Individual Income Taxes

43rd Edition

ISBN: 9780357109731

Author: Hoffman

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 4, Problem 4CPA

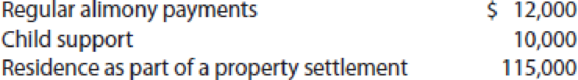

Jake pays the following amounts to his former spouse during the current year:

What amount can Jake deduct as alimony for the current year? Assume that the divorce occurred before 2019.

- a. $0

- b. $12,000

- c. $22,000

- d. $137,000

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Can you help me solve this general accounting problem with the correct methodology?

I need help with this financial accounting problem using proper accounting guidelines.

Please provide the solution to this general accounting question using proper accounting principles.

Chapter 4 Solutions

Individual Income Taxes

Ch. 4 - According to the Supreme Court, would it be good...Ch. 4 - Prob. 2DQCh. 4 - Prob. 3DQCh. 4 - Ben lost his job when his employer moved its...Ch. 4 - Howard buys wrecked cars and stores them on his...Ch. 4 - On December 29, 2019, an employee received a 5,000...Ch. 4 - Prob. 7DQCh. 4 - A Series EE U.S. government savings bond accrues...Ch. 4 - The taxpayer performs services with payment due...Ch. 4 - Wade paid 7,000 for an automobile that needed...

Ch. 4 - Prob. 11DQCh. 4 - Prob. 12DQCh. 4 - A divorce agreement entered into in 2017 requires...Ch. 4 - Prob. 14DQCh. 4 - Patrick and Eva are planning to divorce in 2019....Ch. 4 - Prob. 16DQCh. 4 - Prob. 17DQCh. 4 - Prob. 18DQCh. 4 - Prob. 19DQCh. 4 - Prob. 20DQCh. 4 - On January 1, 2019, Kunto, a cash basis taxpayer,...Ch. 4 - Bigham Corporation, an accrual basis calendar year...Ch. 4 - LO.3 Simba and Zola are married but file separate...Ch. 4 - Casper and Cecile divorced in 2018. As part of the...Ch. 4 - LO.4 Elizabeth made the following interest-free...Ch. 4 - Prob. 26CECh. 4 - Prob. 27CECh. 4 - Prob. 28PCh. 4 - Prob. 29PCh. 4 - Determine the taxpayers gross income for tax...Ch. 4 - Prob. 31PCh. 4 - Prob. 32PCh. 4 - Prob. 33PCh. 4 - Your client is a partnership, ARP Associates,...Ch. 4 - Trip Garage, Inc. (459 Ellis Avenue, Harrisburg,...Ch. 4 - Prob. 36PCh. 4 - Marlene, a cash basis taxpayer, invests in Series...Ch. 4 - Drake Appliance Company, an accrual basis...Ch. 4 - Freda is a cash basis taxpayer. In 2019, she...Ch. 4 - Prob. 40PCh. 4 - Prob. 41PCh. 4 - Troy, a cash basis taxpayer, is employed by Eagle...Ch. 4 - Prob. 43PCh. 4 - Prob. 44PCh. 4 - Prob. 45PCh. 4 - Nell and Kirby are in the process of negotiating...Ch. 4 - Alicia and Rafel are in the process of negotiating...Ch. 4 - Prob. 48PCh. 4 - Prob. 49PCh. 4 - Prob. 50PCh. 4 - Prob. 51PCh. 4 - Prob. 52PCh. 4 - For each of the following, determine the amount...Ch. 4 - Prob. 54PCh. 4 - Prob. 55PCh. 4 - Linda and Don are married and file a joint return....Ch. 4 - Charles E. Bennett, age 64, will retire next year...Ch. 4 - Donna does not think she has an income tax problem...Ch. 4 - Prob. 1RPCh. 4 - Prob. 2RPCh. 4 - Prob. 3RPCh. 4 - Prob. 1CPACh. 4 - Fred and Wilma were divorced in year 1 (before...Ch. 4 - Bill and Jane Jones were divorced on January 1,...Ch. 4 - Jake pays the following amounts to his former...Ch. 4 - Mary purchased an annuity that pays her 500 per...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardWhen incorporating his sole proprietorship, Joe transfers all of its assets and liabilities. Included in the $30,000 of liabilities assumed by the corporation is $500 that relates to a personal expenditure. Under these circumstances, the entire $30,000 will be treated as boot. / Provide explanation please a. True b. Falsearrow_forwardIn determining whether § 357(c) applies, assess whether the liabilities involved exceed the bases of all assets a shareholder transfers to the corporation./ Provide explanation please. a. True b. Falsearrow_forward

- The ending inventory isarrow_forwardhelparrow_forwardBansai, age 66, retires and receives a $1,450 per month annuity from his employer's qualified pension plan. Bansai made $87,600 of after-tax contributions to the plan before retirement. Under the simplified method, Bansai's number of anticipated payments is 240. What is the amount includible in income in the first year of withdrawals assuming 12 monthly payments? A. $10,560 B. $12,540 C. $17,400 D. $8,220arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

How to Calculate your Income Tax? Step-by-Step Guide for Income Tax Calculation; Author: ETMONEY;https://www.youtube.com/watch?v=QdJKpSXCYmQ;License: Standard YouTube License, CC-BY

How to Calculate Federal Income Tax; Author: Edspira;https://www.youtube.com/watch?v=2LrvRqOEYk8;License: Standard Youtube License