an Adjusted Trial Balance Macro Company...Ch. 4 - Reporting an Income Statement The Sky Blue...Ch. 4 - Reporting a Statement of Retained Earnings Refer...Ch. 4 - Prob. 16MECh. 4 - Recording Closing Journal Entries Refer to the...Ch. 4 - Preparing and Posting Adjusting Journal Entries At...Ch. 4 - Preparing and Posting Adjusting Journal Entries At...Ch. 4 - Prob. 20MECh. 4 - Prob. 21MECh. 4 - Prob. 22MECh. 4 - Prob. 23MECh. 4 - Prob. 24MECh. 4 - Prob. 25MECh. 4 - Prob. 26MECh. 4 - Prob. 1ECh. 4 - Identifying Adjustments and Preparing Financial...Ch. 4 - Prob. 3ECh. 4 - Determining Adjustments and Accounting Equation...Ch. 4 - Determining Adjustments and Accounting Equation...Ch. 4 - Determining Adjustments and Accounting Equation...Ch. 4 - Recording Adjusting Journal Entries Refer to E4-6....Ch. 4 - Recording Typical Adjusting Journal Entries...Ch. 4 - Determining Accounting Equation Effects of Typical...Ch. 4 - Determining Adjusted Income Statement Account...Ch. 4 - Reporting Depreciation The adjusted trial balance...Ch. 4 - Recording Transactions Including Adjusting and...Ch. 4 - Analyzing the Effects of Adjusting Journal Entries...Ch. 4 - Reporting an Adjusted Income Statement Dyer, Inc.,...Ch. 4 - Recording Adjusting Entries and Preparing an...Ch. 4 - Recording Four Adjusting Journal Entries and...Ch. 4 - Recording Four Adjusting Journal Entries and...Ch. 4 - Prob. 18ECh. 4 - Analyzing, Recording, and Summarizing Business...Ch. 4 - Preparing Adjusting Entries, an Adjusted Trial...Ch. 4 - Preparing an Adjusted Trial Balance, Closing...Ch. 4 - Analyzing and Recording Adjusting Journal Entries...Ch. 4 - Prob. 3CPCh. 4 - Identifying and Preparing Adjusting Journal...Ch. 4 - Preparing a Trial Balance, Closing Journal Entry,...Ch. 4 - Analyzing and Recording Adjusting Journal Entries...Ch. 4 - Prob. 3PACh. 4 - Identifying and Preparing Adjusting Journal...Ch. 4 - Preparing a Trial Balance, Closing Journal Entry,...Ch. 4 - Recording Adjusting Journal Entries Cactus...Ch. 4 - Determining Accounting Equation Effects of...Ch. 4 - Identifying and Preparing Adjusting Journal...Ch. 4 - From Recording Transactions to Preparing Accrual...Ch. 4 - Prob. 2COPCh. 4 - Recording Transactions (Including Adjusting...Ch. 4 - From Recording Transactions (Including Adjusting...Ch. 4 - From Recording Transactions to Preparing Accrual...Ch. 4 - Prob. 6COPCh. 4 - Finding Financial Information Refer to the...Ch. 4 - Prob. 2SDCCh. 4 - Ethical Decision Making: A Mini-Case Assume you...Ch. 4 - Adjusting the Accounting Records Assume it is now...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please provide the solution to this general accounting question with accurate financial calculations.arrow_forwardCan you solve this general accounting problem using accurate calculation methods?arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forward

- Can you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forwardPlease provide the answer to this general accounting question with proper steps.arrow_forwardCan you help me solve this general accounting question using valid accounting techniques?arrow_forward

- I am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forwardI need help with this general accounting problem using proper accounting guidelines.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Accounting Changes and Error Analysis: Intermediate Accounting Chapter 22; Author: Finally Learn;https://www.youtube.com/watch?v=c2uQdN53MV4;License: Standard Youtube License