Concept explainers

Preparing financial statements including a classified

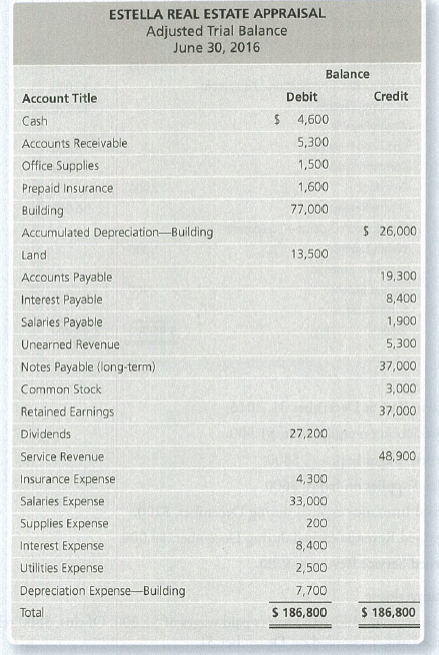

The adjusted trial balance of Estella Real Estate Appraisal at June 30, 2016, follows:

Requirements

1. Prepare the company’s income statement for the year ended June 30, 2016.

2. Prepare the company’s statement of

3. Prepare the company’s classified balance sheet in report form at June 30, 2016.

4. Journalize the closing entries.

5. Open the T-accounts using the balances from the adjusted trial balance, and post the dosing entries to the T-accounts.

6. Prepare the company’s post-closing trial balance at June 30, 2016.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Horngren's Financial & Managerial Accounting (5th Edition)

- E-trax, Inc. has provided the following financial information for the year: Finished Goods Inventory: Units produced Beginning balance, in units 640 2,800 2,900 540 Units sold Ending balance, in units Production costs: Variable manufacturing costs per unit $65 Total fixed manufacturing costs $56,000 What is the unit product cost for the year using absorption costing?arrow_forwardWhat is the amount of allocated manufacturing overhead cost for August? Accountingarrow_forwardNonearrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning