Concept explainers

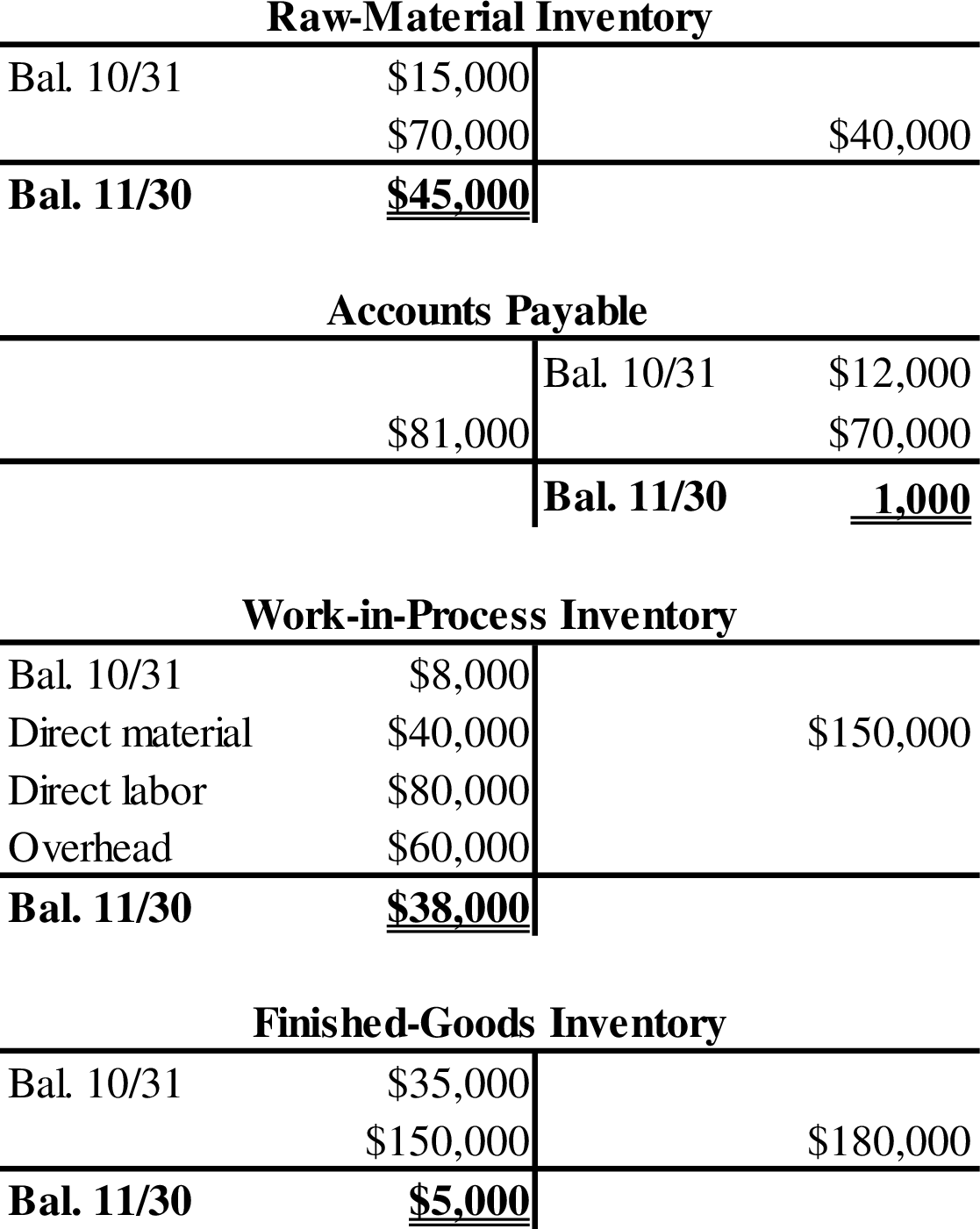

Calculate the missing amounts and prepare the T-accounts.

Explanation of Solution

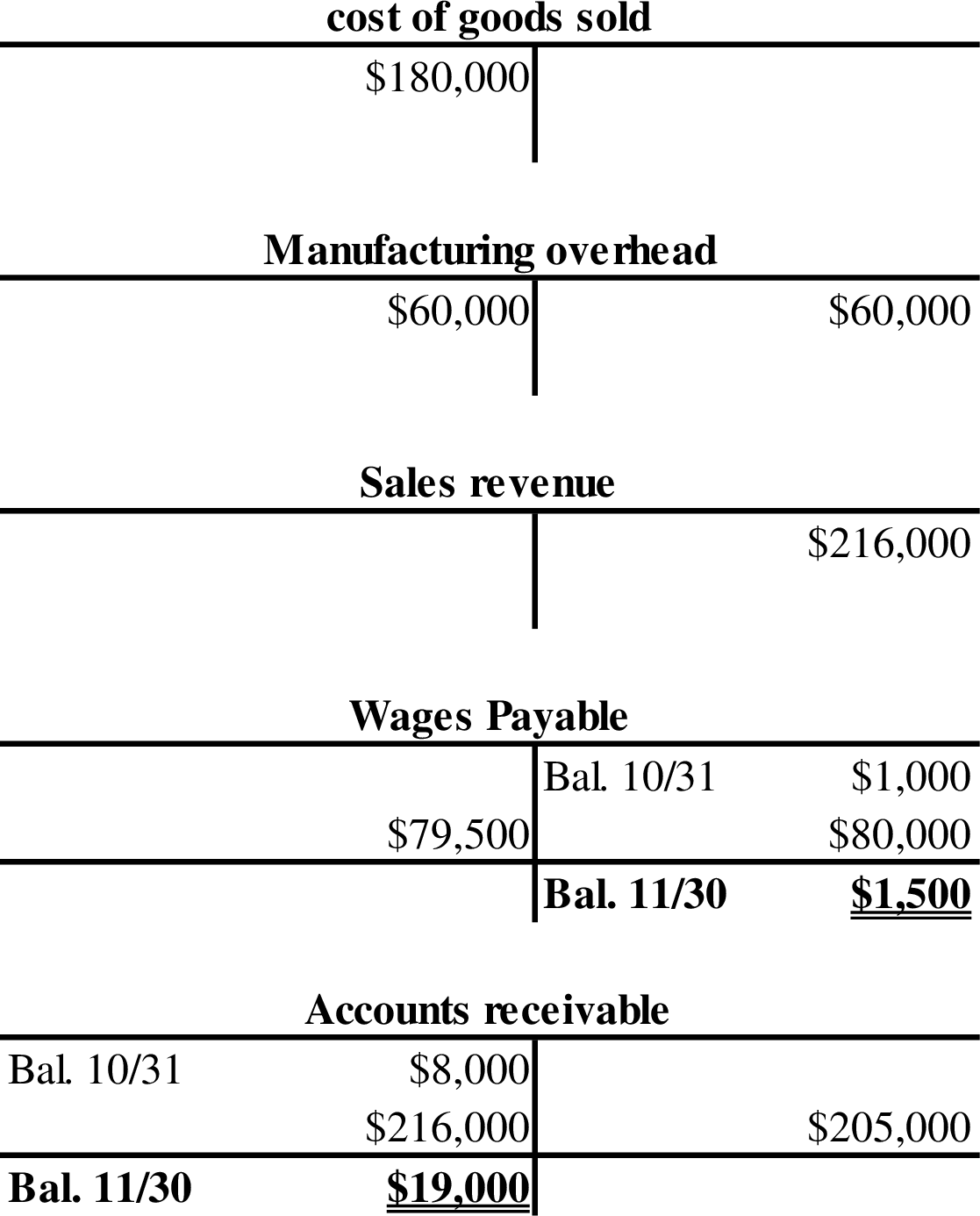

- 1. Calculate the sales revenue for November.

Thus, the sales revenue for November is $216,000.

- 2. Calculate the ending balance of

accounts receivable .

Thus, the ending balance in accounts receivable is $19,000.

- 3. Calculate the cost of raw materials purchased during November.

Thus, the cost of raw materials purchased during November is $70,000.

- 4. Calculate the ending balance in the work-in-process inventory.

Step 1: Calculate the budgeted direct-labor hours.

Step 2: Calculate the predetermined

Step 3: Calculate the ending balance in the work-in-process inventory.

Thus, the ending balance in the work-in-process inventory is $38,000.

- 5. Calculate the amount of direct labor added to work in process during November.

Thus, the amount of direct labor added to work in process during November is $80,000.

- 6. Calculate the amount of applied overhead for November.

Step 1: Calculate the direct-labor hours.

Step 2: Calculate the amount of applied overhead for November.

Thus, the applied overhead for November is $60,000.

- 7. Calculate the cost of goods completed during November.

Thus, the cost of goods completed during November is $150,000.

- 8. Calculate the amount of raw materials used during November.

Thus, the amount of raw materials used during November is $40,000.

- 9. Calculate the amount of October 31 balance in raw-material inventory.

Thus, the amount of October 31 balances in raw-material inventory is $15,000.

- 10. Calculate the amount of overapplied or underapplied for November.

Thus, there is no underapplied or overapplied overhead for the month November.

Prepare the T-accounts.

Want to see more full solutions like this?

Chapter 3 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Can you explain this general accounting question using accurate calculation methods?arrow_forwardFresco Prints is producing 20 customized wedding invitations. The production costs include $42 in materials, $36 in hourly wages, and $22 in workstation rental space. What is the average cost per unit (invitation)?arrow_forwardShaan Manufacturing is planning to sell 320 electronic toys and to produce 300 electronic toys in November. Each electronic toy requires 85 grams of plastic and 1.25 hours of direct labor. The cost of the plastic used in each electronic toy is $4.50 per 85 grams. Employees of the company are paid at a rate of $22.50 per hour. Manufacturing overhead is applied at a rate of 125% of direct labor costs. Shaan Manufacturing has 75,000 grams of plastic in its beginning inventory and wants to have 65,000 grams in its ending inventory. What is the amount of budgeted direct labor cost for the month of November?arrow_forward

- Can you solve this general accounting problem using appropriate accounting principles?arrow_forwardI need guidance with this general accounting problem using the right accounting principles.arrow_forwardAccurate solution wanted. NO AI Please. IF you not sure please dont accept. UNHELPFULarrow_forward

- I am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forwardOyama Manufacturing's performance report shows that its employees worked 120 hours, but their pay card report indicates that they worked 132 hours. What is the variance percentage?arrow_forwardI am searching for the most suitable approach to this financial accounting problem with valid standards.arrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub  Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,