• LO3–2 , LO3–3

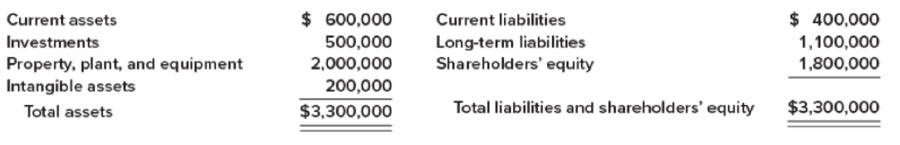

Presented below is the balance sheet for HHD, Inc., at December 31, 2018.

The captions shown in the summarized statement above include the following:

a. Current assets: cash, $150,000;

b. Investments: investments in common stock, short term, $90,000, and long term, $160,000; and restricted cash, long term, $250,000.

c. Property, plant, and equipment: buildings, $1,500,000 less

d. Intangible assets: patent, $110,000; and copyright, $90,000.

e. Current liabilities: accounts payable, $100,000; notes payable, short term, $150,000, and long term, $90,000; and taxes payable, $60,000.

f. Long-term liabilities: bonds payable due 2023.

g. Shareholders’ equity: common stock, $1,000,000;

Required:

Prepare a corrected classified balance sheet for HHD, Inc., at December 31, 2018.

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Intermediate Accounting

- 5 MARKSarrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardKabir Electronics is a retailer of wireless headphones. Typically, the company purchases a headphone set for $80 and sells it for $125. What is the gross profit margin on this headphone set? a. 36% b. $45 c. 56.25% d. 64%arrow_forward

- Can you solve this general accounting problem with appropriate steps and explanations?arrow_forwardSpruce Manufacturing had a pre-tax accounting income of $78 million during the current year. The company's only temporary difference for the year was warranty expenses accrued for the next year in the amount of $25 million. What would be Spruce Manufacturing's taxable income for the year? Give me answerarrow_forwardPlease provide the accurate answer to this financial accounting problem using valid techniques.arrow_forward

- I am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forwardCan you help me solve this general accounting problem with the correct methodology?arrow_forwardI need help with this general accounting problem using proper accounting guidelines.arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,