Advanced Accounting

12th Edition

ISBN: 9781305084858

Author: Paul M. Fischer, William J. Tayler, Rita H. Cheng

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 4.1E

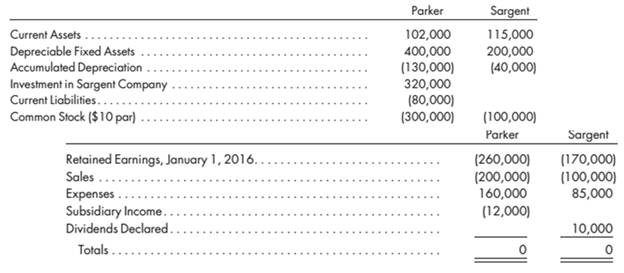

Equity method, second year, eliminations, income statement. The

Parker Company continues to use the simple equity method.

Parker Company continues to use the simple equity method.

1. Prepare all the eliminations and adjustments that would be made on the 2016 consolidated worksheet.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Can you solve this general accounting question with the appropriate accounting analysis techniques?

accounting question?

Three individuals form JEY Corporation with the following contributions: Joe, cash of $50,000 for 50 shares; Ethan, land worth $20,000 (basis of $11,000) for 20 shares; and Young, cattle worth $9,000 (basis of $6,000) for 9 shares and services worth $21,000 for 21 shares.

a. These transfers are fully taxable and not subject to § 351. b. Young’s basis in her stock is $27,000. c. Young’s basis in her stock is $6,000. d. Ethan’s basis in his stock is $20,000. e. None of the above.

Chapter 3 Solutions

Advanced Accounting

Ch. 3 - Prob. 1UTICh. 3 - Prob. 2UTICh. 3 - Prob. 3UTICh. 3 - Prob. 4UTICh. 3 - Prob. 5UTICh. 3 - Prob. 6UTICh. 3 - Prob. 7UTICh. 3 - Prob. 1ECh. 3 - Prob. 2ECh. 3 - Prob. 3.1E

Ch. 3 - Prob. 3.2ECh. 3 - Prob. 3.3ECh. 3 - Prob. 3.4ECh. 3 - Prob. 3.5ECh. 3 - Equity method, second year, eliminations, income...Ch. 3 - Prob. 4.2ECh. 3 - Prob. 5.1ECh. 3 - Prob. 5.2ECh. 3 - Prob. 5.3ECh. 3 - Prob. 5.4ECh. 3 - Prob. 5.5ECh. 3 - Prob. 6.1ECh. 3 - Prob. 6.2ECh. 3 - Prob. 7.1ECh. 3 - Prob. 7.2ECh. 3 - Prob. 7.3ECh. 3 - Prob. 7.4ECh. 3 - Prob. 7.5ECh. 3 - Prob. 8.1ECh. 3 - Prob. 8.2ECh. 3 - Prob. 9ECh. 3 - Prob. 10.1ECh. 3 - Prob. 10.2ECh. 3 - Prob. 10.3ECh. 3 - Prob. 11ECh. 3 - Prob. 3B.1.1AECh. 3 - Prob. 3B.1.2AECh. 3 - Prob. 3B.1.3AECh. 3 - Prob. 3B.2.1AECh. 3 - Prob. 3B.2.2AECh. 3 - Prob. 3B.3AECh. 3 - Prob. 3.1.1PCh. 3 - Prob. 3.1.2PCh. 3 - Prob. 3.1.3PCh. 3 - Prob. 3.2.1PCh. 3 - Prob. 3.2.2PCh. 3 - Prob. 3.3.1PCh. 3 - Prob. 3.3.2PCh. 3 - Prob. 3.3.3PCh. 3 - Prob. 3.3.4PCh. 3 - Prob. 3.4.1PCh. 3 - Prob. 3.4.2PCh. 3 - Prob. 3.5.1PCh. 3 - Prob. 3.5.2PCh. 3 - Prob. 3.5.3PCh. 3 - Prob. 3.6.1PCh. 3 - Prob. 3.6.2PCh. 3 - Prob. 3.6.3PCh. 3 - Prob. 3.7.1PCh. 3 - Prob. 3.7.2PCh. 3 - Prob. 3.7.3PCh. 3 - Prob. 3.8.1PCh. 3 - Prob. 3.8.2PCh. 3 - Prob. 3.9.1PCh. 3 - Prob. 3.9.2PCh. 3 - Prob. 3.10.1PCh. 3 - Prob. 3.10.2PCh. 3 - Prob. 3.11.1PCh. 3 - Prob. 3.11.2PCh. 3 - Prob. 3.12.1PCh. 3 - Prob. 3.12.2PCh. 3 - Prob. 3.13.1PCh. 3 - Prob. 3.13.2PCh. 3 - Prob. 3.15.1PCh. 3 - Prob. 3.15.2PCh. 3 - Prob. 3.16.1PCh. 3 - Prob. 3.16.2PCh. 3 - Prob. 3.17.1PCh. 3 - Prob. 3.17.2PCh. 3 - Prob. 3.18.1PCh. 3 - Prob. 3.18.2PCh. 3 - Prob. 3A.1.1APCh. 3 - Prob. 3A.1.2APCh. 3 - Prob. 3A.2APCh. 3 - Prob. 3A.3APCh. 3 - Prob. 3B.1APCh. 3 - Prob. 3B.2APCh. 3 - Prob. 3B.3.1APCh. 3 - The trial balances of Campton Corporation and Dorn...Ch. 3 - The trial balances of Campton Corporation and Dorn...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you help me solve this general accounting problem using the correct accounting process?arrow_forwardI need help with this general accounting question using the proper accounting approach.arrow_forwardI need guidance with this general accounting problem using the right accounting principles.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

The ACCOUNTING EQUATION For BEGINNERS; Author: Accounting Stuff;https://www.youtube.com/watch?v=56xscQ4viWE;License: Standard Youtube License