Income Statement for Year Ended December 31, 2018 (Millions of Dollars)

| Net sales | $795.0 |

| Cost of goods sold | 660.0 |

| Gross profit | $135.0 |

| Selling expenses | 73.5 |

| EBITDA | $ 61.5 |

| 12.0 | |

| Earnings before interest and taxes (EBIT) | $ 49.5 |

| Interest expenses | 4.5 |

| Earnings before taxes (EBT) | $ 45.0 |

| Taxes (40%) | 18.0 |

| Net income | $ 27.0 |

- a. Calculate the ratios you think would be useful in this analysis.

- b. Construct a DuPont equation, and compare the company’s ratios to the industry average ratios.

- c. Do the balance-sheet accounts or the income statement figures seem to be primarily responsible for the low profits?

- d. Which specific accounts seem to be most out of line relative to other firms in the industry?

- e. If the firm had a pronounced seasonal sales pattern or if it grew rapidly during the year, how might that affect the validity of your ratio analysis? How might you correct for such potential problems?

a.

To determine: The ratios that would be useful in this analysis.

Current Ratio:

Current ratio is a part of liquidity ratio, which reflects the capability of the company to payback its short-term debts. It is calculated based on the current assets and current liabilities that a company possess in an accounting period.

Ratio Analysis:

Ratio is used to compare two arithmetical figures. In case of the ratio analysis of the company, the financial ratios are calculated. The financial ratios examine the performance of the company and is used in comparing with other same business. It indicates relationship of two or more parts of financial statements.

Explanation of Solution

Given information:

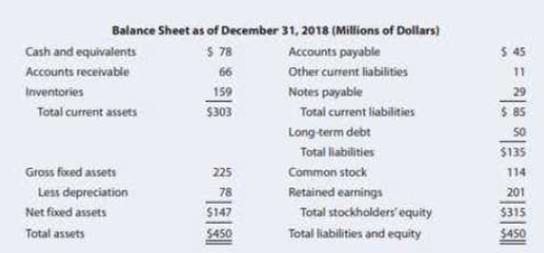

Current assets are $303.

Current liabilities are $85.

The formula to calculate current ratio is as follows:

Substitute $303 for current assets and $85 for current liabilities.

Thus, current ratio is 3.56 times.

Fixed Assets Turnover Ratio:

It reflects the efficiency of the company to utilize fixed asset to increase sale.

Given information:

Sales are $795.

Net fixed assets are $147.

The formula to calculate fixed assets turnover is as follows:

Substitute $795 for total sales and $`147 for fixed assets in above formula.

Thus, fixed assets turnover is 5.40 times.

Debt-to-Capital Ratio:

It is percentage of total capital that is financed by the borrowed fund. Borrowed fund includes short and long-term debts. Operating debt like account payable, accrual are not considered.

Given information:

Total debt is $79 (working note).

Equity is $315 (working note).

The formula of Debt-to-capital ratio is as follows:

Substitute $79 for total debt and $315 for equity in above formula.

Thus, debt-to-capital ratio is 20.05%.

Working notes:

Compute total debt.

Given information:

Long-term debt is $50.

Notes payable is $29.

Calculation of total debt of the company is as follows:

Thus, total debt is $79.

Compute the total value of the common equity is as follows:

Given information:

Common stock is $114.

Retained earnings are $201.

Formula to calculate common equity is as follows:

Substitute $114 for common stock and $201 for retained earnings.

Thus, common equity is $315.

Total Assets Turnover Ratio:

It indicates how effectively the asset of a company is utilized. Total asset is the sum of current assets and fixed assets.

Given,

Total sales is $795

Total assets are $450.

Formula to calculate total assets turnover is,

Substitute $795 for total sales and $450 for total assets.

Thus, total assets turnover is 1.76 times.

Times-Interest Earned Ratio:

It is the type of solvency ratio that indicates the capability of business to repay interest and provide debt related services.

Given,

Earnings before interest and tax (EBIT) are $49.5.

Interest expense is $4.5.

Formula to calculate times interest earned is as follows:

Substitute $49.5 for EBIT and $4.5 for interest expense.

Thus, the times interest earned ratio is 11%.

Profit Margin

Profit margin is the ratio net income of the company and total sales. It is one of the profitability ratios.

Given information:

Net income is $27.

Sales are $795.

Formula to calculate profit ratio is as follows:

Substitute $27 for net income and $795 for sales in above formula.

Thus, profit ratio is 3.40%.

Return on Assets:

It is a profitability ratio. This ratio shows profit earning capability on per dollar of assets. It shows the percentage of net income on total assets. Higher the return on assets better the profitability. Total assets include fixed as well as current assets.

Given information

Net income is$27.

Total asset is $450.

Formula to calculate return on assets is,

Substitute $27 for net income and $450 for total value of assets.

Thus, return on assets is 6%.

Inventory Turnover Ratio:

Inventory turnover ratio reflects the number of times average inventory is converted into sales during the period under consideration. It is used to measures the efficiency of business operations.

Given information:

Total sales are $795.

Total inventory is $159.

Formula to calculate inventory turnover ratio is as follows:

Substitute $795 for total sales and $159 for total inventory.

Thus, inventory turnover ratio is 5 times.

Return on Equity:

Return on equity is the return earned from the capital invested in equity. It is the ratio of net income and shareholders’ equity. This ratio measures the performance of the company and tells how well the company is performing. This ratio is used to compare own firm with competitors.

Given information:

Net income is $27.

Common equity is $315 [Equation (2)].

Formula to calculate return on equity is as follows:

Substitute $27 for net income and $315 for common equity.

Thus, return on equity is 8.57%.

Days Sales Outstanding

Days sales outstanding is used to measure days that a business usually requires to collects its receivable in average. It indicates account receivable of the firm and firm’s efficiency in collecting the account receivable.

Given information

Receivables are $66.

Annual sale is $795.

Formula to calculate day’s sales outstanding is as follows:

Substitute $66 for account receivables and $795 for annual sales.

Thus, day’s sales outstanding is 30.30 days.

Return on Invested Capital:

It represent the amount of return earned by all investors and can be calculated by dividing total earnings available for investors to total invested capital.

Given information:

Earnings before interest and tax (EBIT) are $49.5.

Tax rate is 40%.

Total debt is $79 [equation (1)]

Total equity is $315[equation (2)]

Substitute $49.5 for EBIT, $79 for debt, 40% for the tax rate and $315for equity.

Thus, return on invested capital is 7.53%.

b.

To determine: DuPont equation and comparison of company’s ratio with industry average ratio.

Du Pont Equation:

Among all ratios, return on equity is very common. It shows the value of the firm. Improvement in the ROE is considered as valued addition to the firm. ROE can be linked with other ratios. Analysis of such ratios will indicate proper reason for change in ROE. The combination is known as Du Pont equation, which is shown below.

Explanation of Solution

Given information:

Return on equity (ROE) is 8.57%.

Net income of the company is$27.

Sales of the company are $795.

Total assets are $450.

Total common equity is $315.

The Du point relation of the company’s ratios is shown below,

Substitute $27 for net income, $795 for sales, $450 for total assets and $315 for common equity

Thus DuPont equation is

Comparison:

| Profit Margin | Total Assets Turnover | Equity Multiplier | ROE | |

| Firm | 3.40% | 1.76 times | 1.429 times | 8.57% |

| Industry | 3% | 3 times | 1.249times | 12.86% |

Table (1)

- After analyzing the Du sPont, equation total asset turnover of the firm is lower than industry’s average. Probably firm is carrying more assets than required to carry to support its sales. The firm should increase it sales.

- The return on equity is lower than industry average but the profit margin is higher than industry’s average.

Working notes:

Calculate Industry’s equity multiplier.

Given information:

Industry’s ROE is 12.86%.

Total assets turnover is 3 times.

Profit margin is 3%.

The formula to calculate ROE is as follows:

Substitute 12.86% for ROE, 3% for the profit margin and 3 times for total assets turnover.

Thus, equity multiplier is 1.429 times.

Therefore, DuPont equation has been constructed and the company’s ratios are compared with industry average ratios.

c.

To identify: The balance sheet accounts or income statement figures are primarily responsible for the low profits or not.

Answer to Problem 24P

- Net income is calculated from the income statement so it can be said the income statement figures are accountable for low profits.

- If the firm has not enough cash and other resources and has, too much debt it will results in low sales and funds to get necessary resources. Thus, the items of balance sheet are also responsible for the low profits.

Explanation of Solution

- The figures of income statement like sales, operating expenses affect the profit. If the sale is high, the net income is also high and sales decreases it will decrease profit of the firm. Similarly if there is an increase or decrease in the operating expenses the profit will be affected directly. Therefore, it can be said the income statement items are responsible for low profit.

- The items of balance sheet accounts like cash, inventory debt and capital affect the profit of the firm. If the level of inventory is too high or the debt is too high it can results in low profit. Thus, it can be said the balance sheet items are somehow responsible for lower profit.

Therefore, the balance sheet accounts and income statement figures are responsible for low profit.

d.

To identify: The specific accounts seems to be most out of line comparative to other companies in the same industry.

Answer to Problem 24P

The specific account, which seems to be most out of line relative to the other firms in the same industry, is given below:

- Fixed assets turnover

- Inventory turnover ratio

- Total assets turnover

- Return on assets

- Return on equity

- Return on invested capital(ROIC)

Explanation of Solution

- The fixed asset turnover of the firm is 5.40 times while the industry average is 6 times. It can be said that the ratio is low in comparison to that of the other firm in industry.

- Inventory turnover of 5 times while industry has 10 times. The firm ratio seems out of line to the other firms in the same industry.

- Total assets turnover of firm is 1.76 times is too low in comparison to industry average that is 3 times. It seems out of the line to other firms in the same industry.

- Return on asset of firm is 6% and industry average is 9%, which indicates the firm has lower ratio than other firm in same industry.

- Return on common equity of the firm is 8.57% and average of the industry is 12.86%. The firm got lower ratio than the other firms did which makes firm out of line to the other firm in the same industry.

- Return on invested capital of the firm is 7.53% while the industry average is 11.50%. It shows the firm ratio somehow out of line relative to the other firm.

Therefore, Fixed Assets turnover, inventory turnover ratio, total assets turnover, return on asset, return on equity, and return on invested capital (ROIC)seems to be most out of line comparative to other firms in the same industry.

(e)

To identify: The validity of the ratio analysis if the firm had marked seasonal sales pattern or if the sales grew rapidly during the year and the way of correcting potential problems.

Answer to Problem 24P

- If the sales of the company grew rapidly many ratios such related to cash, receivables, inventories and current liabilities might be distorted. Similarly ratios which are based on sales, profit, and common equity could be influenced.

- This type of problem can be corrected by using average figure instead of ending figures.

Explanation of Solution

The increase in sale affects the ratios which are calculated being based on the sales. The increases in sales increases the cash balance, receivables and it also affect the net income of the company. The ratio will get influenced from such increase.

Therefore, if the firm had pronounced seasonal sales and if the sales grew quickly during the year the ratios will get distorted and such problem can be solved by taking average figure rather than end period figures.

Want to see more full solutions like this?

Chapter 4 Solutions

Fundamentals of Financial Management (MindTap Course List)

- Don't used hand raiting and don't used Ai solutionarrow_forwardDon't used Ai solution and don't used hand raitingarrow_forward(d) Estimate the value of a share of Cisco common stock using the discounted cash flow (DCF) model as of July 27, 2019 using the following assumptions Assumptions Discount rate (WACC) Common shares outstanding 7.60% 5,029.00 million Net nonoperating obligations (NNO) $(8,747) million NNO is negative, which means that Cisco has net nonoperating investments CSCO ($ millions) DCF Model Reported 2019 Forecast Horizon 2020 Est. 2021 Est. 2022 Est. 2023 Est. Terminal Period Increase in NOA FCFF (NOPAT - Increase in NOA) $ 1241 1303 1368 10673 11207 11767 1437 $ 12354 302 ✓ Present value of horizon FCFF 9918 9679 9445 ✔ 0 × Cum. present value of horizon FCFF $ 0 × Present value of terminal FCFF 0 ☑ Total firm value 0 ☑ NNO -8747 ✓ Firm equity value $ 0 ☑ Shares outstanding (millions) 5029 Stock price per share $ 40.05arrow_forward

- Q1: Blossom is 30 years old. She plans on retiring in 25 years, at the age of 55. She believes she will live until she is 105. In order to live comfortably, she needs a substantial retirement income. She wants to receive a weekly income of $5,000 during retirement. The payments will be made at the beginning of each week during her retirement. Also, Blossom has pledged to make an annual donation to her favorite charity during her retirement. The payments will be made at the end of each year. There will be a total of 50 annual payments to the charity. The first annual payment will be for $20,000. Blossom wants the annual payments to increase by 3% per year. The payments will end when she dies. In addition, she would like to establish a scholarship at Toronto Metropolitan University. The first payment would be $80,000 and would be made 3 years after she retires. Thereafter, the scholarship payments will be made every year. She wants the payments to continue after her death,…arrow_forwardCould you please help explain what is the research assumptions, research limitations, research delimitations and their intent? How the research assumptions, research limitations can shape the study design and scope? How the research delimitations could help focus the study and ensure its feasibility? What are the relationship between biblical principles and research concepts such as reliability and validity?arrow_forwardWhat is the concept of the working poor ? Introduction form. Explain.arrow_forward

- What is the most misunderstanding of the working poor? Explain.arrow_forwardProblem Three (15 marks) You are an analyst in charge of valuing common stocks. You have been asked to value two stocks. The first stock NEWER Inc. just paid a dividend of $6.00. The dividend is expected to increase by 60%, 45%, 30% and 15% per year, respectively, in the next four years. Thereafter, the dividend will increase by 4% per year in perpetuity. Calculate NEWER’s expected dividend for t = 1, 2, 3, 4 and 5. The required rate of return for NEWER stock is 14% compounded annually. What is NEWER’s stock price? The second stock is OLDER Inc. OLDER Inc. will pay its first dividend of $10.00 three (3) years from today. The dividend will increase by 30% per year for the following four (4) years after its first dividend payment. Thereafter, the dividend will increase by 3% per year in perpetuity. Calculate OLDER’s expected dividend for t = 1, 2, 3, 4, 5, 6, 7 and 8. The required rate of return for OLDER stock is 16% compounded annually. What is OLDER’s stock price? Now assume that…arrow_forwardProblem Three (15 marks) You are an analyst in charge of valuing common stocks. You have been asked to value two stocks. The first stock NEWER Inc. just paid a dividend of $6.00. The dividend is expected to increase by 60%, 45%, 30% and 15% per year, respectively, in the next four years. Thereafter, the dividend will increase by 4% per year in perpetuity. Calculate NEWER’s expected dividend for t = 1, 2, 3, 4 and 5. The required rate of return for NEWER stock is 14% compounded annually. What is NEWER’s stock price? The second stock is OLDER Inc. OLDER Inc. will pay its first dividend of $10.00 three (3) years from today. The dividend will increase by 30% per year for the following four (4) years after its first dividend payment. Thereafter, the dividend will increase by 3% per year in perpetuity. Calculate OLDER’s expected dividend for t = 1, 2, 3, 4, 5, 6, 7 and 8. The required rate of return for OLDER stock is 16% compounded annually. What is OLDER’s stock price? Now assume that…arrow_forward

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning