Horngren's Financial & Managerial Accounting (5th Edition)

5th Edition

ISBN: 9780133866292

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 4.25E

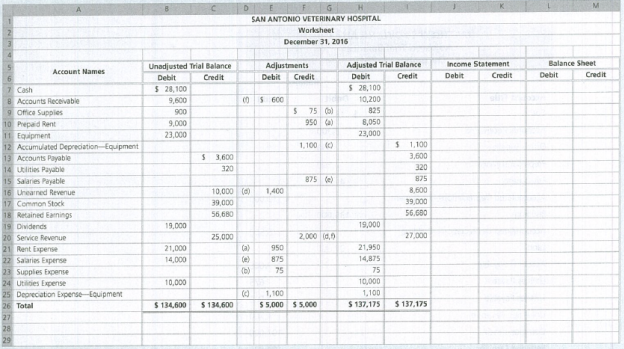

Preparing a worksheet, dosing entries, and a post-dosing

San Antonio Veterinary Hospital completed the following worksheet as of December 31, 2016.

Requirements

- 1. Complete the worksheet for San Antonio Veterinary Hospital.

- 2. Prepare the closing entries.

- 3. Prepare a post-dosing trial balance.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

pure water s total liabilities are.

??

hi expert please help me answer

Chapter 4 Solutions

Horngren's Financial & Managerial Accounting (5th Edition)

Ch. 4 - Assets are listed on the balance sheet in the...Ch. 4 - Which of the following accounts would be included...Ch. 4 - Which situation indicates a net loss within the...Ch. 4 - Which of the following accounts is not closed? a....Ch. 4 - What do closing entries accomplish? a. Zero out...Ch. 4 - Which of the following is not a closing entry?Ch. 4 - Which of the following accounts may appear on a...Ch. 4 - Which of the following steps of the accounting...Ch. 4 - Clean Water Softener Systems has Cash of 600,...Ch. 4 - Which of the following statements concerning...

Ch. 4 - What document are financial statements prepared...Ch. 4 - Prob. 2RQCh. 4 - What does the statement of retained earnings show?Ch. 4 - Prob. 4RQCh. 4 - Why are financial statements prepared in a...Ch. 4 - Prob. 6RQCh. 4 - Prob. 7RQCh. 4 - Prob. 8RQCh. 4 - Prob. 9RQCh. 4 - How could a worksheet help in preparing financial...Ch. 4 - If a business had a net loss for the year, where...Ch. 4 - Prob. 12RQCh. 4 - What are temporary accounts? Are temporary...Ch. 4 - What are permanent accounts? Are permanent...Ch. 4 - How is the Income Summary account used? Is it a...Ch. 4 - What are the steps in the closing process?Ch. 4 - If a business had a net loss for the year, what...Ch. 4 - What types of accounts are listed on the...Ch. 4 - List the steps of the accounting cycle.Ch. 4 - What is the current ratio, and how is it...Ch. 4 - What are reversing entries? Are they required by...Ch. 4 - Preparing an income statement Daylen Hair...Ch. 4 - Preparing a statement of retained earnings Refer...Ch. 4 - Preparing a balance sheet (unclassified, account...Ch. 4 - Preparing a balance sheet (classified, report...Ch. 4 - Classifying balance sheet accounts For each...Ch. 4 - Using the worksheet to prepare financial...Ch. 4 - Determining net income using a worksheet A partial...Ch. 4 - Determining net loss using a worksheet A partial...Ch. 4 - Prob. 4.9SECh. 4 - Posting dosing entries directly to T-accounts The...Ch. 4 - Identifying accounts included on a post-dosing...Ch. 4 - Identifying steps in the accounting cycle Review...Ch. 4 - Calculating the current ratio Heart of Tennessee...Ch. 4 - Journalizing reversing entries Lake View...Ch. 4 - Preparing the financial statements The adjusted...Ch. 4 - Prob. 4.16ECh. 4 - Preparing a classified balance sheet and...Ch. 4 - Preparing a worksheet The unadjusted trial balance...Ch. 4 - Preparing financial statements from the completed...Ch. 4 - Preparing dosing entries from an adjusted trial...Ch. 4 - Preparing closing entries from T-accounts Selected...Ch. 4 - Determining the effects of dosing entries on the...Ch. 4 - Preparing a worksheet and dosing entries Cadence...Ch. 4 - Preparing closing entries from an adjusted trial...Ch. 4 - Preparing a worksheet, dosing entries, and a...Ch. 4 - Journalizing reversing entries Krisp Architects...Ch. 4 - Journalizing reversing entries Ocean View Services...Ch. 4 - Preparing financial statements including a...Ch. 4 - Prob. 4.29APCh. 4 - Preparing a worksheet, financial statements, and...Ch. 4 - Completing the accounting cycle from adjusting...Ch. 4 - Completing the accounting cycle from journal...Ch. 4 - Preparing adjusting entries and reversing entries...Ch. 4 - Preparing financial statements including a...Ch. 4 - Prob. 4.35BPCh. 4 - Preparing a worksheet, financial statements, and...Ch. 4 - Completing the accounting cycle from adjusting...Ch. 4 - Completing the accounting cycle from journal...Ch. 4 - Preparing adjusting entries and reversing entries...Ch. 4 - Completing the accounting cycle from adjusted...Ch. 4 - Completing the accounting cycle from adjusted...Ch. 4 - Comprehensive Problem 1 for Chapters 1-4 Miller...Ch. 4 - Comprehensive Problem 2 for Chapters 1-4 This...Ch. 4 - Prob. 4.1CTEICh. 4 - Prob. 4.1CTFCCh. 4 - Prob. 4.1CTFSCCh. 4 - Kathy Wintz formed a lawn service business as a...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY