Concept explainers

The

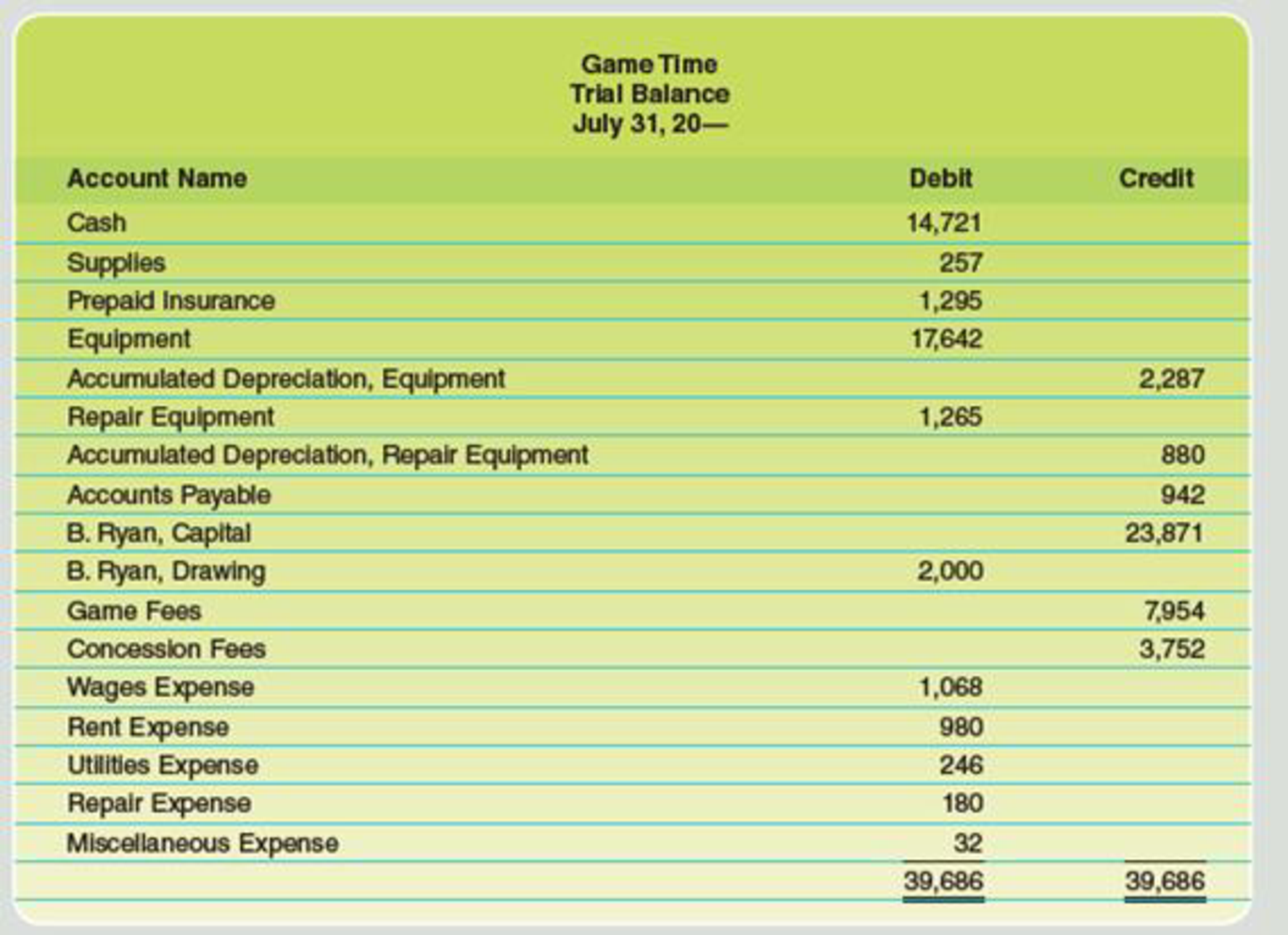

Data for month-end adjustments are as follows:

- Expired or used-up insurance, $480.

Depreciation expense on equipment, $850.- Depreciation expense on repair equipment, $120.

- Wages accrued or earned since the last payday, $525 (owed and to be paid on the next payday).

- Supplies used, $70.

Required

- Complete a work sheet for the month. (Skip this step if using CLGL.)

- Journalize the

adjusting entries . - If using CLGL prepare an adjusted trial balance.

- Prepare an income statement, a statement of owner’s equity, and a

balance sheet . Assume that no additional investments were made during July.

*If you are using CLGL, use the year 2020 when recording transactions and preparing reports.

1.

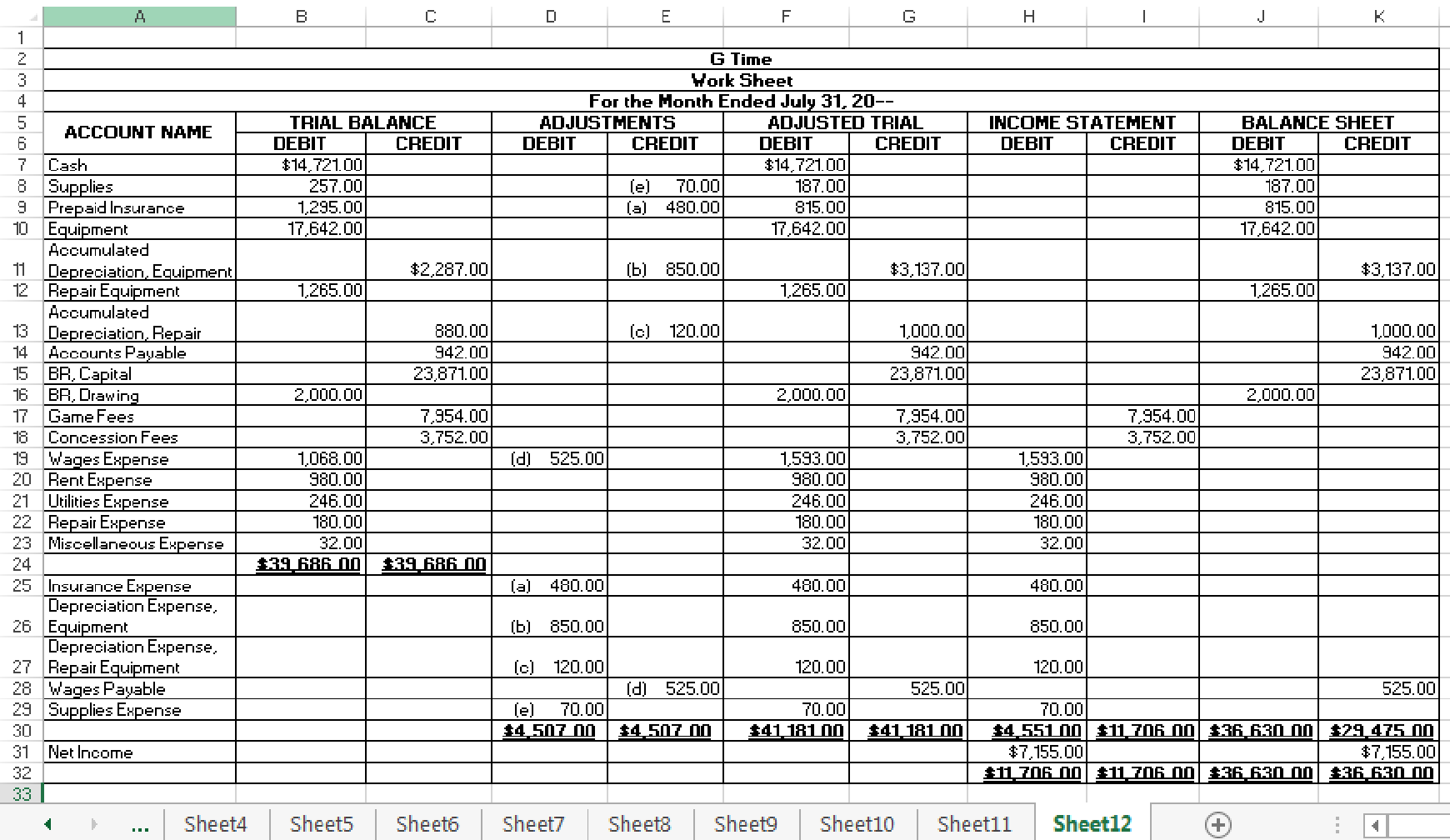

Indicate the given adjustments and complete the worksheet for G Time for the month ended July 31, 20--.

Explanation of Solution

Worksheet: Worksheet is an accounting tool that help accountants to record adjustments and up-date balances required to prepare financial statements. Worksheet is a central place where trial balance, adjustments, adjusted trial balance, income statement, and balance sheet are presented.

Indicate the given adjustments and complete the worksheet for G Time for the month ended July 31, 20--.

Table (1)

2.

Prepare adjusting journal entries for G Time.

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and balance sheet accounts (assets, liabilities, and owners’ or stockholders’ equity) to maintain the records according to accrual basis principle and matching concept.

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Prepare adjusting journal entries for G Time.

Adjusting entry for the prepaid insurance:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| July | 31 | Insurance Expense | 480 | |||

| Prepaid Insurance | 480 | |||||

| (Record part of prepaid insurance expired) | ||||||

Table (2)

Description:

- Insurance Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Prepaid Insurance is an asset account. Since amount of insurance is expired, asset account decreased, and a decrease in asset is credited.

Adjusting entry for the depreciation expense, equipment:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| July | 31 | Depreciation Expense, Equipment | 850 | |||

| Accumulated Depreciation, Equipment | 850 | |||||

| (Record depreciation expense) | ||||||

Table (3)

Description:

- Depreciation Expense, Equipment is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Accumulated Depreciation, Equipment is a contra-asset account, and contra-asset accounts would have a normal credit balance, hence, the account is credited.

Adjusting entry for the depreciation expense, repair equipment:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| July | 31 | Depreciation Expense, Repair Equipment | 120 | |||

| Accumulated Depreciation, Repair Equipment | 120 | |||||

| (Record depreciation expense) | ||||||

Table (4)

Description:

- Depreciation Expense, Repair Equipment is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Accumulated Depreciation, Repair Equipment is a contra-asset account, and contra-asset accounts would have a normal credit balance, hence, the account is credited.

Adjusting entry for the wages expense:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| July | 31 | Wages Expense | 525 | |||

| Wages Payable | 525 | |||||

| (Record accrued wages expenses) | ||||||

Table (5)

Description:

- Wages Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Wages Payable is a liability account. Since amount of payables has increased, liability decreased, and an increase in liability is credited.

Adjusting entry for the supplies expense:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| July | 31 | Supplies Expense | 70 | |||

| Supplies | 70 | |||||

| (Record part of supplies consumed) | ||||||

Table (6)

Description:

- Supplies Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Supplies is an asset account. Since amount of supplies is used, asset account decreased, and a decrease in asset is credited.

3.

Prepare an adjusted trial balance for G Time at July 31, 20--.

Explanation of Solution

Adjusted trial balance: Adjusted trial balance is a summary of all the ledger accounts, and it contains the balances of all the accounts after the adjustment entries are journalized, and posted.

Prepare an adjusted trial balance for G Time at July 31, 20--.

| G Time | |||

| Adjusted Trial Balance | |||

| July 31, 20-- | |||

| Particulars | AccountNo. | Debit $ | Credit $ |

| Cash | $14,721.00 | ||

| Supplies | 187.00 | ||

| Prepaid Insurance | 815.00 | ||

| Equipment | 17,642.00 | ||

| Accumulated Depreciation, Equipment | $3,137.00 | ||

| Repair Equipment | 1,265.00 | ||

| Accumulated Depreciation, Repair Equipment | 1,000.00 | ||

| Accounts payable | 942.00 | ||

| Wages payable | 525.00 | ||

| BR, Capital | 23,871.00 | ||

| BR, Drawing | 2,000.00 | ||

| Game Fees | 7,954.00 | ||

| Concession Fees | 3,752.00 | ||

| Depreciation Expense, Equipment | 850.00 | ||

| Depreciation Expense, Repair Equipment | 120.00 | ||

| Wages Expense | 1,593.00 | ||

| Rent Expense | 980.00 | ||

| Supplies Expense | 70.00 | ||

| Insurance Expense | 480.00 | ||

| Utilities Expense | 246.00 | ||

| Repair Expense | 180.00 | ||

| Miscellaneous Expense | 32.00 | ||

| $41,181.00 | $41,181.00 | ||

Table (7)

The debit column and credit column of the adjusted trial balance are agreed, both having the balance of $41,181.

4.

Prepare income statement, statement of owners’ equity, and balance sheet for G Time.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations, and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare an income statement of G Time for the month ended July 31, 20--.

| G Time | ||

| Income Statement | ||

| For the Month Ended July 31, 20-- | ||

| Revenues: | ||

| Game Fees | $7,954 | |

| Concession Fees | 3,752 | |

| Total Revenue | $11,706 | |

| Expenses: | ||

| Wages Expense | $1,593 | |

| Rent Expense | 980 | |

| Depreciation Expense, Equipment | 850 | |

| Depreciation Expense, Repair Equipment | 120 | |

| Supplies Expense | 70 | |

| Insurance Expense | 480 | |

| Utilities Expense | 246 | |

| Repair Expense | 180 | |

| Miscellaneous Expense | 32 | |

| Total expenses | 4,551 | |

| Net income | $7,155 | |

Table (8)

Statement of owners’ equity: This statement reports the beginning owner’s equity and all the changes which led to ending owners’ equity. Additional capital, net income from income statement is added to, and drawings is deducted from beginning owner’s equity to arrive at the end result, ending owner’s equity.

Prepare a statement of owners’ equity for G Time for the month ended July 31, 20--.

| G Time | ||

| Statement of Owners’ Equity | ||

| For the Month Ended July 31, 20-- | ||

| BR, Capital, July 1, 20-- | $23,871 | |

| Investments during July | $0 | |

| Net income for July | 7,155 | |

| 7,155 | ||

| Less: Withdrawals for July | 2,000 | |

| Increase in capital | 5,155 | |

| BR, Capital, July 31, 20-- | $29,026 | |

Table (9)

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and owners (owners’ equity) over those resources. The resources of the company are assets which include money contributed by owners and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and owners’ equity.

Prepare the balance sheet for G Time as at July 31, 20--.

| G Time | ||

| Balance Sheet | ||

| July 31, 20-- | ||

| Assets | ||

| Cash | $14,721 | |

| Supplies | 187 | |

| Prepaid Insurance | 815 | |

| Equipment | $17,642 | |

| Less: Accumulated Depreciation | 3,317 | 14,505 |

| Repair Equipment | $1,265 | |

| Less: Accumulated Depreciation | 1,000 | 265 |

| Total Assets | $30,493 | |

| Liabilities | ||

| Accounts Payable | $942 | |

| Wages Payable | 525 | |

| Total Liabilities | $1,467 | |

| Owners’ Equity | ||

| BR, Capital | 29,026 | |

| Total Liabilities and Owners’ Equity | $30,493 | |

Table (10)

Want to see more full solutions like this?

Chapter 4 Solutions

College Accounting (Book Only): A Career Approach

Additional Business Textbook Solutions

Engineering Economy (17th Edition)

Marketing: An Introduction (13th Edition)

Intermediate Accounting (2nd Edition)

Horngren's Accounting (12th Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- Debt equity ratioarrow_forwardPlease help me with part B of this problem. I am having trouble. Fill all necessary cells as shown. I have provided the dropdown that includes the accounts.arrow_forwardWhat is a good response to this post? My chosen product is an ergonomic pet bed similar to a large bean bag called a Pooch Poof. And my proposed markets are the United States, as it currently has the largest share of pet product sales, Europe as the pet population is 324.4 million currently, and South America, as this country is expected to be one of the fastest growing markets for pet accessories and food (Shahbandeh, 2024). With my product in two stable markets, and one emerging market, financial risks will be minimized as much as possible when expanding into the emerging market of South America by the stability of the American and European markets that are established. My slogan will be “Pamper your pooch with softness and watch your worries about your pup’s good night sleep go “Poof”. A “poofed” pet is a proper pet!” This slogan works as in the United States and Europe, dogs are generally considered family members, and allowed in public spaces, and socialization, training, health…arrow_forward

- What is its debt to equity ratio for WACC purposes?arrow_forwardWhat is its debt to equity ratio for WACC purposes? Accountingarrow_forwardWhat is a good response to this post? In this week’s discussion, we will consider product slogans and expansion into other countries. For my post, I will be focusing on make-up brand Merit Beauty. It is a vegan beauty brand that focuses on minimalist beauty and offers kits that have all five pieces for ease of application and enhances the natural beauty of the wearer (Fallon, 2024). My slogan: “Where less is more and looking good is easy” The countries I would like to expand marketing to are: Singapore: The country focuses on health and beauty with emphasis on wellbeing and the country has a comprehensive offering of insurance, both private and national insurance, along with initiatives to promote wellbeing (GCPIT, n.d.). Additionally, the makeup market had total revenues of $221.4 million in 2023 which was an annual growth rate of 3.7% between 2018 and 2023 (Marketline, 2024). France: France too has a commitment to offering clean products to their citizens and have been know as one…arrow_forward

- Please find the interest revenue HELParrow_forwardAns plzarrow_forwardToodles Inc. had sales of $1,840,000. Cost of goods sold,administrative and selling expenses, and depreciation expenses were $1,180,000, $185,000 and $365,000 respectively. In addition, the company had an interest expense of $280,000 and a tax rate of 35 percent. (Ignore any tax loss carry-back or carry-forward provisions.)Arrange the financial information for Toodles Inc. in an income statement and compute its OCF?arrow_forward

- Anti-Pandemic Pharma Co. Ltd. reports the following information in its income statement: Sales = $5,250,000; Costs = $2,173,000; Other expenses = $187,400; Depreciation expense = $79,000; Interest expense= $53,555; Taxes = $76,000; Dividends = $69,000. $136,700 worth of new shares were also issued during the year and long-term debt worth $65,300 was redeemed. a) Compute the cash flow from assets b) Compute the net change in working capitalarrow_forwardAnswer the questions in the attached imagearrow_forwardAuditor should assess the likelihood of --------- when identifying potential criteria for the audit. material misstatement wrong answerarrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College