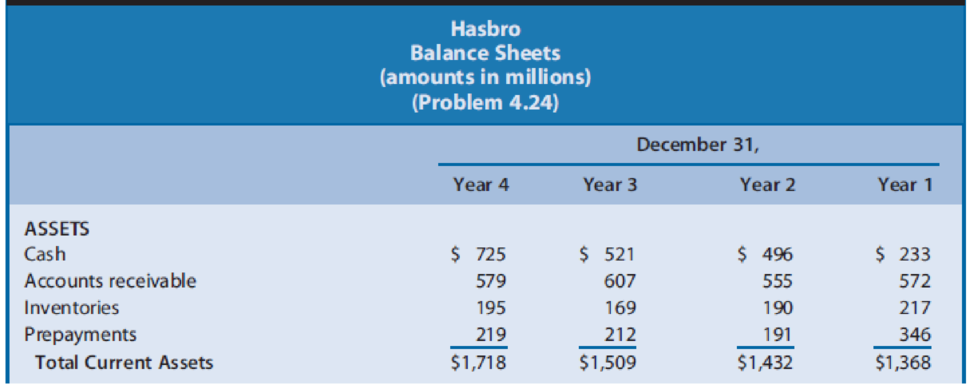

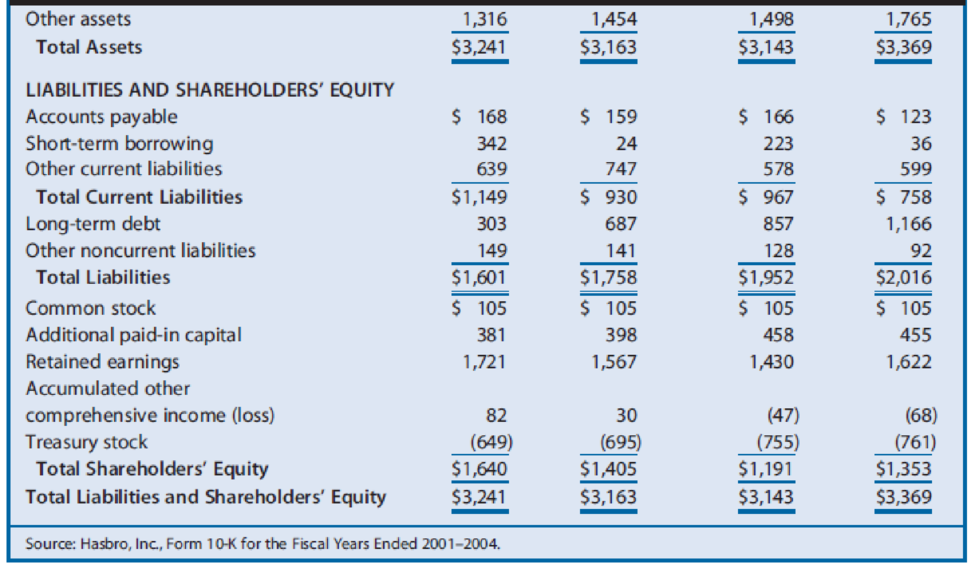

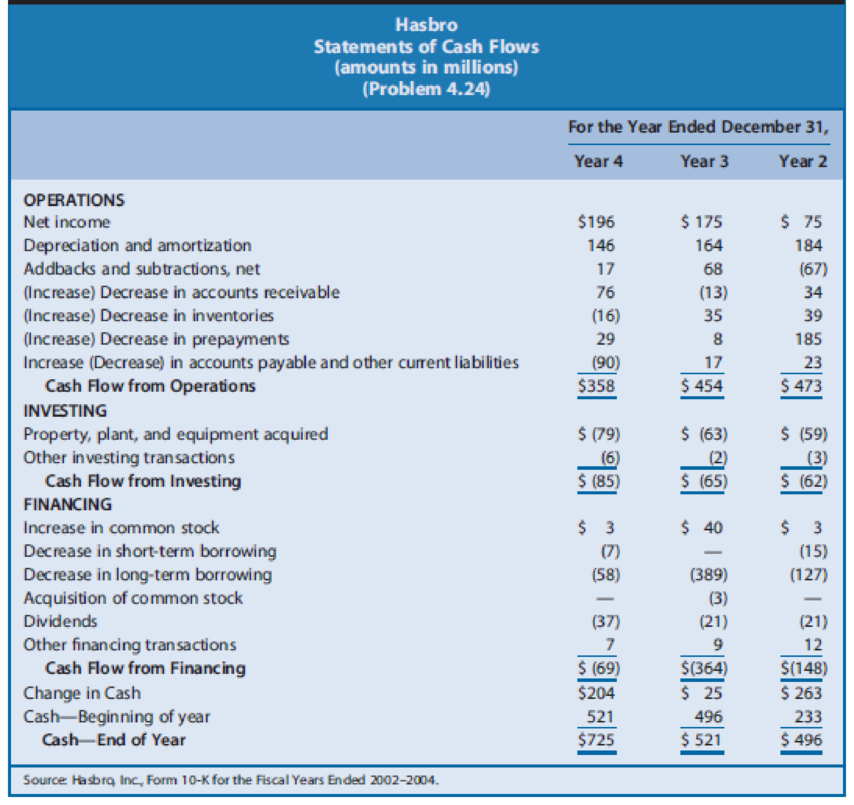

Hasbro is a leading firm in the toy, game, and amusement industry. Its promoted brands group includes products from Playskool, Tonka, Milton Bradley, Parker Brothers, Tiger, and Wizards of the Coast. Sales of toys and games are highly variable from year to year depending on whether the latest products meet consumer interests. Hasbro also faces increasing competition from electronic and online games. Hasbro develops and promotes its core brands and manufactures and distributes products created by others under license arrangements. Hasbro pays a royalty to the creator of such products. In recent years, Hasbro has attempted to reduce its reliance on license arrangements, placing more emphasis on its core brands. Hasbro also has embarked on a strategy of reducing fixed selling and administrative costs in an effort to offset the negative effects on earnings of highly variable sales. Exhibit 4.30 presents the

Exhibit 4.30

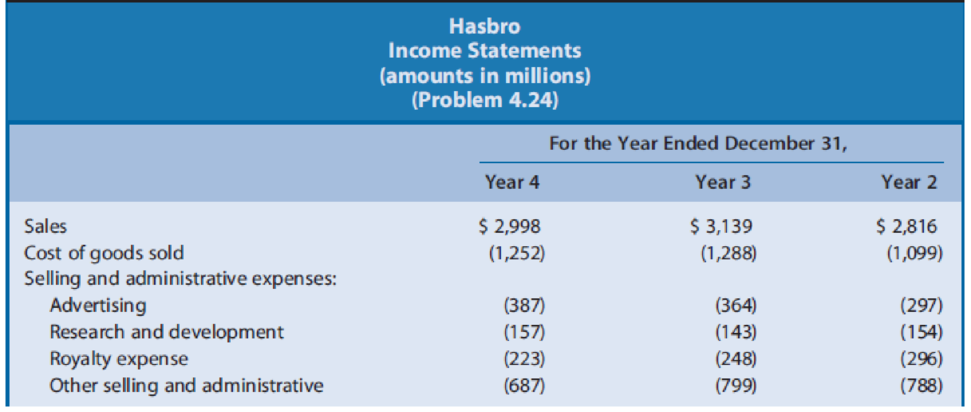

Exhibit 4.31

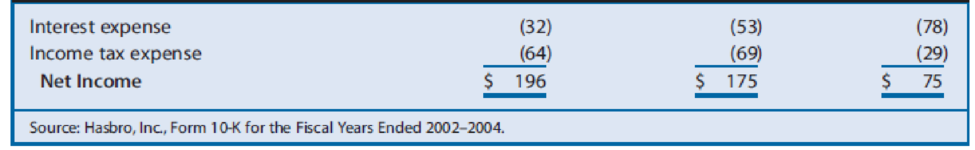

Exhibit 4.32

REQUIRED

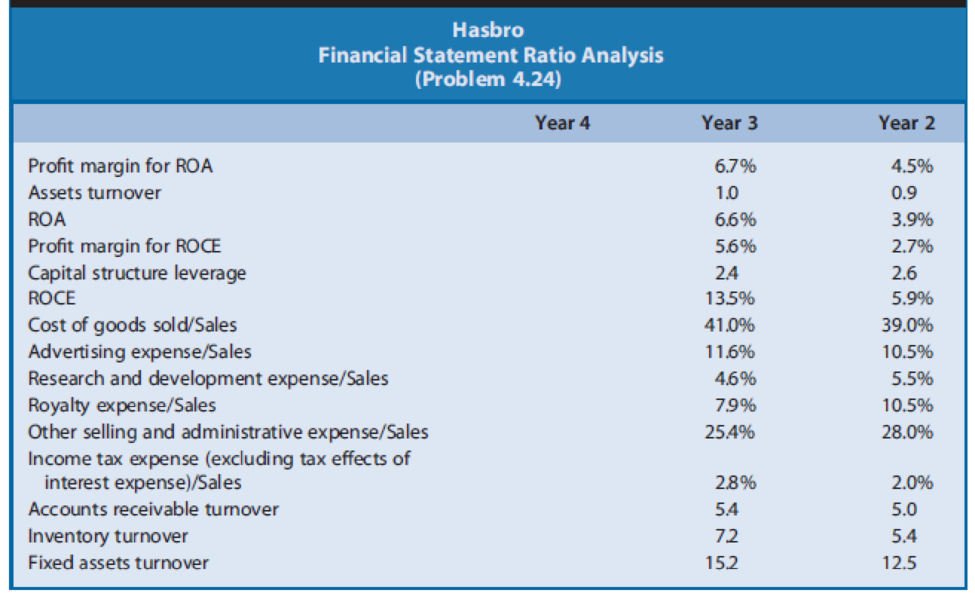

- a. Exhibit 4.33 presents profitability ratios for Hasbro for Year 2 and Year 3. Calculate each of these financial ratios for Year 4. The income tax rate is 35%.

- b. Analyze the changes in

ROA and its components for Hasbro over the three-year period, suggesting reasons for the changes observed. - c. Analyze the changes in ROCE and its components for Hasbro over the three-year period, suggesting reasons for the changes observed.

Exhibit 4.33

Trending nowThis is a popular solution!

Chapter 4 Solutions

Financial Reporting, Financial Statement Analysis and Valuation

- Answer correctly otherwise unhelpfularrow_forwardYou've collected the following information from your favorite financial website. 52-Week Price Dividend Hi 77.40 Lo Stock (Dividend) Yield % PE Ratio Close Price Net Change 10.43 Acevedo .36 2.6 6 13.90 -.24 55.81 33.42 Georgette, Incorporated 1.54 3.8 10 40.43 -.01 131.04 70.05 YBM 2.55 2.9 10 89.08 3.07 50.24 35.00 13.95 Manta Energy .80 5.2 6 20.74 Winter Sports .32 1.5 28 15.43 ?? -.26 .18 According to analysts, the growth rate in dividends for YBM for the next five years is expected to be 21 percent. Suppose YBM meets this growth rate in dividends for the next five years and then the dividend growth rate falls to 5.75 percent, indefinitely. Assume investors require a return of 14 percent on YBM stock. According to the dividend growth model, what should the stock price be today? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forward1. Waterfront Inc. wishes to borrow on a short-term basis without reducing its current ratio below 1.25. At present its current assets and current liabilities are $1,600 and $1,000 respectively. How much can Waterfront Inc. borrow?arrow_forward

- Question 3Footfall Manufacturing Ltd. reports the following financialinformation at the end of the current year:Net Sales $100,000Debtor’s turnover ratio (based onnet sales)2Inventory turnover ratio 1.25Fixed assets turnover ratio 0.8Debt to assets ratio 0.6Net profit margin 5%Gross profit margin 25%Return on investment 2%Use the given information to fill out the templates for incomestatement and balance sheet given below:Income Statement of Footfall Manufacturing Ltd. for the year endingDecember 31, 20XX(in $)Sales 100,000Cost of goodssoldGross profitOther expensesEarnings beforetaxTax @50%Earnings aftertaxBalance Sheet of Footfall Manufacturing Ltd. as at December 31, 20XX(in $)Liabilities Amount Assets AmountEquity Net fixed assetsLong termdebt50,000 InventoryShort termdebtDebtorsCashTOTAL TOTALarrow_forwardSolve correctly and no aiarrow_forwardSolvearrow_forward

- don't use chatgptIf data is unclear or blurr then comment i will write it.arrow_forwardIf data is unclear or blurr then comment i will write it. please don't use AI i will unhelpfularrow_forwardYou are considering an option to purchase or rent a single residential property. You can rent it for $5,000 per month and the owner would be responsible for maintenance, property insurance, and property taxes. Alternatively, you can purchase this property for $204,500 and finance it with an 80 percent mortgage loan at 4 percent interest that will fully amortize over a 30-year period. The loan can be prepaid at any time with no penalty. You have done research in the market area and found that (1) properties have historically appreciated at an annual rate of 2 percent per year, and rents on similar properties have also increased at 2 percent annually; (2) maintenance and insurance are currently $1,545.00 each per year and they have been increasing at a rate of 3 percent per year; (3) you are in a 24 percent marginal tax rate and plan to occupy the property as your principal residence for at least four years; (4) the capital gains exclusion would apply when you sell the property; (5)…arrow_forward

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub