Excel Applications for Accounting Principles

4th Edition

ISBN: 9781111581565

Author: Gaylord N. Smith

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

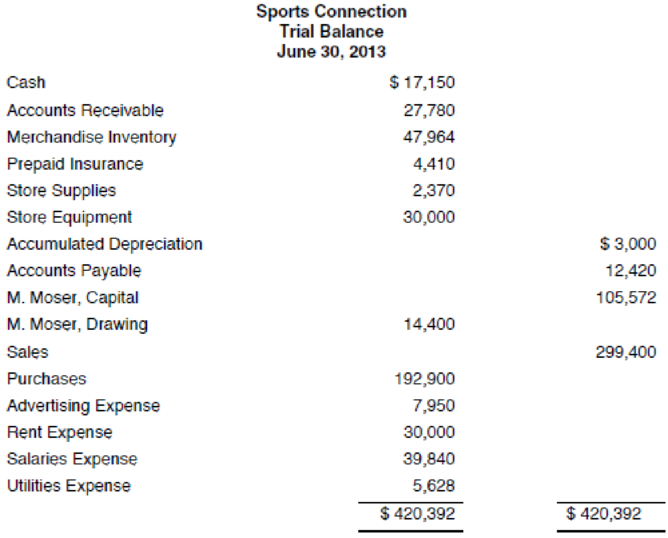

Chapter 3, Problem 3R

The

Adjustment information is as follows:

- a. Supplies on hand as of June 30, 2013, $450.

- b. Insurance premiums that expired during the year, $2,420.

- c.

Depreciation on equipment during the year, $1,500. - d. Included in the rent expense of $30,000 is $1,200 that is prepaid for July 2013.

- e. Salaries accrued but not paid at June 30, 2013, $1,440.

- f. Merchandise inventory on June 30, 2013, $68,864.

Complete the income statement and

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What would a 5-year projection for a startup Accounting Firm business look like?

Include units, dollars, and assumptions in the projection.

How would a startup Accounting Firm present the sales projection in a narrative that includes the description of the units you plan to sell, the services (amount of them) you plan to provide, and your growth projections of these numbers?

When will a startup Accounting Firm start making a profit and have the break-even point?

None

Kindly help me with general accounting question

Chapter 3 Solutions

Excel Applications for Accounting Principles

Ch. 3 - The trial balance of Sports Connection at June 30,...Ch. 3 - The trial balance of Sports Connection at June 30,...Ch. 3 - The trial balance of Sports Connection at June 30,...Ch. 3 - The trial balance of Sports Connection at June 30,...Ch. 3 - The trial balance of Sports Connection at June 30,...Ch. 3 - Open P2WORK4 and click the Chart sheet tab. On the...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company has beginning inventory of 2,300 units at a cost of $4.4 per unit. During the month, it purchases an additional 3,200 units at $5.8 per unit. If the company uses the weighted average cost method, what is the average cost per unit? A. $4.20 B. $4.60 C. $4.40 D. $5.00 E. $5.21arrow_forwardProvide correct answer general Accountingarrow_forwardNeed help with this accounting questionsarrow_forward

- If a company's net income for the year is $115,000 and its total assets at the beginning of the year were $525,000, while its total assets at the end of the year were $710,000, what is the company's return on assets (ROA)? Help me with this financial accounting Queryarrow_forwardThe green tree company manufacturers woodenarrow_forwardIf a company's net income for the year is $115,000 and its total assets at the beginning of the year were $525,000, while its total assets at the end of the year were $710,000, what is the company's return on assets (ROA)?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY