Compare traditional and ABC cost allocations at a pharmacy (Learning Objective 2)

Gracen Pharmacy, part of a large chain of pharmacies, fills a variety of prescriptions for customers. The complexity of prescriptions filled by Gracen varies widely; pharmacists can spend between five minutes and six hours on a prescription order. Traditionally, the pharmacy has allocated its

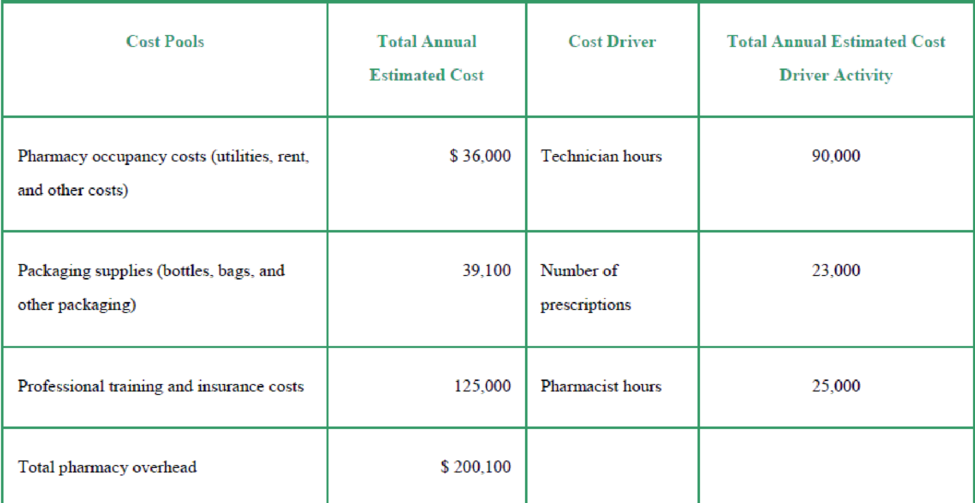

The pharmacy chain’s controller is exploring whether activity-based costing (ABC) may better allocate the pharmacy overhead costs to pharmacy orders. The controller has gathered the following information:

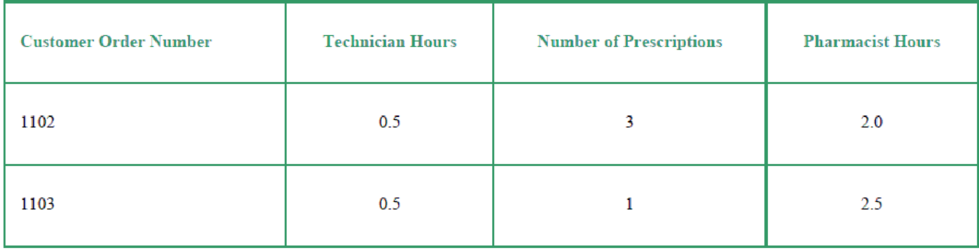

The clerk for Gracen Pharmacy has gathered the following information regarding two recent pharmacy orders:

Requirements

- 1. What is the traditional overhead rate based on the number of prescriptions?

- 2. How much pharmacy overhead would be allocated to customer order number 1102 if traditional overhead allocation based on the number of prescriptions is used?

- 1. How much pharmacy overhead would be allocated to customer order number 1103 if traditional overhead allocation based on the number of prescriptions is used?

- 2. What are the following cost pool allocation rates?

- a. Pharmacy occupancy costs

- b. Packing supplies

- c. Professional training and insurance costs

- 3. How much would be allocated to customer order number 1102 if activity-based costing (ABC) is used to allocate the pharmacy overhead costs?

- 4. How much would be allocated to customer order number 1103 if activity-based costing (ABC) is used to allocate the pharmacy overhead costs?

- 5. Which allocation method (traditional or activity-based costing) would produce a more accurate product cost? Explain your answer.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Managerial Accounting (5th Edition)

- Hii expert please given correct answer financial accountingarrow_forwardThe following information concerns production in the Baking Department for August. All direct materials are placed in process at the beginning of production. Date Item Debit Credit BalanceDebit BalanceCredit August 1 Bal., 6,300 units, 4/5 completed 16,884 31 Direct materials, 113,400 units 226,800 243,684 31 Direct labor 64,390 308,074 31 Factory overhead 36,212 344,286 31 Goods finished, 114,900 units 332,958 11,328 31 Bal., ? units, 2/5 completed 11,328 a. Based on the above data, determine each cost listed below. Round "cost per equivalent unit" answers to the nearest cent. Line Item Description Amount 1. Direct materials cost per equivalent unit $fill in the blank 1 2. Conversion cost per equivalent unit $fill in the blank 2 3. Cost of the beginning work in process completed during August $fill in the blank 3 4. Cost of units started and completed during August $fill in the blank 4 5. Cost of the ending work in…arrow_forwardWaiting for your solution general accounting questionarrow_forward

- Financial accounting questionarrow_forwardI want to this question answer general accounting questionarrow_forwardHave you ever noted facework or saving face techniques being used in US-based companies (ones you have worked for or encountered in everyday life)? Explain and offer examples in your initial posting.arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning