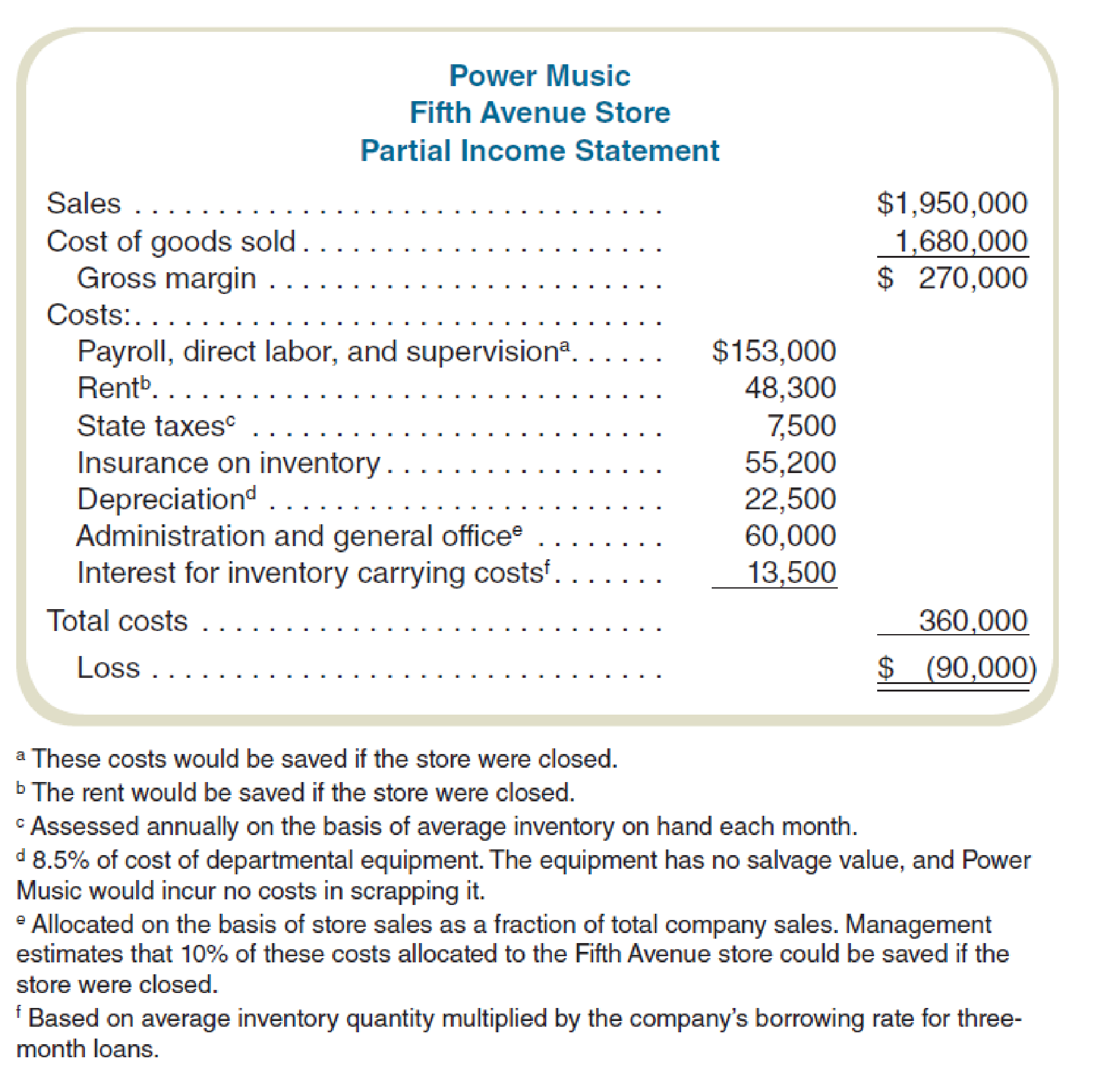

Power Music owns five music stores, where it sells music, instruments, and supplies. In addition, it rents instruments. At the end of last year, the new accounts showed that although the business as a whole was profitable, the Fifth Avenue store had shown a substantial loss. The income statement for the Fifth Avenue store for last month follows:

Analysis of these results has led management to consider closing the Fifth Avenue store. Members of the management team agree that keeping the Fifth Avenue store open is not essential to maintaining good customer relations and supporting the rest of the company’s business. In other words, eliminating the Fifth Avenue store is not expected to affect the amount of business done by the other stores.

Required

What action do you recommend to Power Music’s management? Write a short report to management recommending whether or not to close the Fifth Avenue store. Include the reasons for your recommendation.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Fundamentals of Cost Accounting

- Provide answer general Accounting questionarrow_forwardDegregorio Corporation makes a product that uses a material with the following direct material standards: Standard quantity 2.7 kilos per unit Standard price $9 per kilo The company produced 5,700 units in November using 15,760 kilos of the material. During the month, the company purchased 17,830 kilos of direct material at a total cost of $156,904. The direct materials purchases variance is computed when the materials are purchased. The materials quantity variance for November is: a. $3,330 F b. $3,236 F c. $3,330 U d. $3,236 Uarrow_forwardNonearrow_forward

- The blending department had the following data for the month of March: Units in BWIP Units completed 7,200 Units in EWIP (40% complete) 750 $27,000 Total manufacturing costs Required: 1. What is the output in equivalent units for March? 2. What is the unit manufacturing cost for March?arrow_forwardGiven answer accounting questionarrow_forwardAccounting question answerarrow_forward

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,