Comprehensive ABC implementation (Learning Objectives 2 & 3)

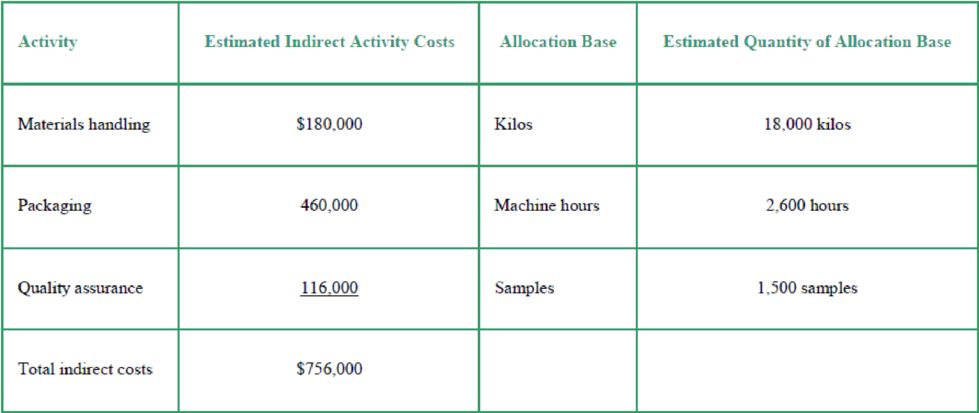

Percival Pharmaceuticals manufactures an over-the-counter allergy medication called Breathe. Percival is trying to win market share from Sudafed and Tylenol. The company has developed several different Breathe products tailored to specific markets. For example, the company sells large commercial containers of 1,000 capsules to health-care facilities and travel packs of 20 capsules to shops in airports, train stations, and hotels. Percival’s controller, Donna Swanson, has just returned from a conference on ABC. She asks Carol Yost, supervisor of the Breathe product line, to help her develop an ABC system. Swanson and Yost identify the following activities, related costs, and cost allocation bases:

The commercial-container Breathe product line had a total weight of 8,500 kilos, used 1,200 machine hours, and 240 required samples. The travel-pack line had a total weight of 6,000 kilos, used 400 machine hours, and required 340 samples. The company produced 2,500 commercial containers of Breathe and 80,000 travel packs.

Requirements

- 1. Compute the cost allocation rate for each activity.

- 2. Use the activity-based cost allocation rates to compute the indirect cost of each unit of the commercial containers and the travel packs. (Hint: Compute the total activity costs allocated to each product line and then compute the cost per unit.)

- 3. The company’s original single-allocation-based cost system allocated indirect costs to products at $350 per machine hour. Compute the total indirect costs allocated to the commercial containers and to the travel packs under the original system. Then, compute the indirect cost per unit for each product.

- 4. Compare the activity-based costs per unit to the costs from the simpler original system. How have the unit costs changed? Explain why the costs changed as they did.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Managerial Accounting, Student Value Edition (5th Edition)

- True option? General accountingarrow_forwardAide Industries is a division of a major corporation. Data concerning the most recent year appears below: Sales Net operating income $18,310,000 $920,000 Average operating assets $6,300,000 The division's margin-is closest to:arrow_forwardHow much will regal enterprises record as goodwillarrow_forward

- What is the other comprehensive income?arrow_forwardCool Comfort currently sells 360 Class A spas, 520 Class C spas, and 230 deluxe model spas each year. The firm is considering adding a mid-class spa and expects that, if it does, it can sell 375 of them. However, if the new spa is added, Class A sales are expected to decline to 255 units while Class C sales are expected to decline to 240. The sales of the deluxe model will not be affected. Class A spas sell for an average of $13,500 each. Class C spas are priced at $7,200 and the deluxe model sells for $19,000 each. The new mid-range spa will sell for $11,000. What is the value of erosion? Financial Accountingarrow_forwardGoodwill if any is recorded atarrow_forward

- Inventory:25000, Accounts payable:16000arrow_forwardMenak Industries purchases a machine at the beginning of the year at a cost of $40,000. The machine is depreciated using the straight-line method. The machine's useful life is estimated to be 10 years with a $6,000 salvage value. The book value of the machine at the end of year 3 is _.helparrow_forwardWhat is the cost of goods manufactured?arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning,

Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning,