Compare traditional and ABC cost allocations at a pharmacy (Learning Objective 2)

Gracen Pharmacy, part of a large chain of pharmacies, fills a variety of prescriptions for customers. The complexity of prescriptions filled by Gracen varies widely; pharmacists can spend between five minutes and six hours on a prescription order. Traditionally, the pharmacy has allocated its

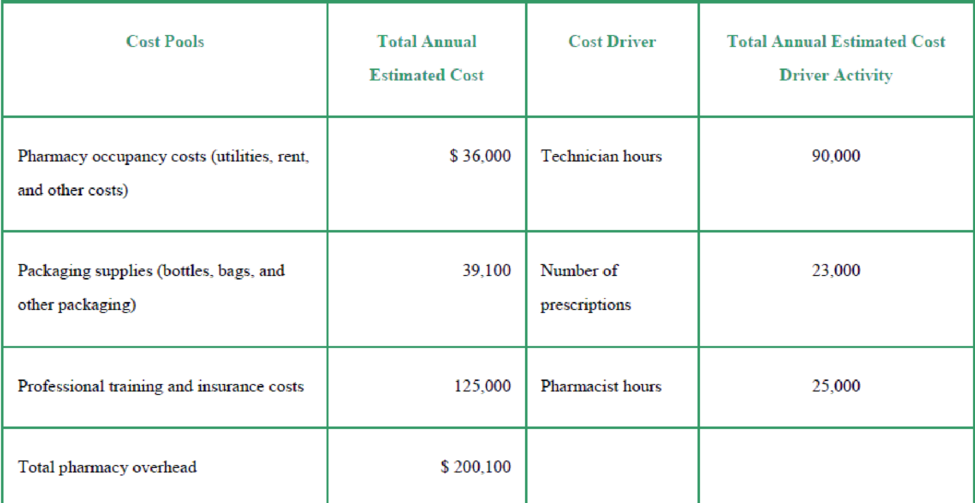

The pharmacy chain’s controller is exploring whether activity-based costing (ABC) may better allocate the pharmacy overhead costs to pharmacy orders. The controller has gathered the following information:

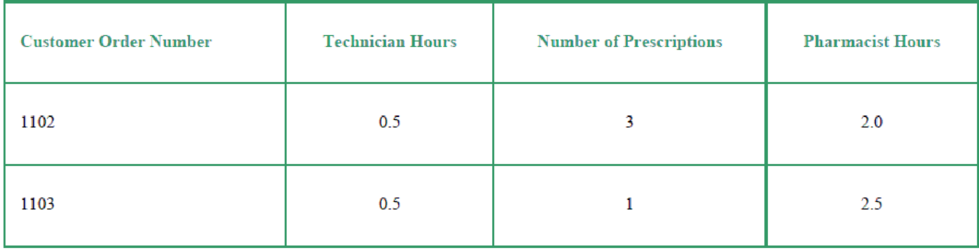

The clerk for Gracen Pharmacy has gathered the following information regarding two recent pharmacy orders:

Requirements

- 1. What is the traditional overhead rate based on the number of prescriptions?

- 2. How much pharmacy overhead would be allocated to customer order number 1102 if traditional overhead allocation based on the number of prescriptions is used?

- 1. How much pharmacy overhead would be allocated to customer order number 1103 if traditional overhead allocation based on the number of prescriptions is used?

- 2. What are the following cost pool allocation rates?

- a. Pharmacy occupancy costs

- b. Packing supplies

- c. Professional training and insurance costs

- 3. How much would be allocated to customer order number 1102 if activity-based costing (ABC) is used to allocate the pharmacy overhead costs?

- 4. How much would be allocated to customer order number 1103 if activity-based costing (ABC) is used to allocate the pharmacy overhead costs?

- 5. Which allocation method (traditional or activity-based costing) would produce a more accurate product cost? Explain your answer.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Managerial Accounting, Student Value Edition (5th Edition)

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College