FUNDAMENTALS OF FINANCIAL ACCOUNTING

6th Edition

ISBN: 9781260664386

Author: PHILLIPS, LIBB

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 1PA

Preparing a

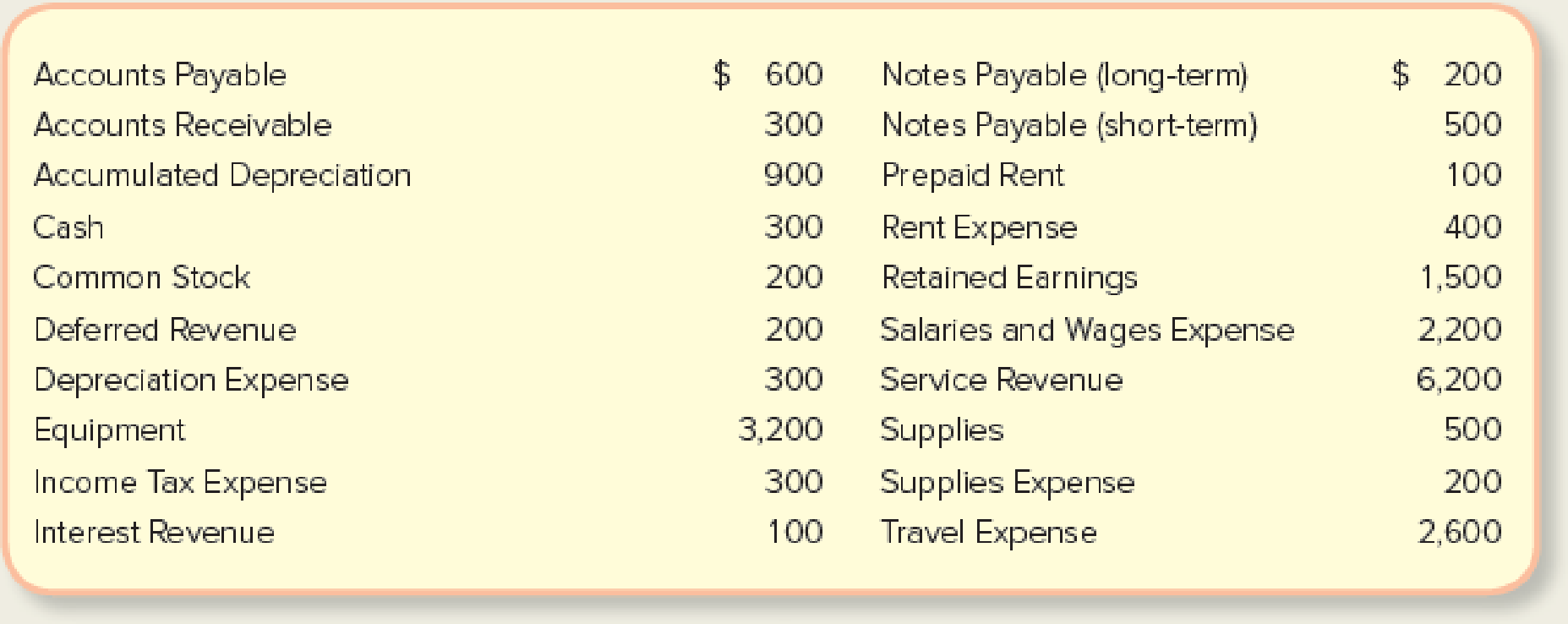

Starbooks Corporation provides an online bookstore for electronic books. The following is a simplified list of accounts and amounts reported in its accounting records. The accounts have normal debit or credit balances. Assume the year ended on September 30, 2018.

Required:

- 1. Prepare an adjusted trial balance at September 30, 2018. Is the

Retained Earnings balance of $1,500 the amount that would be reported on thebalance sheet as of September 30, 2018? - 2. Prepare the closing entry required at September 30, 2018.

- 3. Prepare a post-closing trial balance at September 30, 2018.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

13

Which of the following is correct about the difference between basic earnings per share (EPS) and diluted earnings per share?

Question 13 options:

Basic EPS uses comprehensive income in its calculation, whereas diluted EPS does not.

Basic EPS is not a required disclosure, whereas diluted EPS is required disclosure.

Basic EPS uses total common shares outstanding, whereas diluted EPS uses the weighted-average number of common shares.

Basic EPS is not adjusted for the potential dilutive effects of complex financial structures, whereas diluted EPS is adjusted.

Please explain the solution to this general accounting problem with accurate explanations.

I need guidance with this financial accounting problem using the right financial principles.

Chapter 4 Solutions

FUNDAMENTALS OF FINANCIAL ACCOUNTING

Ch. 4 - Prob. 1QCh. 4 - Explain the relationships between adjustments and...Ch. 4 - Prob. 3QCh. 4 - Prob. 4QCh. 4 - What is a contra-asset? Give an example of one.Ch. 4 - Explain the differences between depreciation...Ch. 4 - What is an adjusted trial balance? What is its...Ch. 4 - On December 31, a company makes a 59,000 payment...Ch. 4 - Using the information in question 8, determine the...Ch. 4 - Using the information in question 8, prepare the...

Ch. 4 - What is the equation for each of the following...Ch. 4 - Prob. 12QCh. 4 - What is the purpose of closing journal entries?Ch. 4 - Prob. 14QCh. 4 - Prob. 15QCh. 4 - What is a post-closing trial balance? Is it a...Ch. 4 - The owner of a local business complains that the...Ch. 4 - Which of the following accounts would not appear...Ch. 4 - Which account is least likely to appear in an...Ch. 4 - When a concert promotions company collects cash...Ch. 4 - On December 31, an adjustments made to reduce...Ch. 4 - An adjusting journal entry to recognize accrued...Ch. 4 - Prob. 6MCCh. 4 - Company A has owned a building for several years....Ch. 4 - Which of the following trial balances is used as a...Ch. 4 - Assume the balance in Prepaid Insurance is 2,500...Ch. 4 - Assume a company receives a bill for 10,000 for...Ch. 4 - Prob. 1MECh. 4 - Understanding Concepts Related to Adjustments...Ch. 4 - Matching Transactions with Type of Adjustment...Ch. 4 - Recording Adjusting Journal Entries Using the...Ch. 4 - Determine Accounting Equation Effects of Deferral...Ch. 4 - Prob. 6MECh. 4 - Determining Accounting Equation Effects of Accrual...Ch. 4 - Recording Adjusting Journal Entries Using be...Ch. 4 - Preparing Journal Entries for Deferral...Ch. 4 - Preparing Journal Entries for Deferral...Ch. 4 - Preparing Journal Entries for Deferral and Accrual...Ch. 4 - Reporting Adjusted Account Balances Indicate...Ch. 4 - Preparing an Adjusted Trial Balance Macro Company...Ch. 4 - Reporting an Income Statement The Sky Blue...Ch. 4 - Reporting a Statement of Retained Earnings Refer...Ch. 4 - Prob. 16MECh. 4 - Recording Closing Journal Entries Refer to the...Ch. 4 - Preparing and Posting Adjusting Journal Entries At...Ch. 4 - Preparing and Posting Adjusting Journal Entries At...Ch. 4 - Prob. 20MECh. 4 - Prob. 21MECh. 4 - Prob. 22MECh. 4 - Prob. 23MECh. 4 - Prob. 24MECh. 4 - Prob. 25MECh. 4 - Prob. 26MECh. 4 - Prob. 1ECh. 4 - Identifying Adjustments and Preparing Financial...Ch. 4 - Prob. 3ECh. 4 - Determining Adjustments and Accounting Equation...Ch. 4 - Determining Adjustments and Accounting Equation...Ch. 4 - Determining Adjustments and Accounting Equation...Ch. 4 - Recording Adjusting Journal Entries Refer to E4-6....Ch. 4 - Recording Typical Adjusting Journal Entries...Ch. 4 - Determining Accounting Equation Effects of Typical...Ch. 4 - Determining Adjusted Income Statement Account...Ch. 4 - Reporting Depreciation The adjusted trial balance...Ch. 4 - Recording Transactions Including Adjusting and...Ch. 4 - Analyzing the Effects of Adjusting Journal Entries...Ch. 4 - Reporting an Adjusted Income Statement Dyer, Inc.,...Ch. 4 - Recording Adjusting Entries and Preparing an...Ch. 4 - Recording Four Adjusting Journal Entries and...Ch. 4 - Recording Four Adjusting Journal Entries and...Ch. 4 - Prob. 18ECh. 4 - Analyzing, Recording, and Summarizing Business...Ch. 4 - Preparing Adjusting Entries, an Adjusted Trial...Ch. 4 - Preparing an Adjusted Trial Balance, Closing...Ch. 4 - Analyzing and Recording Adjusting Journal Entries...Ch. 4 - Prob. 3CPCh. 4 - Identifying and Preparing Adjusting Journal...Ch. 4 - Preparing a Trial Balance, Closing Journal Entry,...Ch. 4 - Analyzing and Recording Adjusting Journal Entries...Ch. 4 - Prob. 3PACh. 4 - Identifying and Preparing Adjusting Journal...Ch. 4 - Preparing a Trial Balance, Closing Journal Entry,...Ch. 4 - Recording Adjusting Journal Entries Cactus...Ch. 4 - Determining Accounting Equation Effects of...Ch. 4 - Identifying and Preparing Adjusting Journal...Ch. 4 - From Recording Transactions to Preparing Accrual...Ch. 4 - Prob. 2COPCh. 4 - Recording Transactions (Including Adjusting...Ch. 4 - From Recording Transactions (Including Adjusting...Ch. 4 - From Recording Transactions to Preparing Accrual...Ch. 4 - Prob. 6COPCh. 4 - Finding Financial Information Refer to the...Ch. 4 - Prob. 2SDCCh. 4 - Ethical Decision Making: A Mini-Case Assume you...Ch. 4 - Adjusting the Accounting Records Assume it is now...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- General Accounting Question Solutionarrow_forwardWhich is not an objective of internal controls?A. Safeguard assetsB. Improve profitsC. Ensure accurate recordsD. Promote operational efficiencyarrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forward

- Nelson and Murdock, a law firm, sells $8,000,000 of four-year, 8% bonds priced to yield 6.6%. The bonds are dated January 1, 2026, but due to some regulatory hurdles are not issued until March 1, 2026. Interest is payable on January 1 and July 1 each year. The bonds sell for $8,388,175 plus accrued interest. In mid-June, Nelson and Murdock earns an unusually large fee of $11,000,000 for one of its cases. They use part of the proceeds to buy back the bonds in the open market on July 1, 2026 after the interest payment has been made. Nelson and Murdock pays a total of $8,456,234 to reacquire the bonds and retires them. Required1. The issuance of the bonds—assume that Nelson and Murdock has adopted a policy of crediting interest expense for the accrued interest on the date of sale.2. Payment of interest and related amortization on July 1, 2026.3. Reacquisition and retirement of the bonds. Question 20 options: Paragrapharrow_forwardNelson and Murdock, a law firm, sells $8,000,000 of four-year, 8% bonds priced to yield 6.6%. The bonds are dated January 1, 2026, but due to some regulatory hurdles are not issued until March 1, 2026. Interest is payable on January 1 and July 1 each year. The bonds sell for $8,388,175 plus accrued interest. In mid-June, Nelson and Murdock earns an unusually large fee of $11,000,000 for one of its cases. They use part of the proceeds to buy back the bonds in the open market on July 1, 2026 after the interest payment has been made. Nelson and Murdock pays a total of $8,456,234 to reacquire the bonds and retires them. Required1. The issuance of the bonds—assume that Nelson and Murdock has adopted a policy of crediting interest expense for the accrued interest on the date of sale.2. Payment of interest and related amortization on July 1, 2026.3. Reacquisition and retirement of the bonds. Question 20 options: Paragrapharrow_forward11 Which statement is correct about accounting for financial instruments? Question 11 options: All financial instruments are accounted for at fair value through OCI. All financial instruments are accounted for at amortized cost. All are accounted for in accordance to their economic substance. All financial instruments are accounted for at fair value through profit or loss.arrow_forward

- Which of the following is correct about the difference between basic earnings per share (EPS) and diluted earnings per share? Question 13 options: Basic EPS uses comprehensive income in its calculation, whereas diluted EPS does not. Basic EPS is not a required disclosure, whereas diluted EPS is required disclosure. Basic EPS uses total common shares outstanding, whereas diluted EPS uses the weighted-average number of common shares. Basic EPS is not adjusted for the potential dilutive effects of complex financial structures, whereas diluted EPS is adjusted.arrow_forwardI need help Which entry is correct for recording revenue earned on account?A. Debit Cash, Credit RevenueB. Debit Revenue, Credit Accounts ReceivableC. Debit Accounts Receivable, Credit RevenueD. Debit Unearned Revenue, Credit Casharrow_forwardCan you solve this financial accounting problem using appropriate financial principles?arrow_forward

- 5 What are "zero-coupon bonds"? Question 5 options: Bonds that are sold at a premium. Bonds that are unsecured. Bonds that do not pay interest. Bonds that pay the market rate of interest.arrow_forwardWhich statement is correct about accounting for financial instruments? Question 11 options: All financial instruments are accounted for at fair value through OCI. All financial instruments are accounted for at amortized cost. All are accounted for in accordance to their economic substance. All financial instruments are accounted for at fair value through profit or loss.arrow_forward14 Which statement is correct about "weighted average number of ordinary shares outstanding"? Question 14 options: Treasury shares that are not cancelled are adjusted in this calculation. Treasury shares that are cancelled are adjusted in this calculation. Treasury shares that are repurchased are adjusted in this calculation. Treasury shares are ignored for purposes of this calculation.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning - Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY