Bundle: Financial Accounting: The Impact on Decision Makers, Loose-Leaf Version, 10th Edition + LMS Integrated for CengageNOWv2â„¢, 1 term Printed Access Card

10th Edition

ISBN: 9781305793217

Author: Gary A. Porter, Curtis L. Norton

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 4.9E

Working Backward:

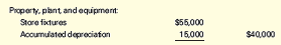

Polk Corp. purchased new store fixtures for $55,000 on January 31, 2014. Polk depreciates assets using the straight-line method and estimated a salvage value for the machine of $5,000. On its December 31, 2016,

Required

- What is the yearly amount of depreciation expense for the store fixtures?

- What is the estimated useful life in years for the store fixtures? Explain your answer.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is it's ROE on these financial accounting question?

Provide correct answer general accounting

Financial Account

Chapter 4 Solutions

Bundle: Financial Accounting: The Impact on Decision Makers, Loose-Leaf Version, 10th Edition + LMS Integrated for CengageNOWv2â„¢, 1 term Printed Access Card

Ch. 4 - Read each definition below and write the number of...Ch. 4 - Prob. 4.1ECh. 4 - Comparing the Income Statement and the Statement...Ch. 4 - Prob. 4.3ECh. 4 - Accruals and Deferrals For the following...Ch. 4 - Office Supplies Somerville Corp. purchases office...Ch. 4 - Prepaid Rent—Quarterly Adjustments On September...Ch. 4 - Prob. 4.7ECh. 4 - Depreciation On July 1, 2016, Dexter Corp. buys a...Ch. 4 - Working Backward: Depreciation Polk Corp....

Ch. 4 - Prob. 4.10ECh. 4 - Subscriptions Horse Country Living publishes a...Ch. 4 - Customer Deposits Wolfe $ Wolfe collected $9,000...Ch. 4 - Concert Tickets Sold in Advance Rock N Roll...Ch. 4 - Prob. 4.14ECh. 4 - Wages Payable Denton Corporation employs 50...Ch. 4 - Prob. 4.16ECh. 4 - Prob. 4.17ECh. 4 - Interest Payable—Quarterly Adjustments Glendive...Ch. 4 - Prob. 4.19ECh. 4 - Interest Receivable On June 1, 2016, MicroTel...Ch. 4 - Rent Receivable Hudson Corp. has extra space in...Ch. 4 - Working Backward: Rent Receivable Randys Rentals...Ch. 4 - The Effect of Ignoring Adjusting Entries on Net...Ch. 4 - The Effect of Adjusting Entries on the Accounting...Ch. 4 - Reconstruction of Adjusting Entries from...Ch. 4 - The Accounting Cycle The steps in the accounting...Ch. 4 - Trial Balance The following account titles,...Ch. 4 - Prob. 4.28ECh. 4 - Preparation of a Statement of Retained Earnings...Ch. 4 - Reconstruction of Closing Entries The following T...Ch. 4 - Closing Entries for Nordstrom The following...Ch. 4 - Prob. 4.32ECh. 4 - Prob. 4.33ECh. 4 - Prob. 4.34ECh. 4 - Revenue Recognition, Cash and Accrual Bases...Ch. 4 - Depreciation Expense During 2016, Carter Company...Ch. 4 - Prob. 4.37MCECh. 4 - Adjusting Entries Kretz Corporation prepares...Ch. 4 - Prob. 4.2PCh. 4 - Prob. 4.3PCh. 4 - Recurring and Adjusting Entries Following are...Ch. 4 - Prob. 4.5PCh. 4 - Prob. 4.6PCh. 4 - Prob. 4.7PCh. 4 - Prob. 4.8PCh. 4 - Prob. 4.9PCh. 4 - Prob. 4.10PCh. 4 - Prob. 4.1IPCh. 4 - Prob. 4.2APCh. 4 - Prob. 4.3APCh. 4 - Prob. 4.7APCh. 4 - Prob. 4.9APCh. 4 - Prob. 4.10APCh. 4 - Prob. 4.11MCPCh. 4 - Prob. 4.12MCPCh. 4 - Prob. 4.13MCPCh. 4 - Prob. 4.11AMCPCh. 4 - Prob. 4.12AMCPCh. 4 - Prob. 4.13AMCPCh. 4 - Prob. 4.1APCh. 4 - Prob. 4.4APCh. 4 - Prob. 4.5APCh. 4 - Prob. 4.6APCh. 4 - Prob. 4.8APCh. 4 - Prob. 4.1DCCh. 4 - Prob. 4.2DCCh. 4 - Prob. 4.3DCCh. 4 - Prob. 4.4DCCh. 4 - Depreciation Jensen Inc., a graphic arts studio,...Ch. 4 - Prob. 4.6DCCh. 4 - Prob. 4.7DC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- general accountingarrow_forwardIf a company has sales revenue of $120,000, cost of goods sold of $70,000, and operating expenses of $20,000, what is the net income? Correct Answerarrow_forwardIf a company has sales revenue of $120,000, cost of goods sold of $70,000, and operating expenses of $20,000, what is the net income? Financial Accountingarrow_forward

- A company’s beginning inventory is $13,000, purchases during the period are $33,000, and the ending inventory is $9,500. What is the cost of goods sold (COGS)? General Accountingarrow_forwardData for the two departments of Kimble & Pierce Company for June of the current fiscal year are as follows: Drawing Department Winding Department Work in process, June 1 Completed and transferred to next 7,400 units, 30% completed 2,900 units, 60% completed 101,400 units 100,400 units processing department during June Work in process, June 30 5,600 units, 75% completed 3,900 units, 30% completed Production begins in the Drawing Department and finishes in the Winding Department. If all direct materials are placed in process at the beginning of production, determine the direct materials and conversion equivalent units of production for June for the Winding Department.arrow_forwardGeneral Accountingarrow_forward

- Financial Accounting please answer the questionarrow_forwardA business purchases equipment for $25,000, paying $6,000 in cash and signing a note payable for the remainder. What amount should be recorded as a liability?HELParrow_forwardMyrna and Geoffrey filed a joint tax return in 2017. Their AGI was $85,000, and itemized deductions were $13,700, which included $4,000 in state income tax. In 2018, they received a $1,800 refund of the state income taxes that they paid in 2017. The standard deduction for married filing jointly in 2017 was $12,700. Under the tax benefit rule, how much of the state income tax refund is included in gross income in 2018?(General Account)arrow_forward

- Assume the company uses variable costing. Determine its product cost per unit.arrow_forwardAnnenbaum Corporation uses the weighted-average method in its process costing system. This month, the beginning inventory in the first processing department consisted of 2,400 units. The costs and percentage completion of these units in the beginning inventory were: Cost Percent Complete Materials costs $ 7,700 65% Conversion costs $ 8,800 45% A total of 10,500 units were started and 7,900 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month: Cost Materials costs $ 1,27,500 Conversion costs $2,09,000 The ending inventory was 50% complete with respect to materials and 35% complete with respect to conversion costs. What are the equivalent units for conversion costs for the month in the first processing department?arrow_forwardGive me answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Accounting for Derivatives_1.mp4; Author: DVRamanaXIMB;https://www.youtube.com/watch?v=kZky1jIiCN0;License: Standard Youtube License

Depreciation|(Concept and Methods); Author: easyCBSE commerce lectures;https://www.youtube.com/watch?v=w4lScJke6CA;License: Standard YouTube License, CC-BY