Managerial Accounting: Creating Value in a Dynamic Business Environment

11th Edition

ISBN: 9781259727757

Author: HILTON

Publisher: MCG COURSE

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 50P

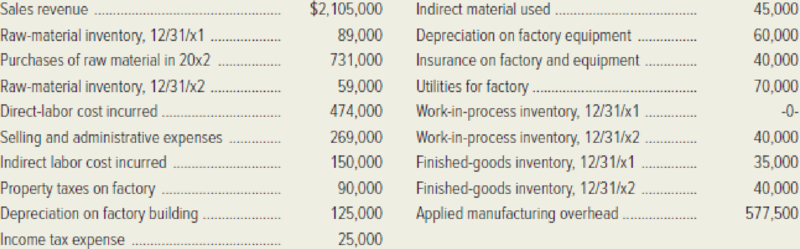

The following data refers to Huron Corporation for the year 20x2.

Required:

- 1. Prepare Huron’s schedule of cost of goods manufactured for 20x2.

- 2. Prepare the company’s schedule of cost of goods sold for 20x2. The company closes overapplied or underapplied

overhead into Cost of Goods Sold. - 3. Prepare the company’s income statement for 20x2.

- 4. Build a spreadsheet: Construct an Excel spreadsheet to solve all of the preceding requirements. Show how the solution will change if the following data change: sales revenue was $2,115,000, applied manufacturing overhead was $580,000, and utilities amounted to $78,000.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Scarce resource; discontinued product lines; negative contribution marginThe officers of Bardwell Company are reviewing the profitability of the company’s four products and the potential effects of several proposals for varying the product mix. The following is an excerpt from the income statement and other data.

Total

Product P

Product Q

Product R

Product S

Sales

$62,600

$10,000

$18,000

$12,600

$22,000

Cost of goods sold

(44,274)

(4,750)

(7,056)

(13,968)

(18,500)

Gross profit

$18,326

$5,250

$10,944

$(1,368)

$3,500

Operating expenses

(12,004)

(1,990)

(2,968)

(2,826)

(4,220)

Income before taxes

6,322

$3,260

$7,976

$(4,194)

$(720)

Units sold

1,000

1,200

1,800

2,000

Sales price per unit

$10.00

$15.00

$7.00

$11.00

Variable cost of goods sold

2.50

3.00

6.50

6.00

Variable operating expenses

1.17

1.25

1.00

1.20

Each of the following proposals is to be considered independently of the other proposals. Consider only the product changes stated in each…

Analyzing one company's make or buy and special order proposals

OneCo is a retail organization in the Northeast that sells upscale clothing. Each year, store managers (in consultation with their supervisors) establish financial goals; a monthly reporting system captures actual performance.

OneCo Inc. produces a single product. Cost per unit, based on the manufacture and sale of 10,000 units per month at full capacity, is shown below.

Product costs

Direct materials

$4.00

Direct labor

1.30

Variable overhead

2.50

Fixed overhead

3.40

Sales commission

0.90

$12.10

The $0.90 sales commission is paid for every unit sold through regular channels. Market demand is such that OneCo is operating at full capacity, and the firm has found it can sell all it can produce at the market price of $16.50.

Currently, OneCo is considering two separate proposals:

· Gatsby, Inc. has offered to buy 1,000 units at $14.35 each. Sales commission would be $0.35 on this special order.

·…

MYS App Ch 1 M Ques M X

Chat Use ta gaut Soluta acco a webs a wear a acco

calcuTelesa Requ

/ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fconnect.mheducation.com%252Fconnect

ework i

ces

Saved

[The following information applies to the questions displayed below.]

The first production department in a process manufacturing system reports the following unit data.

Beginning work in process inventory

Units started and completed

35,200 units

52,800 units

Units completed and transferred out

Ending work in process inventory

88,000 units

17,900 units

Help

Save &

Exercise 16-4 (Algo) Weighted average: Computing equivalent units LO P1

Prepare the production department's equivalent units of production for direct materials under each of the following three separate

assumptions using the weighted average method for process costing.

Equivalent Units of Production (EUP)-Weighted Average Method

1. All direct materials are added to products when…

Chapter 3 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Ch. 3 - List and explain four purposes of product costing.Ch. 3 - Explain the difference between job-order and...Ch. 3 - How is the concept of product costing applied in...Ch. 3 - What are the purposes of the following documents:...Ch. 3 - Why is manufacturing overhead applied to products...Ch. 3 - Explain the benefits of using a predetermined...Ch. 3 - Describe one advantage and one disadvantage of...Ch. 3 - Describe an important cost-benefit issue involving...Ch. 3 - Explain the difference between actual and normal...Ch. 3 - When a single, volume-based cost driver (or...

Ch. 3 - Prob. 11RQCh. 3 - Describe the process of two-stage cost allocation...Ch. 3 - Define each of the following terms, and explain...Ch. 3 - Describe how job-order costing concepts are used...Ch. 3 - What is meant by the term cost driver? What is a...Ch. 3 - Describe the flow of costs through a...Ch. 3 - Give an example of how a hospital, such as the...Ch. 3 - Why are some manufacturing firms switching from...Ch. 3 - What is the cause of over applied or under applied...Ch. 3 - Briefly describe two ways of closing out over...Ch. 3 - Describe how a large retailer such as Lowes would...Ch. 3 - Prob. 22RQCh. 3 - For each of the following companies, indicate...Ch. 3 - The controller for Tender Bird Poultry, Inc....Ch. 3 - Finley Educational Products started and finished...Ch. 3 - Bodin Company manufactures finger splints for kids...Ch. 3 - McAllister, Inc. employs a normal costing system....Ch. 3 - Garrett Toy Company incurred the following costs...Ch. 3 - Crunchem Cereal Company incurred the following...Ch. 3 - Reimel Furniture Company, Inc. incurred the...Ch. 3 - Selected data concerning the past years operations...Ch. 3 - Sweet Tooth Confectionary incurred 157,000 of...Ch. 3 - The following information pertains to Trenton...Ch. 3 - The following data pertain to the Oneida...Ch. 3 - Refer to the data for the preceding exercise for...Ch. 3 - Design Arts Associates is an interior decorating...Ch. 3 - Suppose you are the controller for a company that...Ch. 3 - Laramie Leatherworks, which manufactures saddles...Ch. 3 - Refer to Exhibit 312, which portrays the three...Ch. 3 - Refer to the illustration of overhead application...Ch. 3 - The following data refer to Twisto Pretzel Company...Ch. 3 - Burlington Clock Works manufactures fine,...Ch. 3 - Perfecto Pizza Company produces microwavable...Ch. 3 - Stellar Sound, Inc. which uses a job-order costing...Ch. 3 - Finlon Upholstery, Inc. uses a job-order costing...Ch. 3 - JLR Enterprises provides consulting services...Ch. 3 - Garcia, Inc. uses a job-order costing system for...Ch. 3 - MarineCo, Inc. manufactures outboard motors and an...Ch. 3 - The following data refers to Huron Corporation for...Ch. 3 - Refer to the schedule of cost of goods...Ch. 3 - Marco Polo Map Companys cost of goods sold for...Ch. 3 - Midnight Sun Apparel Company uses normal costing,...Ch. 3 - Marc Jackson has recently been hired as a cost...Ch. 3 - Troy Electronics Company calculates its...Ch. 3 - Tiana Shar, the controller for Bondi Furniture...Ch. 3 - Scholastic Brass Corporation manufactures brass...Ch. 3 - Refer to the preceding problem regarding...Ch. 3 - Prob. 59PCh. 3 - TeleTech Corporation manufactures two different...Ch. 3 - CompuFurn, Inc. manufactures furniture for...Ch. 3 - FiberCom, Inc., a manufacturer of fiber optic...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Describe and evaluate what Pfizer is doing with its PfizerWorks.

Management (14th Edition)

Mary Williams, owner of Williams Products, is evaluating whether to introduce a new product line. After thinkin...

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Assume you are a CFO of a company that is attempting to race additional capital to finance an expansion of its ...

Financial Accounting, Student Value Edition (5th Edition)

How is activity-based costing useful for pricing decisions?

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Assume the United States is an importer of televisions and there are no trade restrictions. US consumers buy 1 ...

Principles of Microeconomics (MindTap Course List)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Job Cost Sheet - Job Cost Accounting System; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=ElD8nKNXE1I;License: Standard Youtube License