Bundle: Financial Accounting: The Impact on Decision Makers, Loose-Leaf Version, 10th Edition + LMS Integrated for CengageNOWv2â„¢, 1 term Printed Access Card

10th Edition

ISBN: 9781305793217

Author: Gary A. Porter, Curtis L. Norton

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 4.31E

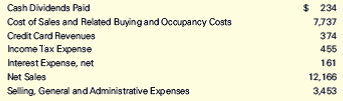

Closing Entries for Nordstrom

The following accounts appear on Nordstrom’s 2013 financial statements as reported in its Form 10-K for the fiscal year ended February 1, 2014. The accounts are listed in alphabetical order, and the balance in each account is the normal balance for that account. All amounts are in millions of dollars. Prepare closing entries for Nordstrom for 2013.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Recently, Abercrombie & Fitch has been implementing a turnaround strategy since its sales had been falling for the past few years (11% decrease in 2014, 8% in 2015, and just 3% in 2016.) One part of Abercrombie's new strategy has been to abandon its logo-adorned merchandise, replacing it with a subtler look. Abercrombie wrote down $20.6 million of inventory, including logo-adorned merchandise, during the year ending January 30, 2016. Some of this inventory dated back to late 2013. The write-down was net of the amount it would be able to recover selling the inventory at a discount. The write-down is significant; Abercrombie's reported net income after this write-down was $35.6 million. Interestingly, Abercrombie excluded the inventory write-down from its non-GAAP income measures presented to investors; GAAP earnings were also included in the same report. Question: From an investor standpoint, do you think that the effect of the inventory write-down should be considered when…

Financial accounting

Dont use ai solution general Accounting question

Chapter 4 Solutions

Bundle: Financial Accounting: The Impact on Decision Makers, Loose-Leaf Version, 10th Edition + LMS Integrated for CengageNOWv2â„¢, 1 term Printed Access Card

Ch. 4 - Read each definition below and write the number of...Ch. 4 - Prob. 4.1ECh. 4 - Comparing the Income Statement and the Statement...Ch. 4 - Prob. 4.3ECh. 4 - Accruals and Deferrals For the following...Ch. 4 - Office Supplies Somerville Corp. purchases office...Ch. 4 - Prepaid Rent—Quarterly Adjustments On September...Ch. 4 - Prob. 4.7ECh. 4 - Depreciation On July 1, 2016, Dexter Corp. buys a...Ch. 4 - Working Backward: Depreciation Polk Corp....

Ch. 4 - Prob. 4.10ECh. 4 - Subscriptions Horse Country Living publishes a...Ch. 4 - Customer Deposits Wolfe $ Wolfe collected $9,000...Ch. 4 - Concert Tickets Sold in Advance Rock N Roll...Ch. 4 - Prob. 4.14ECh. 4 - Wages Payable Denton Corporation employs 50...Ch. 4 - Prob. 4.16ECh. 4 - Prob. 4.17ECh. 4 - Interest Payable—Quarterly Adjustments Glendive...Ch. 4 - Prob. 4.19ECh. 4 - Interest Receivable On June 1, 2016, MicroTel...Ch. 4 - Rent Receivable Hudson Corp. has extra space in...Ch. 4 - Working Backward: Rent Receivable Randys Rentals...Ch. 4 - The Effect of Ignoring Adjusting Entries on Net...Ch. 4 - The Effect of Adjusting Entries on the Accounting...Ch. 4 - Reconstruction of Adjusting Entries from...Ch. 4 - The Accounting Cycle The steps in the accounting...Ch. 4 - Trial Balance The following account titles,...Ch. 4 - Prob. 4.28ECh. 4 - Preparation of a Statement of Retained Earnings...Ch. 4 - Reconstruction of Closing Entries The following T...Ch. 4 - Closing Entries for Nordstrom The following...Ch. 4 - Prob. 4.32ECh. 4 - Prob. 4.33ECh. 4 - Prob. 4.34ECh. 4 - Revenue Recognition, Cash and Accrual Bases...Ch. 4 - Depreciation Expense During 2016, Carter Company...Ch. 4 - Prob. 4.37MCECh. 4 - Adjusting Entries Kretz Corporation prepares...Ch. 4 - Prob. 4.2PCh. 4 - Prob. 4.3PCh. 4 - Recurring and Adjusting Entries Following are...Ch. 4 - Prob. 4.5PCh. 4 - Prob. 4.6PCh. 4 - Prob. 4.7PCh. 4 - Prob. 4.8PCh. 4 - Prob. 4.9PCh. 4 - Prob. 4.10PCh. 4 - Prob. 4.1IPCh. 4 - Prob. 4.2APCh. 4 - Prob. 4.3APCh. 4 - Prob. 4.7APCh. 4 - Prob. 4.9APCh. 4 - Prob. 4.10APCh. 4 - Prob. 4.11MCPCh. 4 - Prob. 4.12MCPCh. 4 - Prob. 4.13MCPCh. 4 - Prob. 4.11AMCPCh. 4 - Prob. 4.12AMCPCh. 4 - Prob. 4.13AMCPCh. 4 - Prob. 4.1APCh. 4 - Prob. 4.4APCh. 4 - Prob. 4.5APCh. 4 - Prob. 4.6APCh. 4 - Prob. 4.8APCh. 4 - Prob. 4.1DCCh. 4 - Prob. 4.2DCCh. 4 - Prob. 4.3DCCh. 4 - Prob. 4.4DCCh. 4 - Depreciation Jensen Inc., a graphic arts studio,...Ch. 4 - Prob. 4.6DCCh. 4 - Prob. 4.7DC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Need correct answer general Accountingarrow_forwardYear 0123 Cash Flow -$ 19,000 11,300 10,200 6,700 a. What is the profitability index for the set of cash flows if the relevant discount rate is 11 percent? Note: Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161. b. What is the profitability index for the set of cash flows if the relevant discount rate is 16 percent? Note: Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161. c. What is the profitability index for the set of cash flows if the relevant discount rate is 23 percent? Note: Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161. a. Profitability index b. Profitability index c. Profitability indexarrow_forwardSol This question answerarrow_forward

- Recently, Abercrombie & Fitch has been implementing a turnaround strategy since its sales had been falling for the past few years (11% decrease in 2014, 8% in 2015, and just 3% in 2016.) One part of Abercrombie's new strategy has been to abandon its logo-adorned merchandise, replacing it with a subtler look. Abercrombie wrote down $20.6 million of inventory, including logo-adorned merchandise, during the year ending January 30, 2016. Some of this inventory dated back to late 2013. The write-down was net of the amount it would be able to recover selling the inventory at a discount. The write-down is significant; Abercrombie's reported net income after this write-down was $35.6 million. Interestingly, Abercrombie excluded the inventory write-down from its non-GAAP income measures presented to investors; GAAP earnings were also included in the same report. Question: What is the impact on Abercrombie & Fitch's financial statements from the write-down of its logo-adorned merchandise…arrow_forwardTherefore the final answerarrow_forwardAns ? General Accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY