Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN: 9781285190907

Author: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 4, Problem 16PC

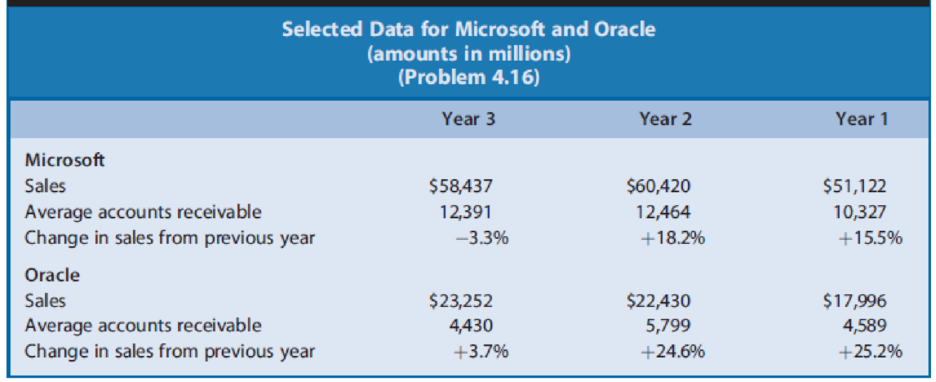

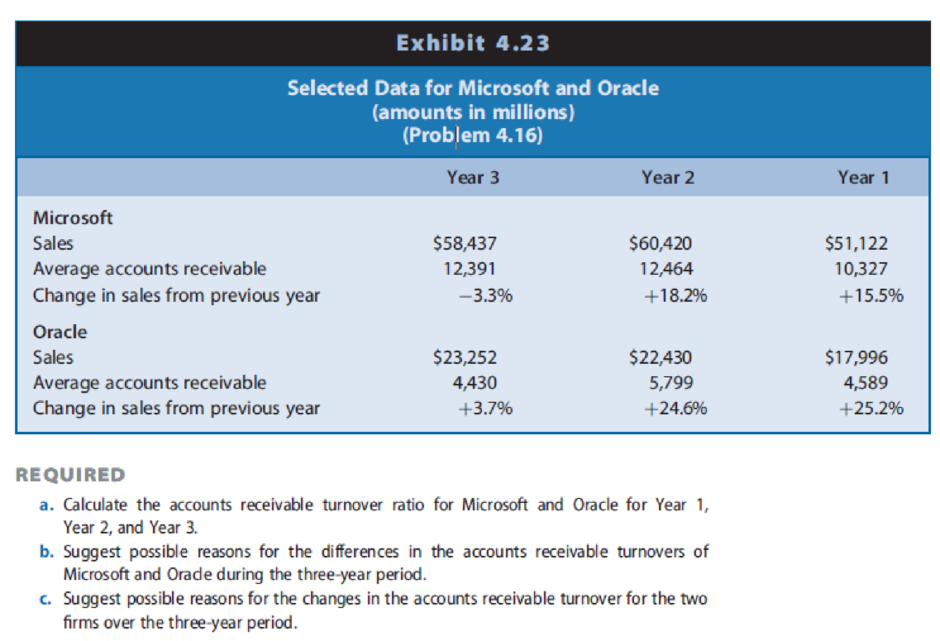

Microsoft Corporation (Microsoft) and Oracle Corporation (Oracle) engage in the design, manufacture, and sale of computer software. Microsoft sells and licenses a wide range of systems and application software to businesses, computer hardware manufacturers, and consumer retailers. Oracle sells software for information management almost exclusively to businesses. Exhibit 4.23 presents selected data for the two firms for three recent years.

Exhibit 4.23

REQUIRED

- a. Calculate the accounts receivable turnover ratio for Microsoft and Oracle for Year 1, Year 2, and Year 3.

- b. Suggest possible reasons for the differences in the accounts receivable turnovers of Microsoft and Oracle during the three-year period.

- c. Suggest possible reasons for the changes in the accounts receivable turnover for the two firms over the three-year period.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Don't used Ai solution and don't used hand raiting

Q1:

Blossom is 30 years old. She plans on retiring in 25 years, at the age of 55. She believes she will live until she is 105.

In order to live comfortably, she needs a substantial retirement income. She wants to receive a weekly income of $5,000 during retirement. The payments will be made at the beginning of each week during her retirement.

Also, Blossom has pledged to make an annual donation to her favorite charity during her retirement. The payments will be made at the end of each year. There will be a total of 50 annual payments to the charity. The first annual payment will be for $20,000. Blossom wants the annual payments to increase by 3% per year. The payments will end when she dies.

In addition, she would like to establish a scholarship at Toronto Metropolitan University. The first payment would be $80,000 and would be made 3 years after she retires. Thereafter, the scholarship payments will be made every year. She wants the payments to continue after her death,…

Could you please help explain what is the research assumptions, research limitations, research delimitations and their intent?

How the research assumptions, research limitations can shape the study design and scope?

How the research delimitations could help focus the study and ensure its feasibility?

What are the relationship between biblical principles and research concepts such as reliability and validity?

Chapter 4 Solutions

Financial Reporting, Financial Statement Analysis and Valuation

Ch. 4 - Common-Size Analysis. Common-size analysis is a...Ch. 4 - Earnings per Share. Firm A reports an increase in...Ch. 4 - Prob. 3QECh. 4 - Profit Margin for ROA versus ROCE. Describe the...Ch. 4 - Concept and Measurement of Financial Leverage....Ch. 4 - Advantages of Financial Leverage. A company...Ch. 4 - Prob. 7QECh. 4 - Nucor, a steel manufacturer, reported net income...Ch. 4 - Phillips-Van Heusen, an apparel manufacturer,...Ch. 4 - TJX, Inc., an apparel retailer, reported net...

Ch. 4 - Boston Scientific, a medical device manufacturer,...Ch. 4 - Valero Energy, a petroleum company, reported net...Ch. 4 - Exhibit 4.22 presents selected operating data for...Ch. 4 - Microsoft Corporation (Microsoft) and Oracle...Ch. 4 - Prob. 17PCCh. 4 - Prob. 18PCCh. 4 - Texas Instruments (TI) designs and manufactures...Ch. 4 - JCPenney operates a chain of retail department...Ch. 4 - Prob. 21PCCh. 4 - Selected data for General Mills for 2007, 2008,...Ch. 4 - Prob. 23PCCh. 4 - Hasbro is a leading firm in the toy, game, and...Ch. 4 - Fitch sells casual apparel and personal care...Ch. 4 - Prob. 26PCCh. 4 - Starwood Hotels (Starwood) owns and operates many...Ch. 4 - Select data for Avis and Hertz for 2012 follow....Ch. 4 - Integrative Case 1.1 introduced the industry...Ch. 4 - Prob. 1ABICCh. 4 - Prob. 1ACICCh. 4 - Prob. 1BAICCh. 4 - Prob. 1BBICCh. 4 - Walmart and Carrefour follow similar strategies....Ch. 4 - Walmart and Carrefour follow similar strategies....

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- What is the concept of the working poor ? Introduction form. Explain.arrow_forwardWhat is the most misunderstanding of the working poor? Explain.arrow_forwardProblem Three (15 marks) You are an analyst in charge of valuing common stocks. You have been asked to value two stocks. The first stock NEWER Inc. just paid a dividend of $6.00. The dividend is expected to increase by 60%, 45%, 30% and 15% per year, respectively, in the next four years. Thereafter, the dividend will increase by 4% per year in perpetuity. Calculate NEWER’s expected dividend for t = 1, 2, 3, 4 and 5. The required rate of return for NEWER stock is 14% compounded annually. What is NEWER’s stock price? The second stock is OLDER Inc. OLDER Inc. will pay its first dividend of $10.00 three (3) years from today. The dividend will increase by 30% per year for the following four (4) years after its first dividend payment. Thereafter, the dividend will increase by 3% per year in perpetuity. Calculate OLDER’s expected dividend for t = 1, 2, 3, 4, 5, 6, 7 and 8. The required rate of return for OLDER stock is 16% compounded annually. What is OLDER’s stock price? Now assume that…arrow_forward

- Problem Three (15 marks) You are an analyst in charge of valuing common stocks. You have been asked to value two stocks. The first stock NEWER Inc. just paid a dividend of $6.00. The dividend is expected to increase by 60%, 45%, 30% and 15% per year, respectively, in the next four years. Thereafter, the dividend will increase by 4% per year in perpetuity. Calculate NEWER’s expected dividend for t = 1, 2, 3, 4 and 5. The required rate of return for NEWER stock is 14% compounded annually. What is NEWER’s stock price? The second stock is OLDER Inc. OLDER Inc. will pay its first dividend of $10.00 three (3) years from today. The dividend will increase by 30% per year for the following four (4) years after its first dividend payment. Thereafter, the dividend will increase by 3% per year in perpetuity. Calculate OLDER’s expected dividend for t = 1, 2, 3, 4, 5, 6, 7 and 8. The required rate of return for OLDER stock is 16% compounded annually. What is OLDER’s stock price? Now assume that…arrow_forwardYour father is 50 years old and will retire in 10 years. He expects to live for 25 years after he retires, until he is 85. He wants a fixed retirement income that has the same purchasing power at the time he retires as $45,000 has today. (The real value of his retirement income will decline annually after he retires.) His retirement income will begin the day he retires, 10 years from today, at which time he will receive 24 additional annual payments. Annual inflation is expected to be 4%. He currently has $240,000 saved, and he expects to earn 8% annually on his savings. Required annuity payments Retirement income today $45,000 Years to retirement 10 Years of retirement 25 Inflation rate 4.00% Savings $240,000 Rate of return 8.00% Calculate value of…arrow_forwardProblem Three (15 marks) You are an analyst in charge of valuing common stocks. You have been asked to value two stocks. The first stock NEWER Inc. just paid a dividend of $6.00. The dividend is expected to increase by 60%, 45%, 30% and 15% per year, respectively, in the next four years. Thereafter, the dividend will increase by 4% per year in perpetuity. Calculate NEWER’s expected dividend for t = 1, 2, 3, 4 and 5. The required rate of return for NEWER stock is 14% compounded annually. What is NEWER’s stock price? The second stock is OLDER Inc. OLDER Inc. will pay its first dividend of $10.00 three (3) years from today. The dividend will increase by 30% per year for the following four (4) years after its first dividend payment. Thereafter, the dividend will increase by 3% per year in perpetuity. Calculate OLDER’s expected dividend for t = 1, 2, 3, 4, 5, 6, 7 and 8. The required rate of return for OLDER stock is 16% compounded annually. What is OLDER’s stock price? Now assume that…arrow_forward

- Problem Three (15 marks) You are an analyst in charge of valuing common stocks. You have been asked to value two stocks. The first stock NEWER Inc. just paid a dividend of $6.00. The dividend is expected to increase by 60%, 45%, 30% and 15% per year, respectively, in the next four years. Thereafter, the dividend will increase by 4% per year in perpetuity. Calculate NEWER’s expected dividend for t = 1, 2, 3, 4 and 5. The required rate of return for NEWER stock is 14% compounded annually. What is NEWER’s stock price? The second stock is OLDER Inc. OLDER Inc. will pay its first dividend of $10.00 three (3) years from today. The dividend will increase by 30% per year for the following four (4) years after its first dividend payment. Thereafter, the dividend will increase by 3% per year in perpetuity. Calculate OLDER’s expected dividend for t = 1, 2, 3, 4, 5, 6, 7 and 8. The required rate of return for OLDER stock is 16% compounded annually. What is OLDER’s stock price? Now assume that…arrow_forwardProblem Three (15 marks) You are an analyst in charge of valuing common stocks. You have been asked to value two stocks. The first stock NEWER Inc. just paid a dividend of $6.00. The dividend is expected to increase by 60%, 45%, 30% and 15% per year, respectively, in the next four years. Thereafter, the dividend will increase by 4% per year in perpetuity. Calculate NEWER’s expected dividend for t = 1, 2, 3, 4 and 5. The required rate of return for NEWER stock is 14% compounded annually. What is NEWER’s stock price? The second stock is OLDER Inc. OLDER Inc. will pay its first dividend of $10.00 three (3) years from today. The dividend will increase by 30% per year for the following four (4) years after its first dividend payment. Thereafter, the dividend will increase by 3% per year in perpetuity. Calculate OLDER’s expected dividend for t = 1, 2, 3, 4, 5, 6, 7 and 8. The required rate of return for OLDER stock is 16% compounded annually. What is OLDER’s stock price? Now…arrow_forwardYou are considering a 10-year, $1,000 par value bond. Its coupon rate is 11%, and interest is paid semiannually. Bond valuation Years to maturity 10 Par value of bond $1,000.00 Coupon rate 11.00% Frequency interest paid per year 2 Effective annual rate 8.78% Calculation of periodic rate: Formulas Nominal annual rate #N/A Periodic rate #N/A Calculation of bond price: Formulas Number of periods #N/A Interest rate per period 0.00% Coupon payment per period #N/A Par value of bond $1,000.00 Price of bond #N/Aarrow_forward

- How much do investor psychology and market sentiment play into stock price movements? Do these emotional reactions having a bigger impact on short-term swings, or do they also shape long-term trends in a meaningful way?arrow_forwardExplain The business of predatory tax return preparation, including: How they deceive the working poor,The marketing tactics the preparers use, and Other than paying high fees, what negative impact can the use of these unqualified and unregulated preparers have on the taxpayer?arrow_forwardExplain the changes in tax return preparation you would like to see in Alabama, based on what has been successful in other states.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License