Using ABC to bill clients at a service firm (Learning Objective 2)

Kushner & Company is an architectural firm specializing in home remodeling for private clients and new office buildings for corporate clients.

Kushner charges customers at a billing rate equal to 130% of the client’s total

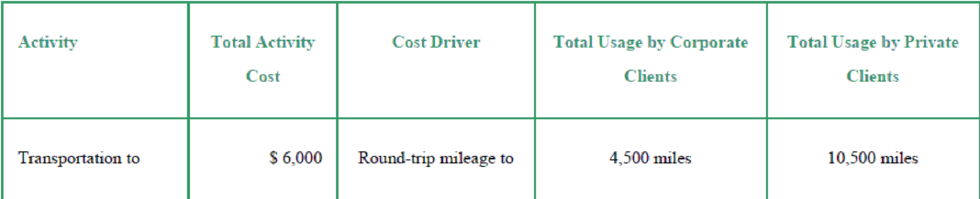

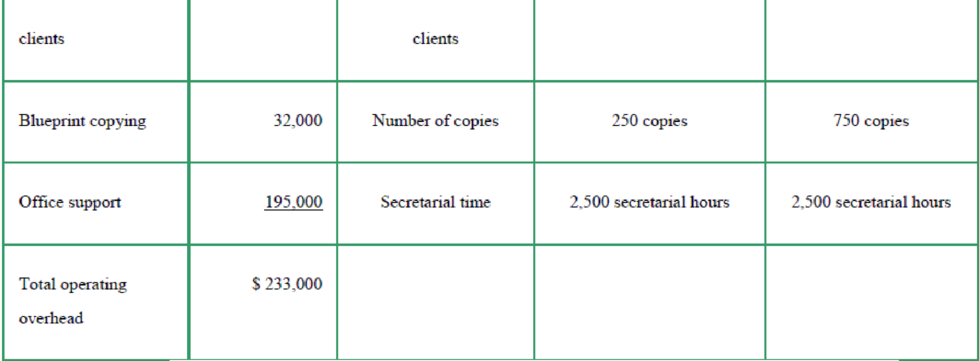

All operating costs other than professional salaries (travel reimbursements, copy costs, secretarial salaries, office lease, and so forth) can be assigned to the three activities. Total activity costs, cost drivers, and total usage of those cost drivers are estimated as follows:

Yimeng Li hired Kushner to design her kitchen remodeling. A total of 25 professional hours were incurred on this job. In addition, Li’s remodeling job required one of the professionals to travel back and forth to her house for a total of 125 miles. The blueprints had to be copied four times because Li changed the plans several times. In addition, 15 hours of secretarial time were used lining up the subcontractors for the job.

Yimeng Li hired Kushner to design her kitchen remodeling. A total of 25 professional hours were incurred on this job. In addition, Li’s remodeling job required one of the professionals to travel back and forth to her house for a total of 125 miles. The blueprints had to be copied four times because Li changed the plans several times. In addition, 15 hours of secretarial time were used lining up the subcontractors for the job.

Requirements

- 1. Calculate the current indirect cost allocation rate per professional hour.

- 2. Calculate the total amount that would be billed to Li given the current costing structure.

- 3. Calculate the activity cost allocation rates that could be used to allocate operating overhead costs to client jobs.

- 4. Calculate the amount that would be billed to Li using ABC costing.

- 5. Which type of billing system is more fair to clients? Explain.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Managerial Accounting (5th Edition)

- Reffering to fair value of an asset, division, or organization, What exactly is fair value and how is it assessed?arrow_forwardThe following transactions involving intangible assets of Oriole Corporation occurred on or near December 31, 2025. 1.) Oriole paid Grand Company $520,000 for the exclusive right to market a particular product, using the Grand name and logo in promotional material. The franchise runs for as long as Oriole is in business. 2.) Oriole spent $654,000 developing a new manufacturing process. It has applied for a patent, and it believes that its application will be successful. 3.) In January 2026, Oriole's application for a patent (#2 above) was granted. Legal and registration costs incurred were $247,800. The patent runs for 20 years. The manufacturing process will be useful to Oriole for 10 years. 4.) Oriole incurred $168,000 in successfully defending one of its patents in an infringement suit. The patent expires during December 2029. Oriole incurred 5.) $446,400 in an unsuccessful patent defense. As a result of the adverse verdict, the patent, with a remaining unamortized cost of…arrow_forwardNonearrow_forward

- I need help solving this general accounting question with the proper methodology.arrow_forwardI need help with this general accounting question using the proper accounting approach.arrow_forwardPlease provide the correct answer to this general accounting problem using valid calculations.arrow_forward

- Can you explain the correct methodology to solve this general accounting problem?arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forwardCan you solve this general accounting problem using appropriate accounting principles?arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning