Apply activity cost allocation rates (Learning Objective 2)

SUSTAINABILITY

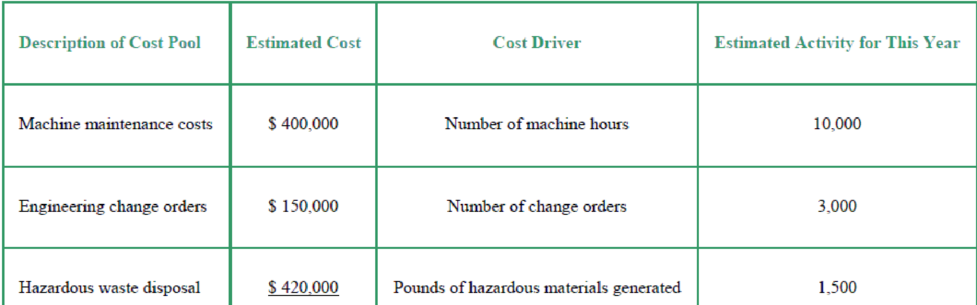

Holiday Industries manufactures a variety of custom products. The company has traditionally used a plantwide manufacturing

Up to this point, hazardous waste disposal fees have been absorbed into the plantwide manufacturing overhead rate and allocated to all products as part of the manufacturing overhead process. Recently, the company has been experiencing significantly increased waste-disposal fees for hazardous waste generated by certain products, and as a result, profit margins on all products have been negatively impacted. Company management wants to implement an activity-based costing system so that managers know the cost of each product, including its hazardous waste disposal costs.

Expected usage and

During the year, Job 356 is started and completed. Usage for this job follows:

| 290 pounds of direct materials at $35 per pound |

| 20 direct labor hours used at $20 per labor hour |

| 60 machine hours used |

| 9 change orders |

| 60 pounds of hazardous waste generated |

Requirements

- 1. Calculate the cost of Job 356 using the traditional plantwide manufacturing overhead rate based on machine hours.

- 2. Calculate the cost of Job 356 using activity-based costing.

- 3. If you were a manager, which cost estimate would provide you more useful information? How might you use this information?

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Managerial Accounting (5th Edition)

- I am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardHow can I solve this financial accounting problem using the appropriate financial process?arrow_forwardCan you demonstrate the accurate steps for solving this financial accounting problem with valid procedures?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning