Concept explainers

Cost Flows

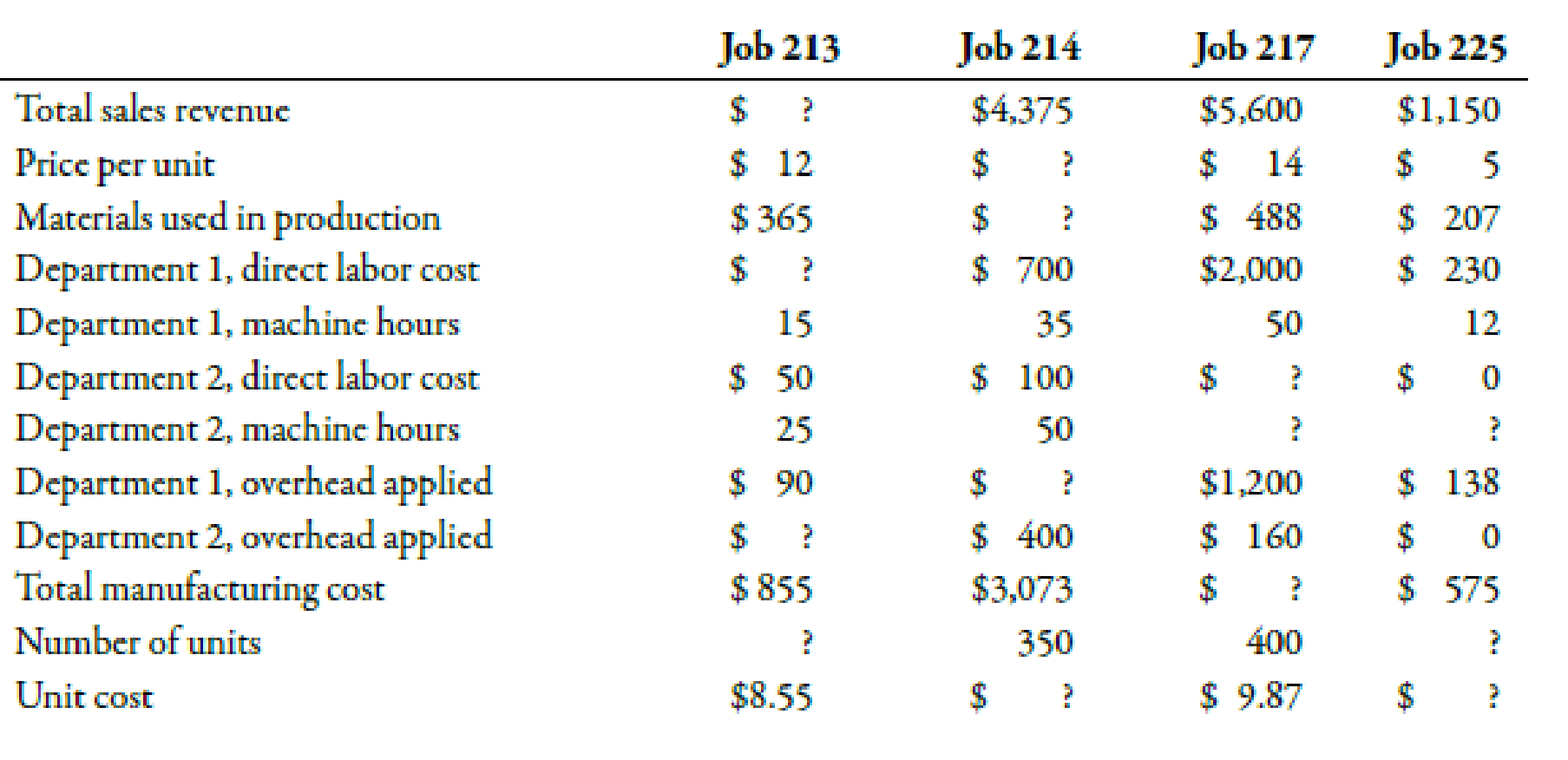

Consider the following independent jobs.

Direct labor wages average $10 per hour in each department.

Required:

Fill in the missing data for each job.

Complete the table by finding the missing amounts.

Explanation of Solution

Cost Flow:

A method which describes the way of accounting costs from the time of their occurrence to the time of their recognition as an expense on the income statement is known as cost flow.

| Job 213 | Job 214 | Job 217 | Job 225 | |

| Total sales revenue | $1,200 | $4,375 | $5,600 | $1,150 |

| Price per unit | $12 | $8.78 | $14 | $5 |

| Materials used in production | $365 | $1,453 | $488 | $207 |

| Department 1, direct labor cost | $150 | $700 | $2,000 | $230 |

| Department 1, machine hours | 15 | 35 | 50 | 12 |

| Department 2, direct labor cost | $50 | $100 | $100 | $0 |

| Department 2, machine hours | 25 | 50 | 20 | 0 |

| Department 1, overhead applied | $90 | $420 | $1,200 | $138 |

| Department 2, overhead applied | $200 | $400 | $160 | $0 |

| Total manufacturing cost | $855 | $3,073 | $3,948 | $575 |

| Number of units | 100 | 350 | 400 | 230 |

| Unit cost | $8.55 | $12.50 | $9.87 | $2.50 |

Table (1)

Working Note:

1. Job 213:

Calculation of number of units

Number of units=Total manufaturing costUnit cost=$855$8.55=100 units

Calculation of total sales revenue:

Total sales revenue=Number of units×Unit price=100 units×$12=$1200

Calculation of department 1, direct labor hours:

Department1,directlaborhours=Department1, overhead appliedDepartment1, overhead rate=$90$6=15 DLH

Calculation of department 1, direct labor cost:

Department1,directlaborcost=Direct labor hours×Wage rate=15 DLH×$10=$150

Calculation of department 2, overhead applied:

Department 2, overhead applied=Actual activity×Overhead rate=25 mhrs×$8=$200

2. Job 214:

Calculation of price per unit:

Unit price=Total sales revenueNumber of units=$4,375350 units=12.50

Calculation of department 1, direct labor hours:

Department1,directlaborhours=Department1, direct labor costDepartment1, direct labor rate=$700$10=70 DLH

Calculation of department 1, overhead applied:

Department 1, overhead applied=Actual activity×Overhead rate=70 DLH×$6=$420

Calculation of material used:

Material used=(Total manufaturing cost−Direct labor cost−Department 1, labor cost−Department 2, labor cost−Department 1, overhead applied−Department 2, overhead applied)=$3,073−$700−$100−$420−$400=$1,453

Calculation of unit cost:

Unit cost=Total manufaturing costNumber of units=$3,073350 units=$8.78

3. Job 217:

Calculation of department 2, machine hours:

Department2,machinehours=Department2, overhead appliedOverhead rate=$160$8=20 mhrs

Calculation of manufacturing cost:

Total manufaturing cost=Number of units×Unit cost=400 units×$9.87=$3,948

Calculation of department 2, labor cost:

Department 2, labor cost=(Total manufaturing cost−Material used−Direct labor cost−Department 1, labor cost−Department 1, overhead applied−Department 2, overhead applied)=$3,948−$488−$2,000−$12,00−$160=$100

4. Job 225:

Calculation of number of units:

Number of units=Total sales revenueUnit price=$1,150$5=$230 units

Calculation of unit cost:

Unit cost=Total manufaturing costNumber of units=$575230 units=$2.50

Calculation of department 2, machine hours:

Department2,machinehours=Department2, overhead appliedOverhead rate=$0$8=0 mhrs

Want to see more full solutions like this?

Chapter 4 Solutions

Managerial Accounting

- The amount spent for capital expenditures will be reported in which section of the statement of cash flows? Cash Provided/used In Financing Activities Cash Provided/used In Investing Activities Cash Provided/used In Operating Activities Supplemental Informationarrow_forwardWhich of the following will appear as a negative amount on a statement of cash flows that was prepared using the indirect method? A Decrease In Inventory An Increase In Accounts Payable An Increase In Accounts Receivable Depreciation Expensearrow_forwardWhich of the following will appear as a positive amount on a statement of cash flows that was prepared using the indirect method? An Increase In Accounts Receivable An Increase In Inventory A Decrease In Accounts Payable Depreciation Expensearrow_forward

- What is usually presented first in the notes to the financial statements? Accumulated Other Comprehensive Income Commitments And Contingencies Significant Accounting Policiesarrow_forwardWhich is the annual report to the SEC that contains the financial statements of a publicly-traded corporation? Form 1040 Form 10-K Form 10-Q Schedule Carrow_forwardImportant disclosures regarding likely losses that could not be estimated are found where? General Ledger Accounts Income Statement Notes To The Financial Statementsarrow_forward

- On December 1, your company paid its insurance agent $2,400 for the annual insurance premium covering the twelve-month period beginning on December 1. The $2,400 payment was recorded on December 1 with a debit to the current asset Prepaid Insuranceand a credit to the current asset Cash. Your company prepares monthly financial statements at the end of each calendar month. The following questions pertain to the adjusting entry that should be written by the company. What date should be used to record the December adjusting entry?arrow_forwardA bank lent $100,000 to a customer on December 1 that required the customer topay an annual percentage rate (APR) of 12% on the amount of the loan. The loan is duein six months and no payment of interest or principal is to be made until the note is dueon May 31. The bank prepares monthly financial statements at the end of each calendarmonth. The following questions pertain to the adjusting entry that the bank will be making for its accounting records. Question: What date should be used to record the December adjusting entry?arrow_forwardTypically an adjusting entry will include which of the following? One Balance Sheet Account And One Income Statement Account Two Balance Sheet Accounts Two Income Statement Accountsarrow_forward

- Which type of adjusting entry is often reversed on the first day of the next accounting period? Accrual Deferral Depreciationarrow_forward. In the case of a bank's accrued interest revenues, which occurs first? Earning The Interest Revenues Receiving The Interest From The Borrowerarrow_forwardThe ending balance in the account Prepaid Insurance is expected to report which of the following? The Accrued Amount Of Insurance Expense The Original Amount Of The Insurance Premiums Paid The Expired Portion Of The Insurance Premiums Paid The Unexpired Portion Of The Insurance Premiums Paidarrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub